The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

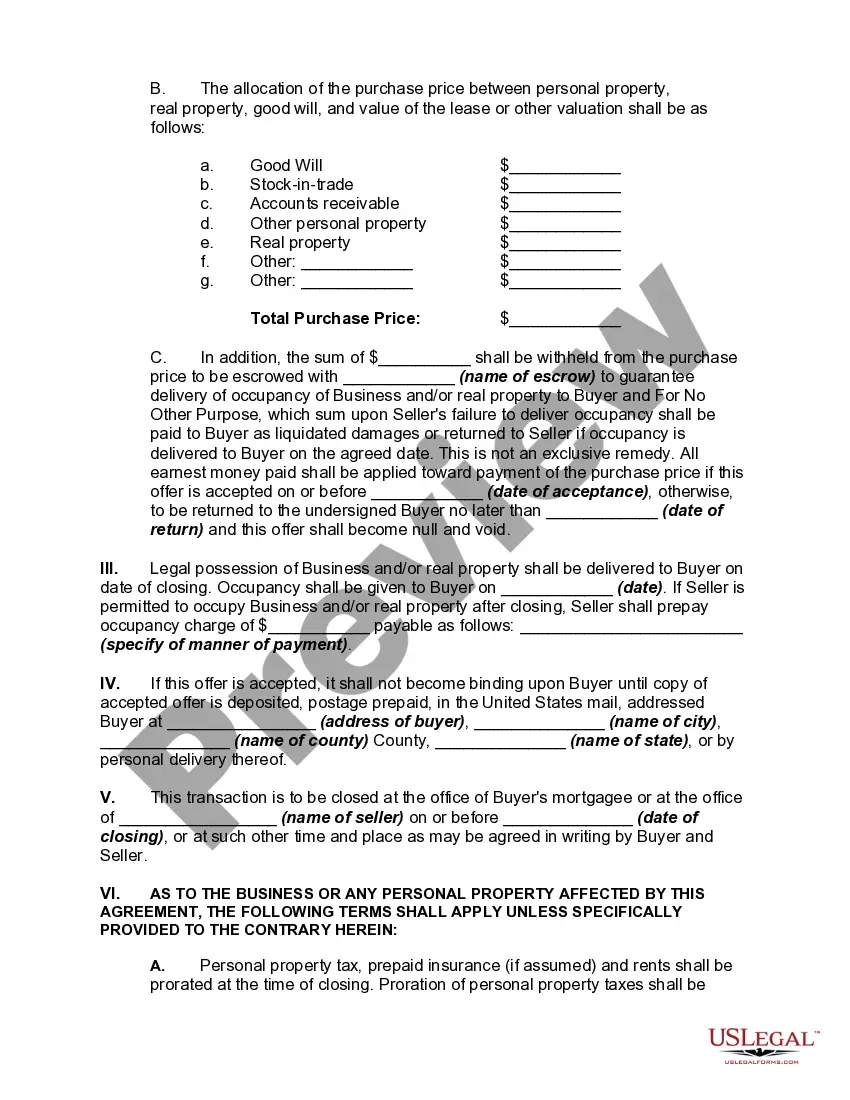

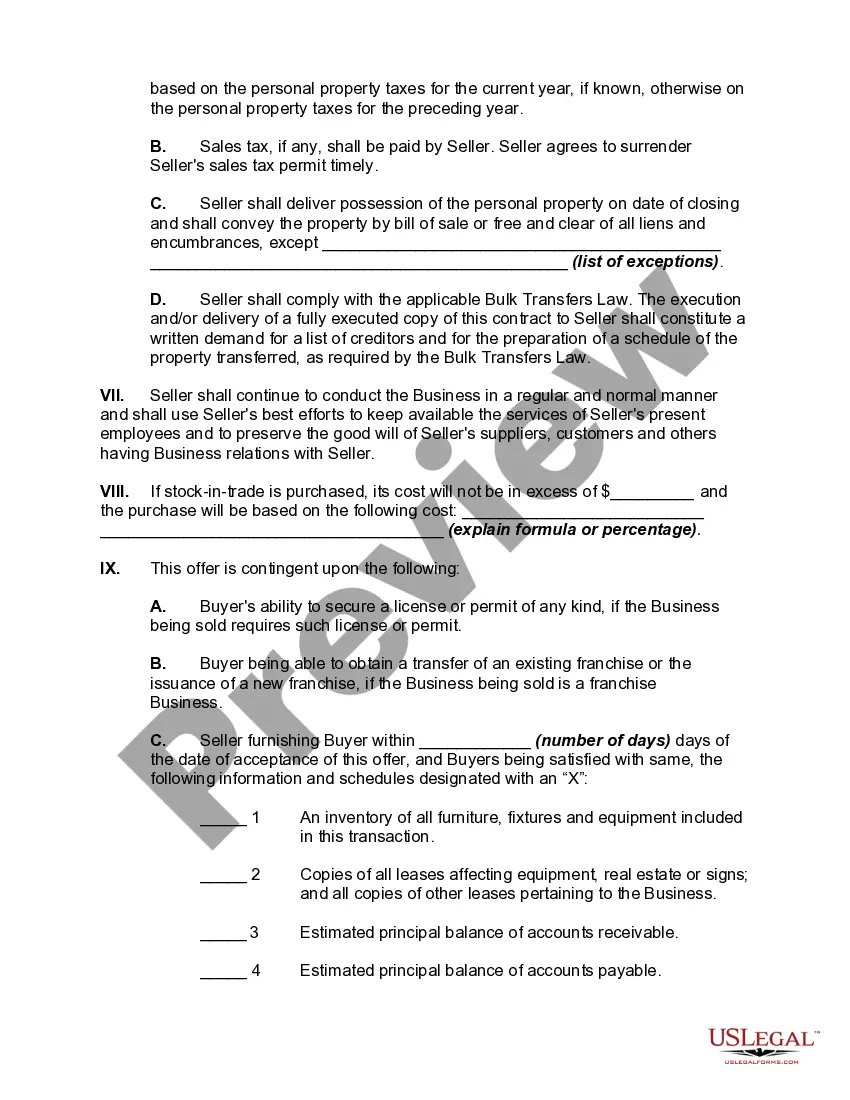

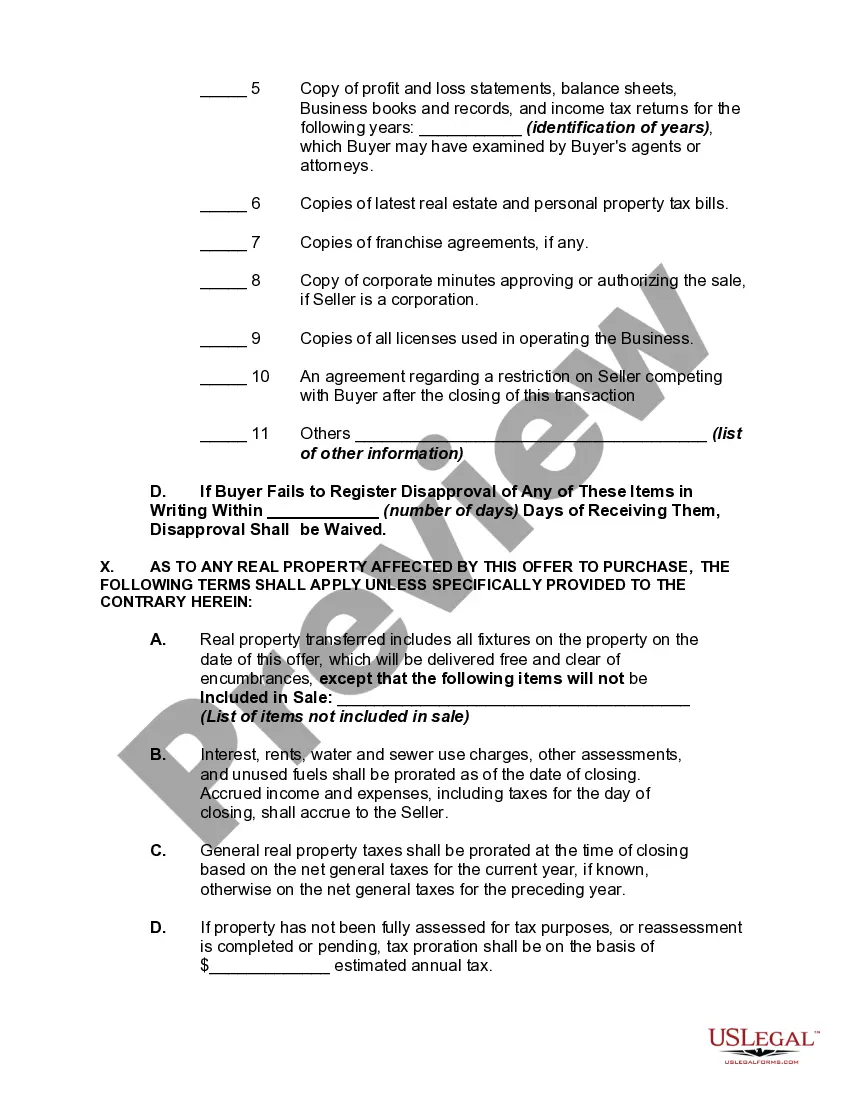

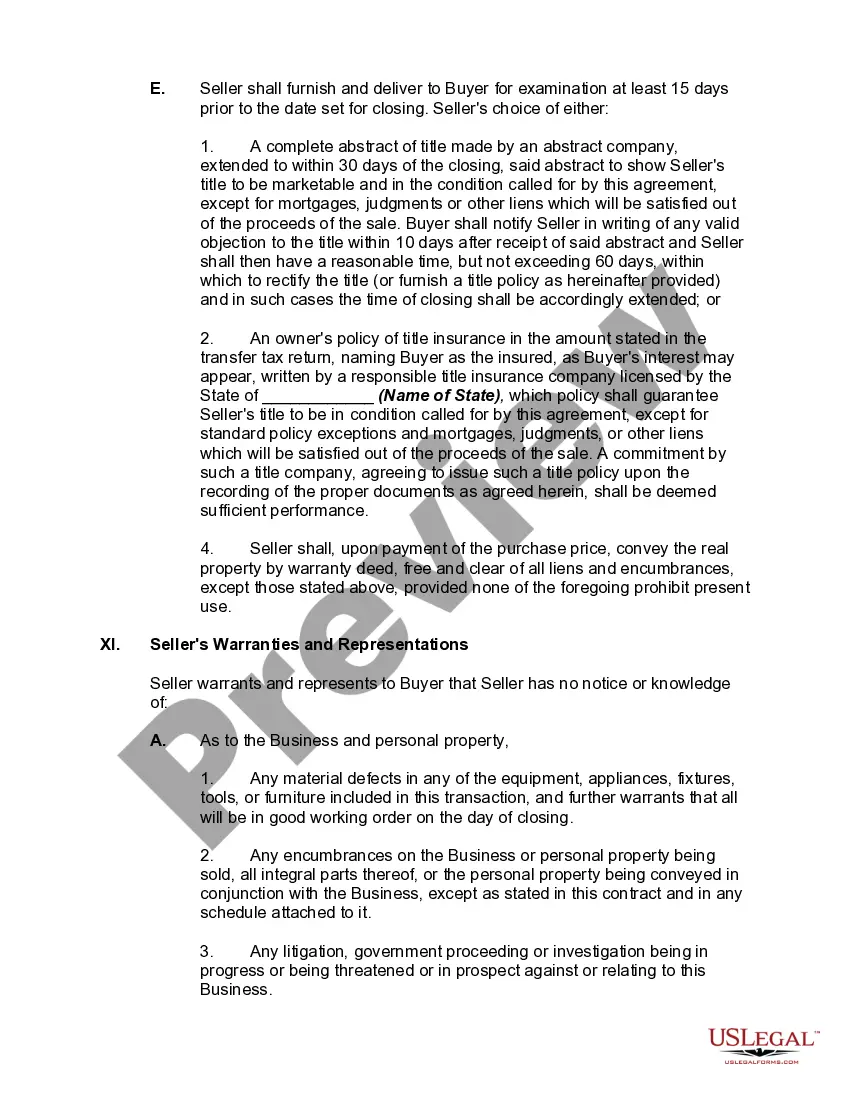

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

Louisiana Offer to Purchase Business, Including Good Will: A Comprehensive Guide Introduction: The Louisiana Offer to Purchase Business, Including Good Will, is a legal document that outlines the terms and conditions under which one party intends to purchase a business, including its goodwill. Goodwill refers to the intangible value associated with a business such as reputation, customer loyalty, brand recognition, and ongoing relationships. This detailed description of the Louisiana Offer to Purchase Business, Including Good Will, will provide insight into its purpose, content, and different types. Purpose: The primary purpose of the Louisiana Offer to Purchase Business, Including Good Will, is to establish a legally binding agreement between the buyer and the seller. It ensures that both parties fully understand their obligations and expectations regarding the purchase of the business and its associated goodwill. This document serves as a safeguard for both parties, minimizing potential conflicts and disputes throughout the transaction process. Content: 1. Parties Involved: Clearly identify the buyer(s) and seller(s) involved in the transaction. Include their legal names, addresses, and contact details. 2. Business Details: Provide a comprehensive description of the business being sold, including its legal name, address, industry, products/services offered, and any pertinent financial information such as annual revenue, assets, and liabilities. 3. Purchase Price and Terms: Specify the agreed-upon purchase price, making sure to outline whether it involves a lump sum or installment payments. Include details regarding the payment structure, schedule, and any contingencies related to financing or loans. 4. Assets and Liabilities: List all assets being sold as part of the business, such as equipment, inventory, furniture, patents, licenses, intellectual property, websites, and lease agreements. Similarly, identify any existing liabilities the buyer will assume. 5. Goodwill: Detail the value assigned to the goodwill associated with the business and explain how it was determined, usually based on factors like customer loyalty, brand reputation, and market position. 6. Transition Period: Define the duration and terms of the transition period during which the seller will assist the buyer in transitioning smoothly into the business. This may involve training, introductions to key stakeholders, and ensuring a seamless handover of responsibilities. 7. Due Diligence: Specify the timeframe allotted for the buyer to conduct due diligence on the business. Clarify the buyer's access to financial records, contracts, and other pertinent information necessary for assessment. 8. Confidentiality: Establish confidentiality provisions to protect sensitive business information that may be shared during the negotiation and due diligence processes. 9. Governing Law: Specify that the Louisiana state laws will govern the interpretation and enforceability of the agreement. Types: 1. Asset Purchase Agreement: This type of agreement focuses on the purchase of specific assets of the business, including its goodwill, rather than the acquisition of the entire business entity. 2. Stock or Membership Interest Purchase Agreement: In this type of agreement, the buyer purchases the stocks or membership interests (in the case of an LLC) of the existing business entity, thereby acquiring the entire business, inclusive of its goodwill. Conclusion: The Louisiana Offer to Purchase Business, Including Good Will, is an essential document for both parties involved in the sale of a business. Its comprehensive nature ensures that all aspects of the transaction, including the purchase price, assets, liabilities, and goodwill, are clearly defined and understood. By outlining the rights and responsibilities of both buyer and seller, this document provides a solid foundation for a successful business transfer in Louisiana.Louisiana Offer to Purchase Business, Including Good Will: A Comprehensive Guide Introduction: The Louisiana Offer to Purchase Business, Including Good Will, is a legal document that outlines the terms and conditions under which one party intends to purchase a business, including its goodwill. Goodwill refers to the intangible value associated with a business such as reputation, customer loyalty, brand recognition, and ongoing relationships. This detailed description of the Louisiana Offer to Purchase Business, Including Good Will, will provide insight into its purpose, content, and different types. Purpose: The primary purpose of the Louisiana Offer to Purchase Business, Including Good Will, is to establish a legally binding agreement between the buyer and the seller. It ensures that both parties fully understand their obligations and expectations regarding the purchase of the business and its associated goodwill. This document serves as a safeguard for both parties, minimizing potential conflicts and disputes throughout the transaction process. Content: 1. Parties Involved: Clearly identify the buyer(s) and seller(s) involved in the transaction. Include their legal names, addresses, and contact details. 2. Business Details: Provide a comprehensive description of the business being sold, including its legal name, address, industry, products/services offered, and any pertinent financial information such as annual revenue, assets, and liabilities. 3. Purchase Price and Terms: Specify the agreed-upon purchase price, making sure to outline whether it involves a lump sum or installment payments. Include details regarding the payment structure, schedule, and any contingencies related to financing or loans. 4. Assets and Liabilities: List all assets being sold as part of the business, such as equipment, inventory, furniture, patents, licenses, intellectual property, websites, and lease agreements. Similarly, identify any existing liabilities the buyer will assume. 5. Goodwill: Detail the value assigned to the goodwill associated with the business and explain how it was determined, usually based on factors like customer loyalty, brand reputation, and market position. 6. Transition Period: Define the duration and terms of the transition period during which the seller will assist the buyer in transitioning smoothly into the business. This may involve training, introductions to key stakeholders, and ensuring a seamless handover of responsibilities. 7. Due Diligence: Specify the timeframe allotted for the buyer to conduct due diligence on the business. Clarify the buyer's access to financial records, contracts, and other pertinent information necessary for assessment. 8. Confidentiality: Establish confidentiality provisions to protect sensitive business information that may be shared during the negotiation and due diligence processes. 9. Governing Law: Specify that the Louisiana state laws will govern the interpretation and enforceability of the agreement. Types: 1. Asset Purchase Agreement: This type of agreement focuses on the purchase of specific assets of the business, including its goodwill, rather than the acquisition of the entire business entity. 2. Stock or Membership Interest Purchase Agreement: In this type of agreement, the buyer purchases the stocks or membership interests (in the case of an LLC) of the existing business entity, thereby acquiring the entire business, inclusive of its goodwill. Conclusion: The Louisiana Offer to Purchase Business, Including Good Will, is an essential document for both parties involved in the sale of a business. Its comprehensive nature ensures that all aspects of the transaction, including the purchase price, assets, liabilities, and goodwill, are clearly defined and understood. By outlining the rights and responsibilities of both buyer and seller, this document provides a solid foundation for a successful business transfer in Louisiana.