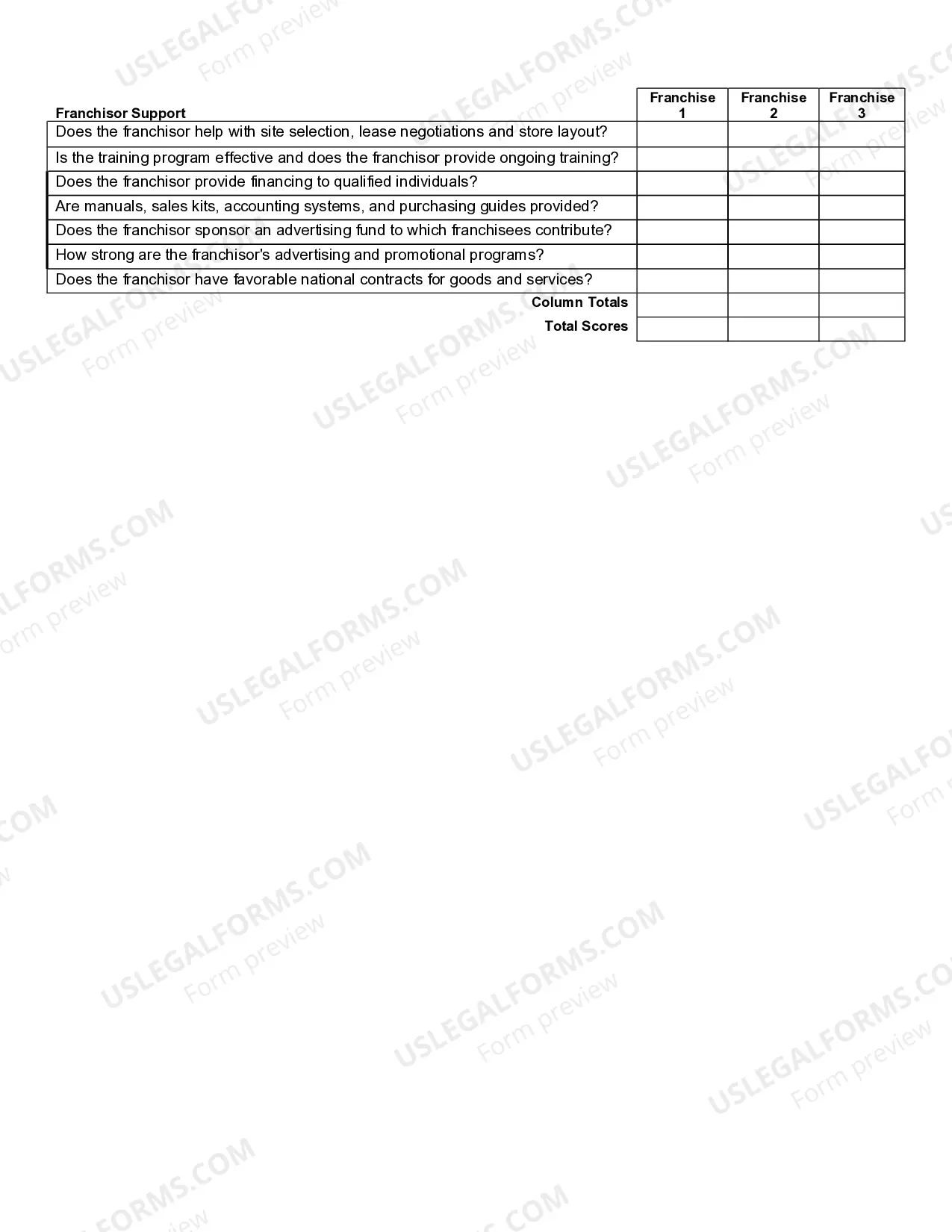

Louisiana Franchise Comparison Worksheet

Description

How to fill out Franchise Comparison Worksheet?

Choosing the right legal file web template could be a struggle. Obviously, there are a lot of web templates available online, but how do you find the legal develop you want? Use the US Legal Forms internet site. The services gives a large number of web templates, like the Louisiana Franchise Comparison Worksheet, that you can use for organization and private demands. All the kinds are checked out by professionals and satisfy state and federal specifications.

When you are presently registered, log in in your accounts and click the Down load key to obtain the Louisiana Franchise Comparison Worksheet. Use your accounts to check with the legal kinds you might have purchased previously. Visit the My Forms tab of your accounts and have an additional copy of the file you want.

When you are a brand new customer of US Legal Forms, allow me to share simple instructions that you should follow:

- Initial, be sure you have chosen the proper develop for the area/area. You are able to examine the shape utilizing the Review key and read the shape description to make sure this is the best for you.

- When the develop is not going to satisfy your requirements, use the Seach field to obtain the appropriate develop.

- Once you are certain that the shape would work, click on the Purchase now key to obtain the develop.

- Select the costs plan you would like and enter the essential information. Build your accounts and purchase an order making use of your PayPal accounts or Visa or Mastercard.

- Select the document file format and download the legal file web template in your system.

- Comprehensive, change and printing and signal the acquired Louisiana Franchise Comparison Worksheet.

US Legal Forms will be the greatest library of legal kinds where you can discover a variety of file web templates. Use the company to download professionally-created papers that follow status specifications.

Form popularity

FAQ

A Louisiana S corporation is a corporation that is legally registered to operate within the state. This type of corporation elects for different taxation than a C corporation, which is the standard formation of a corporation in Louisiana.

Rate of Tax For periods beginning on or after January 1, 2023, $2.75 for each $1,000 or major fraction thereof in excess of $300,000 of capital employed in Louisiana. The initial corporation franchise tax is $110.

Follow these five steps to start a Louisiana LLC and elect Louisiana S corp designation: Name Your Business. Choose a Registered Agent. File the Louisiana Articles of Organization. Create an Operating Agreement. File Form 2553 to Elect Louisiana S Corp Tax Designation.

DOMESTIC CORPORATIONS ? Corporations organized under the laws of Louisiana must file an income and franchise tax return (Form CIFT-620) each year unless exempt from both taxes.

Technically an S Corporation is a pass-through entity but Louisiana income tax law does not recognize Subchapter S corporation status. An S corporation is required to file income tax in the same manner as a C corporation.

Some jurisdictions?the District of Columbia, Louisiana, New Hampshire, New York City, Tennessee, and Texas?do not recognize the federal S corporation election and, for the most part, tax S corporations like other business corporations.

Corporation Income and Franchise Tax The new tax rates are 3.5% on the first $50,000 of net income, 5.5% on the next $100,000 of net income, and 7.5% on the excess over $150,000. Also, some provisions of Act 389 of the 2021 Regular Session of the Louisiana Legislature became effective.

Louisiana also accepts any extension granted by the Internal Revenue Service (IRS). A copy of the extension should be attached to the state return when it is filed.