Louisiana Wire Transfer Instruction to Receiving Bank

Description

How to fill out Wire Transfer Instruction To Receiving Bank?

Discovering the right lawful papers web template can be quite a battle. Of course, there are tons of web templates available online, but how would you obtain the lawful type you will need? Use the US Legal Forms web site. The assistance delivers a large number of web templates, like the Louisiana Wire Transfer Instruction to Receiving Bank, that you can use for company and private needs. Every one of the forms are examined by specialists and fulfill state and federal specifications.

If you are currently authorized, log in to your profile and click the Down load key to have the Louisiana Wire Transfer Instruction to Receiving Bank. Make use of profile to search through the lawful forms you may have purchased in the past. Proceed to the My Forms tab of your own profile and get an additional copy of your papers you will need.

If you are a brand new end user of US Legal Forms, allow me to share simple instructions that you should follow:

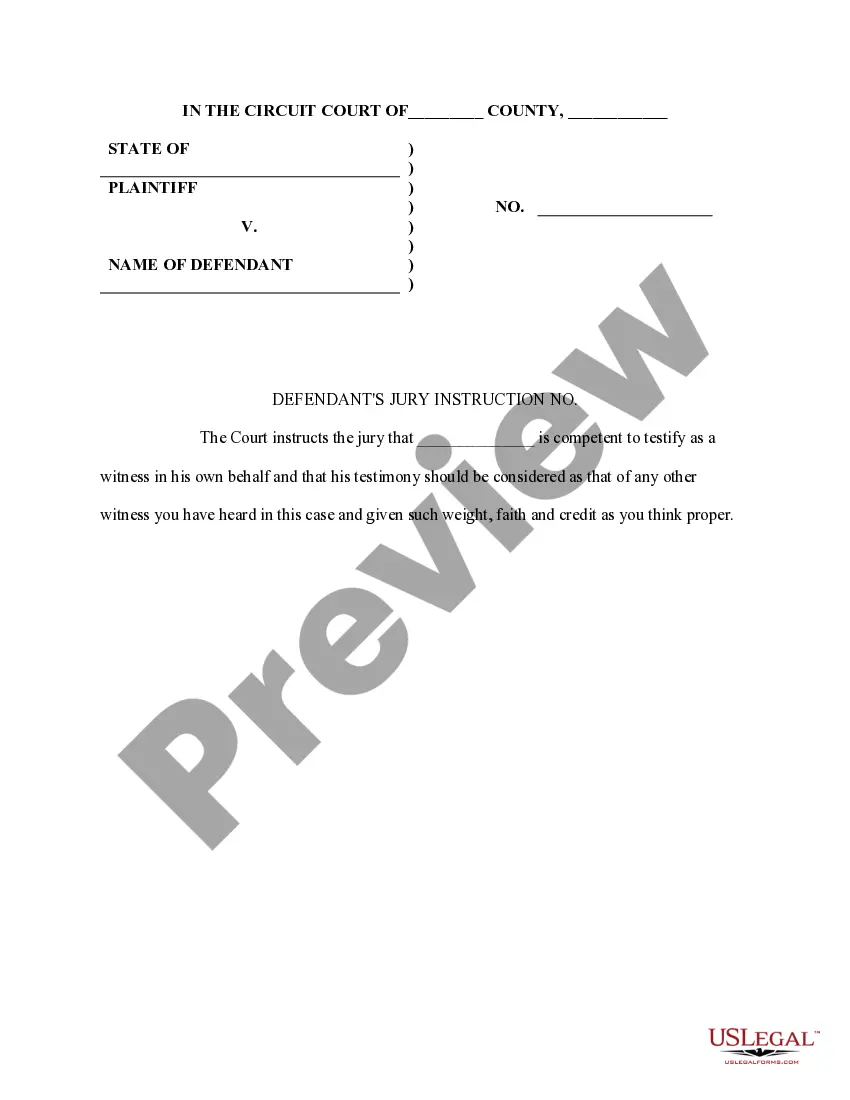

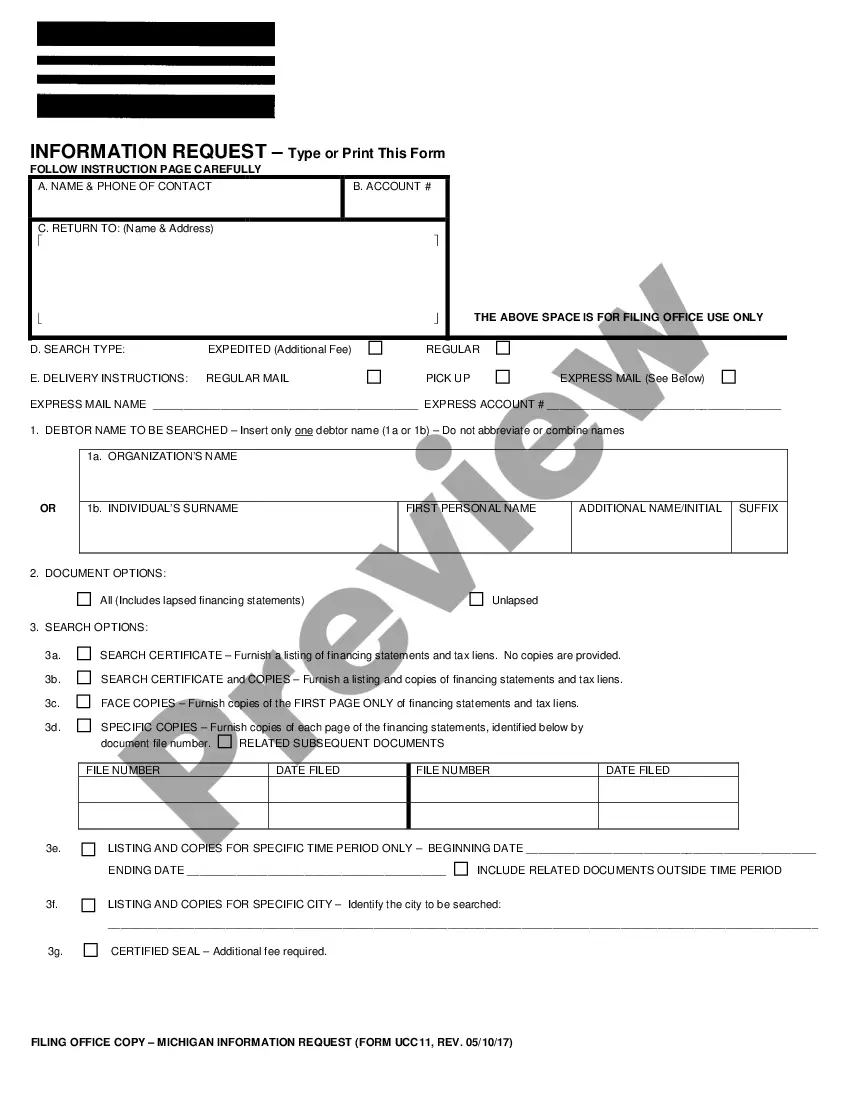

- Initial, make sure you have chosen the proper type for the area/area. You can look over the form while using Review key and study the form information to guarantee it will be the right one for you.

- When the type does not fulfill your expectations, utilize the Seach area to find the appropriate type.

- Once you are sure that the form is proper, click on the Purchase now key to have the type.

- Opt for the rates strategy you want and enter in the necessary information. Make your profile and purchase your order with your PayPal profile or charge card.

- Opt for the document structure and down load the lawful papers web template to your gadget.

- Comprehensive, change and printing and indicator the acquired Louisiana Wire Transfer Instruction to Receiving Bank.

US Legal Forms may be the largest library of lawful forms where you can find different papers web templates. Use the service to down load professionally-created papers that follow condition specifications.

Form popularity

FAQ

Your full name, as it appears on the account. Your full account number. For domestic wires, your routing number. For international wires, they need to use a Swift Code instead of the routing number.

Rather than cash, the participating institutions share information about the recipient, the bank receiving account number, and the amount transferred. The sender pays for the transaction upfront at their bank.

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

From experience, as long as the bank's routing number / sort code and recipient's account number are correct, the wire should go through. If by "address" you mean the bank's street address, that shouldn't be an issue. If you mean recipient's address, that also should be no problem.

To send a wire transfer by bank, you will typically be asked to provide the following information: Recipient full name. Sender full name. Recipient phone number. Sender phone number. Recipient address. Recipient bank name and information. Recipient checking account information.

What are the required details for a bank transfer? The full name of the recipient. The amount of money you want to transfer. Your recipient's 6-digit sort code. Your recipient's 8-digit account number. A payment reference (usually with your name, so the recipient can identify the source of money) Date of transfer.

Key Takeaways. To receive money through bank transfers, you need to provide your full name, sort code, and account number. Additional details, such as a reference and the bank's name, may be optional but can help ensure smooth transactions.

The wiring instructions will include all of the title or escrow company's information - the financial institution's name, an account number, and a routing number or ABA number (American Bankers Association). Once you've got that in order, you need to specify how much money will be sent and prepare ingly.

You will need to provide your account number and wire transfer routing number. For incoming international wires, you will also need to provide the appropriate SWIFT Code. Bank of America's SWIFT code BOFAUS3N should be used for incoming wires in U.S. dollars.

Recipient bank name, address and country. Recipient bank's routing code and recipient's account number. SWIFT Code, National ID or IBAN number of the bank where the receiving account is located. Purpose for transfer.