Louisiana Cash Receipts Control Log is a crucial tool used in financial management to monitor and track cash transactions in various organizations, businesses, and institutions within the state of Louisiana. This log aids in maintaining accurate records of all cash inflows, ensuring proper control, and preventing any potential financial discrepancies or fraudulent activities. The Louisiana Cash Receipts Control Log serves as a designated place to record and organize important information related to cash receipts, providing a clear audit trail for financial transparency and accountability. This log enables efficient monitoring of cash inflows, ensuring that all funds received are properly documented, recorded, and captured in the accounting system. Some vital components recorded in the Louisiana Cash Receipts Control Log include: 1. Date: The specific date when the cash transaction occurred. 2. Receipt Number: A unique identifier assigned to each receipt, enabling easy tracking and identification. 3. Payer/Received From: The name and details of the individual or organization who made the payment. 4. Description: A brief description or purpose of the transaction, providing clarity and context. 5. Amount: The exact amount received in cash. 6. Method of Payment: The mode of payment used (cash, check, credit card, etc.). 7. Deposited Amount: The total sum deposited into the organization's bank account. 8. Deposited Date: The date when the cash amount was deposited into the bank. 9. Deposited Bank: The name of the bank where the cash was deposited. Different types or variations of the Louisiana Cash Receipts Control Log may exist based on the specific needs and requirements of different organizations. These may include: 1. Non-profit Organization Cash Receipts Control Log: Designed specifically for non-profit organizations to track and manage cash inflows, ensuring compliance with legal and accounting standards specific to their sector. 2. Government Agency Cash Receipts Control Log: Tailored for government agencies to record cash transactions accurately, considering the additional regulations and accountability requirements placed upon public entities. 3. Educational Institute Cash Receipts Control Log: Created for educational institutions like schools and universities to effectively monitor cash receipts related to tuition fees, donations, and other revenue sources specific to the education sector. 4. Small Business Cash Receipts Control Log: Suited for small businesses and startups to maintain a systematic and organized record of cash transactions, managing cashflow efficiently. In summary, the Louisiana Cash Receipts Control Log is a vital financial management tool used to ensure accurate tracking and management of cash receipts within various organizations. By employing this log, businesses and institutions in Louisiana can keep proper track of their cash inflows, maintain financial accountability, and mitigate the risk of financial discrepancies or fraudulent activities.

Osrap Portal

Description

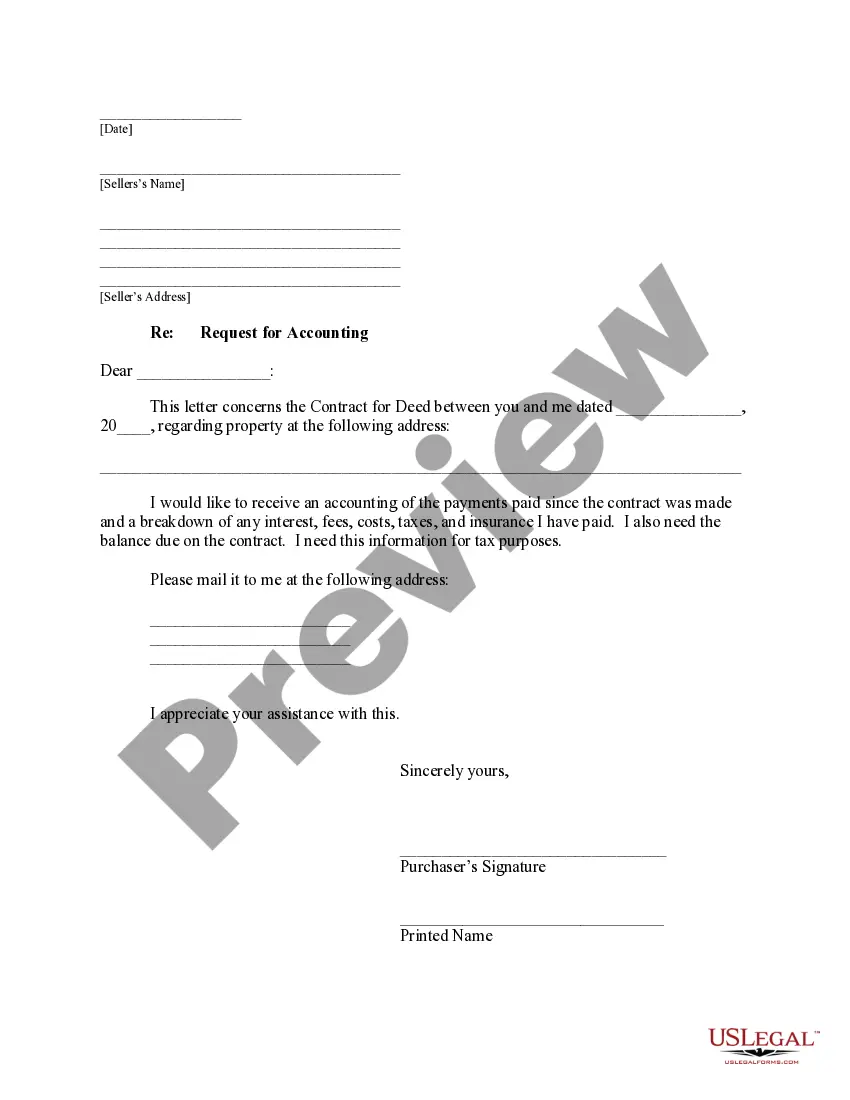

How to fill out Louisiana Cash Receipts Control Log?

If you wish to total, download, or printing legitimate document layouts, use US Legal Forms, the largest variety of legitimate types, which can be found on the Internet. Take advantage of the site`s simple and practical search to get the documents you will need. A variety of layouts for enterprise and individual functions are sorted by groups and states, or search phrases. Use US Legal Forms to get the Louisiana Cash Receipts Control Log in just a few clicks.

In case you are already a US Legal Forms client, log in to the accounts and click on the Download option to have the Louisiana Cash Receipts Control Log. You can even gain access to types you in the past downloaded inside the My Forms tab of the accounts.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form to the appropriate town/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s information. Do not overlook to read through the outline.

- Step 3. In case you are not satisfied using the kind, use the Look for discipline near the top of the display screen to locate other types of the legitimate kind web template.

- Step 4. After you have identified the form you will need, go through the Purchase now option. Choose the prices program you like and add your qualifications to sign up for the accounts.

- Step 5. Approach the deal. You can use your credit card or PayPal accounts to complete the deal.

- Step 6. Pick the structure of the legitimate kind and download it on the product.

- Step 7. Comprehensive, modify and printing or sign the Louisiana Cash Receipts Control Log.

Each legitimate document web template you purchase is yours permanently. You might have acces to each and every kind you downloaded inside your acccount. Select the My Forms portion and pick a kind to printing or download yet again.

Compete and download, and printing the Louisiana Cash Receipts Control Log with US Legal Forms. There are many expert and condition-distinct types you can use to your enterprise or individual requires.

Form popularity

FAQ

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

A cash receipt business log is a source document used during cash transactions when receipts or a cash register may not be available.

What are cash receipts? You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet.

Internal control mechanisms the auditor should check for include documents that establish accountability for the reception of cash and completion of bank deposits, an accurate daily cash summary and deposit slip, requiring daily journal entries that post the amount received to customer accounts and appropriate

Strong internal controls are necessary to prevent mishandling of funds and safeguard assets. They protect both the University and the employees handling the cash.

Best practices:Record cash receipts when received.Keep funds secured.Document transfers.Give receipts to each customer.Don't share passwords.Give each cashier a separate cash drawer.Supervisors verify cash deposits.Supervisors approve all voided refunded transactions.

This includes cash sales, receipt of funds from a bank loan, payments from customer accounts, and the sale of assets.

A cash receipt is a printed acknowledgement of the amount of cash received during a transaction involving the transfer of cash or cash equivalent. The original copy of the cash receipt is given to the customer, while the other copy is kept by the seller for accounting purposes.

The most effective way to protect cash at both receipt and disbursement is to have both written protocol on cash handling and separation of duties. Separation of duties means to separate one big job into several smaller jobs, with a different individual performing each.

A cash receipts log is used to track the cash receipts of a business. Although the format of the cash receipts log varies from business to business, the essential details presented on the form are the same and include the customer's name, amount of cash receipt and details related to the payment.