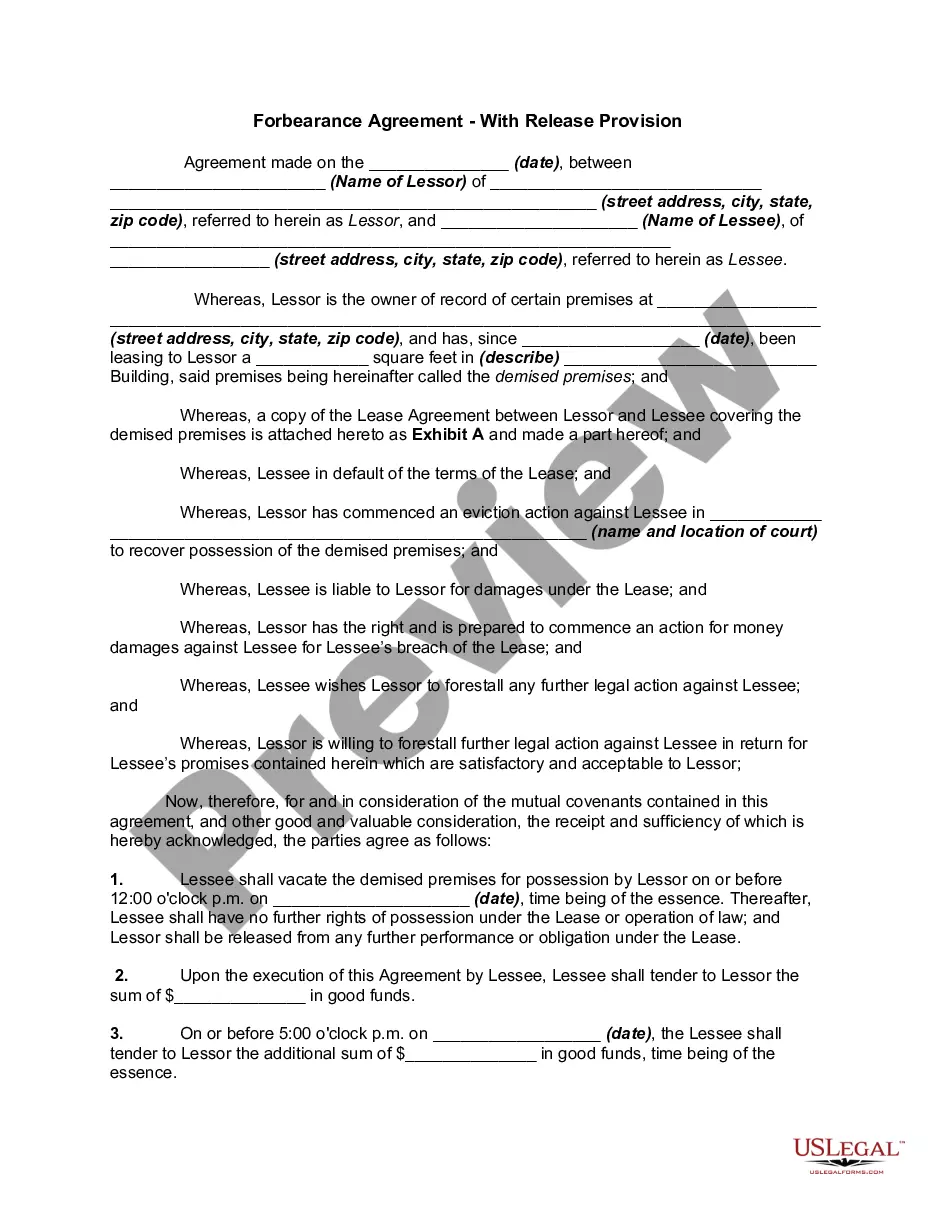

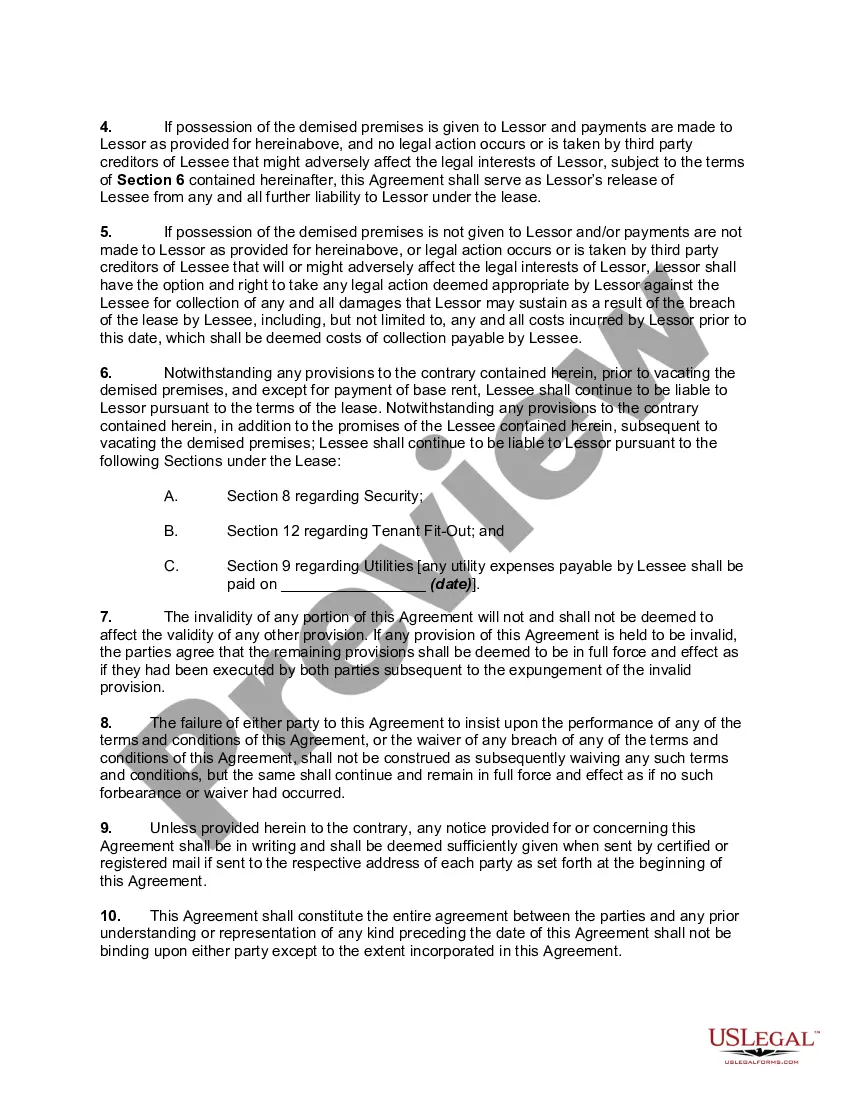

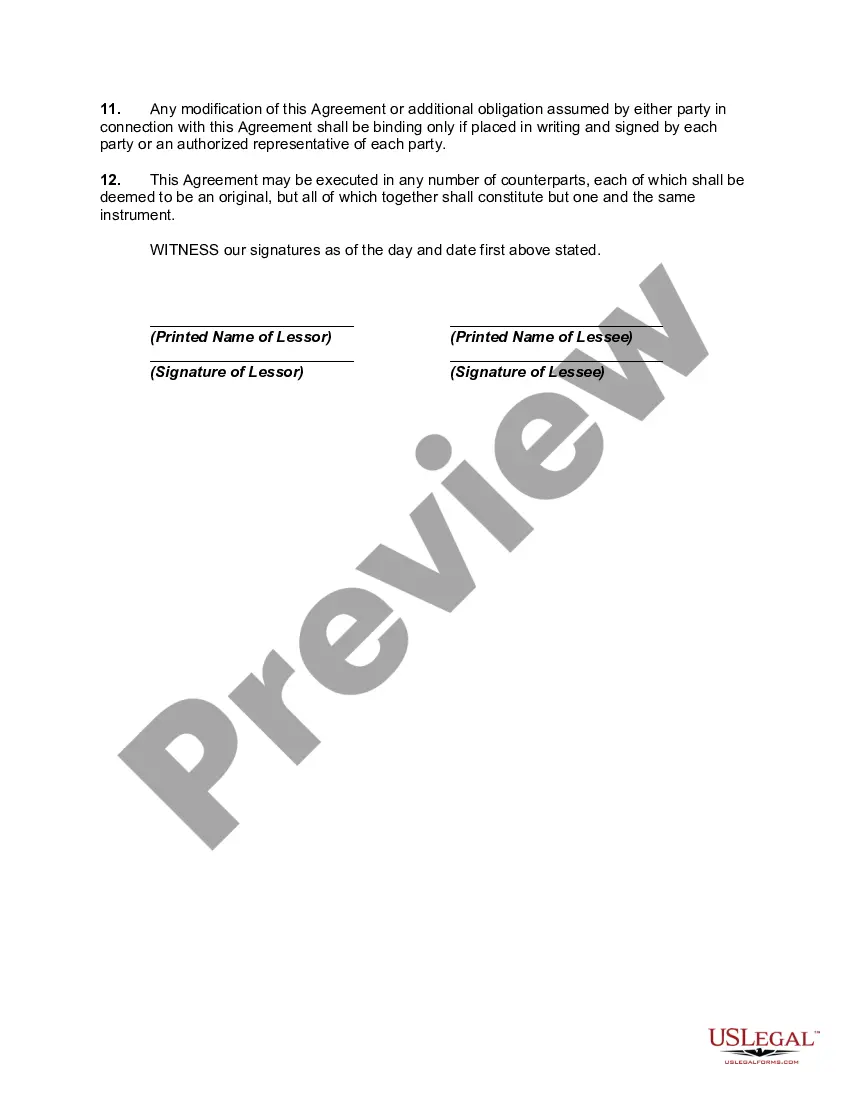

In this form, the lessee is in default and lessor has brought an eviction action against lessee. Pursuant to two cash payments, lessor agrees to release lessee (with some exceptions) from the lease, covenants not to sue for monetary damages, and drop the eviction action.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Louisiana Forbearance Agreement — With Release Provision is a legal document that outlines the terms and conditions of an agreement between a lender and a borrower in the state of Louisiana. This agreement allows the borrower to temporarily suspend or reduce their mortgage payments for a specific period of time, while the lender agrees to refrain from pursuing any foreclosure action during this forbearance period. Keywords: Louisiana, Forbearance Agreement, Release Provision, lender, borrower, mortgage payments, foreclosure, forbearance period. The Louisiana Forbearance Agreement — With Release Provision offers a clear solution for borrowers facing financial hardship or unexpected circumstances that make it difficult for them to meet their mortgage obligations. By entering into this agreement, both parties agree to temporary modifications to the original loan terms, providing the borrower with much-needed relief. During the forbearance period, the borrower may have the option to suspend their monthly mortgage payments entirely or make reduced payments. This flexibility allows borrowers to regain their financial stability without the immediate threat of foreclosure. The lender, on the other hand, benefits from avoiding the costly and time-consuming process of foreclosure. It is important to note that the Louisiana Forbearance Agreement — With Release Provision may come in different types based on the specific circumstances and agreements between the lender and borrower. Some common variations include: 1. Lump Sum Forbearance: In this type, the borrower agrees to make a one-time payment, usually after the forbearance period ends, to compensate for the suspended or reduced payments made during that period. 2. Extended Repayment Plan: With this type, the forbearance period is followed by an extended period during which the borrower agrees to make higher monthly payments to repay the missed or reduced payments. 3. Loan Modification: In certain cases, the forbearance agreement may include options to permanently modify the loan terms, such as reducing the interest rate, extending the loan term, or adjusting the payment schedule, to make it more manageable for the borrower. Overall, the Louisiana Forbearance Agreement — With Release Provision provides a crucial lifeline for borrowers in temporary financial distress, allowing them to avoid foreclosure and regain control of their finances. Lenders also benefit by avoiding the costly process of foreclosure and maintaining a positive working relationship with their borrowers. Note: The specific terms and conditions of a Louisiana Forbearance Agreement — With Release Provision may vary based on individual circumstances, lender policies, and state regulations. It is recommended that borrowers consult with legal professionals or mortgage lenders to understand the specifics of their agreement.Louisiana Forbearance Agreement — With Release Provision is a legal document that outlines the terms and conditions of an agreement between a lender and a borrower in the state of Louisiana. This agreement allows the borrower to temporarily suspend or reduce their mortgage payments for a specific period of time, while the lender agrees to refrain from pursuing any foreclosure action during this forbearance period. Keywords: Louisiana, Forbearance Agreement, Release Provision, lender, borrower, mortgage payments, foreclosure, forbearance period. The Louisiana Forbearance Agreement — With Release Provision offers a clear solution for borrowers facing financial hardship or unexpected circumstances that make it difficult for them to meet their mortgage obligations. By entering into this agreement, both parties agree to temporary modifications to the original loan terms, providing the borrower with much-needed relief. During the forbearance period, the borrower may have the option to suspend their monthly mortgage payments entirely or make reduced payments. This flexibility allows borrowers to regain their financial stability without the immediate threat of foreclosure. The lender, on the other hand, benefits from avoiding the costly and time-consuming process of foreclosure. It is important to note that the Louisiana Forbearance Agreement — With Release Provision may come in different types based on the specific circumstances and agreements between the lender and borrower. Some common variations include: 1. Lump Sum Forbearance: In this type, the borrower agrees to make a one-time payment, usually after the forbearance period ends, to compensate for the suspended or reduced payments made during that period. 2. Extended Repayment Plan: With this type, the forbearance period is followed by an extended period during which the borrower agrees to make higher monthly payments to repay the missed or reduced payments. 3. Loan Modification: In certain cases, the forbearance agreement may include options to permanently modify the loan terms, such as reducing the interest rate, extending the loan term, or adjusting the payment schedule, to make it more manageable for the borrower. Overall, the Louisiana Forbearance Agreement — With Release Provision provides a crucial lifeline for borrowers in temporary financial distress, allowing them to avoid foreclosure and regain control of their finances. Lenders also benefit by avoiding the costly process of foreclosure and maintaining a positive working relationship with their borrowers. Note: The specific terms and conditions of a Louisiana Forbearance Agreement — With Release Provision may vary based on individual circumstances, lender policies, and state regulations. It is recommended that borrowers consult with legal professionals or mortgage lenders to understand the specifics of their agreement.