A Louisiana Installment Promissory Note with Bank Deposit as Collateral is a legal document that establishes a repayment agreement between a borrower and a lender. This type of promissory note is specific to the state of Louisiana and involves utilizing a bank deposit as collateral to secure the loan. The Louisiana Installment Promissory Note with Bank Deposit as Collateral outlines the terms and conditions of the loan, including the principal amount borrowed, the interest rate, the repayment schedule, and any additional fees or charges. It serves as a legally binding contract between the borrower and the lender, ensuring that both parties are aware of their rights and responsibilities. There may be different types of Louisiana Installment Promissory Note with Bank Deposit as Collateral, depending on the specific details and requirements of the loan. Some common variations include: 1. Fixed-Rate Installment Promissory Note: This type of promissory note has a fixed interest rate that remains constant throughout the repayment period. Borrowers who prefer a predictable payment schedule often opt for this type of note. 2. Variable-Rate Installment Promissory Note: Unlike the fixed-rate note, a variable-rate promissory note has an interest rate that fluctuates based on changes in a designated financial index. This type of note is suitable for borrowers who are comfortable with potential interest rate adjustments. 3. Balloon Installment Promissory Note: A balloon note involves regular installment payments, but with a larger final payment, often referred to as the "balloon payment." This unique structure allows borrowers to enjoy lower monthly payments initially, with a one-time payment due at the end of the term. Regardless of the specific type of Louisiana Installment Promissory Note with Bank Deposit as Collateral, it is crucial for both parties involved to fully understand the terms and conditions before signing. Seeking legal advice or consulting with a financial professional can ensure that the agreement aligns with the borrower's financial goals and abilities.

Louisiana Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Louisiana Installment Promissory Note With Bank Deposit As Collateral?

You may invest hours online trying to find the lawful document format which fits the state and federal requirements you will need. US Legal Forms offers thousands of lawful kinds that happen to be reviewed by professionals. It is possible to obtain or printing the Louisiana Installment Promissory Note with Bank Deposit as Collateral from the support.

If you have a US Legal Forms accounts, you can log in and then click the Download switch. Next, you can total, edit, printing, or signal the Louisiana Installment Promissory Note with Bank Deposit as Collateral. Every single lawful document format you get is your own eternally. To get one more backup for any obtained form, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms site the first time, stick to the easy guidelines under:

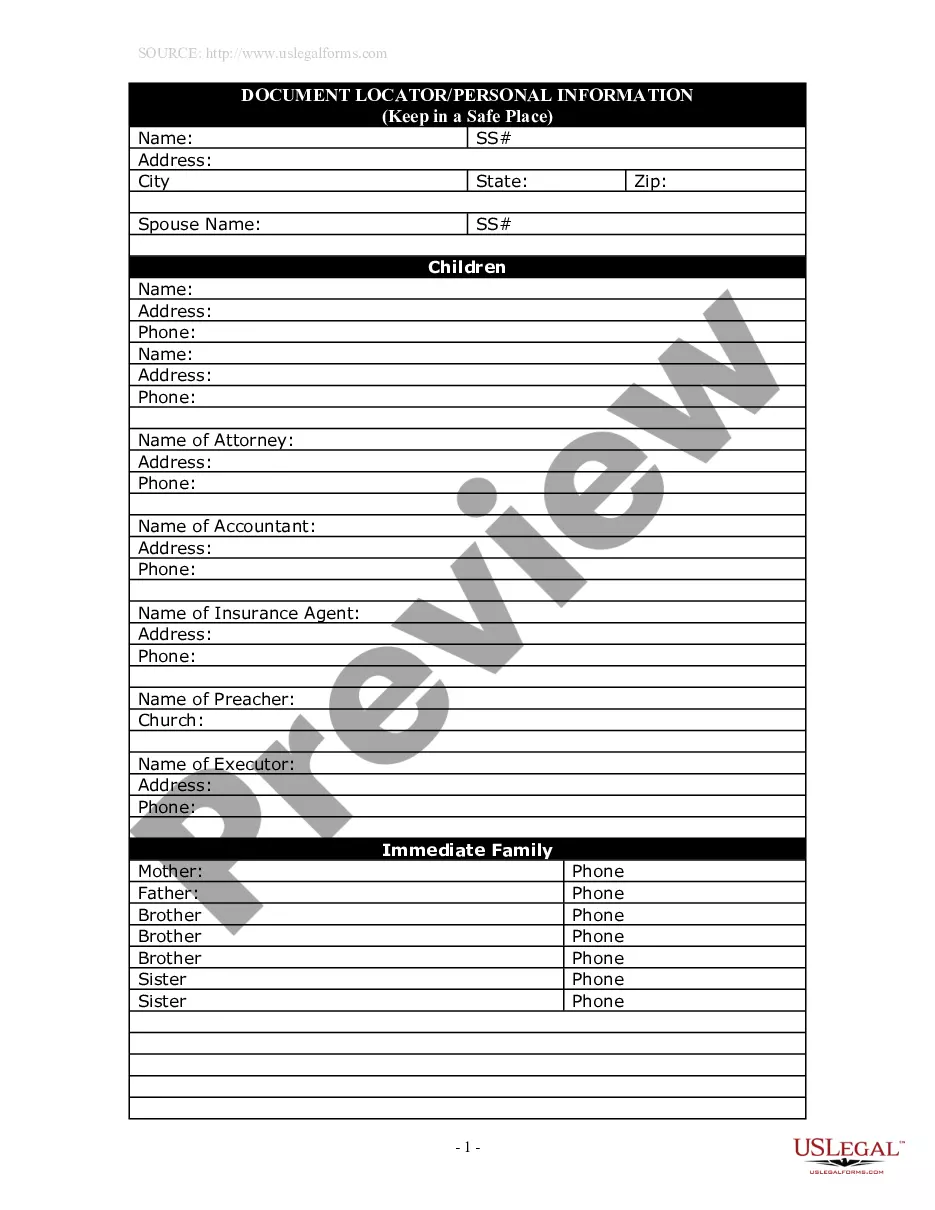

- Initial, make certain you have chosen the right document format for that county/area of your liking. Read the form outline to ensure you have picked out the correct form. If readily available, make use of the Preview switch to appear with the document format at the same time.

- If you would like find one more model from the form, make use of the Lookup discipline to discover the format that suits you and requirements.

- Once you have found the format you need, just click Purchase now to proceed.

- Pick the rates prepare you need, enter your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal accounts to pay for the lawful form.

- Pick the file format from the document and obtain it in your system.

- Make changes in your document if possible. You may total, edit and signal and printing Louisiana Installment Promissory Note with Bank Deposit as Collateral.

Download and printing thousands of document layouts making use of the US Legal Forms Internet site, which provides the greatest variety of lawful kinds. Use specialist and state-specific layouts to handle your small business or personal demands.