Louisiana Sample Letter for Payment Schedule

Description

How to fill out Sample Letter For Payment Schedule?

Are you in a placement the place you require files for possibly company or individual reasons nearly every day time? There are plenty of legal papers web templates available on the net, but finding ones you can rely on is not effortless. US Legal Forms provides 1000s of form web templates, just like the Louisiana Sample Letter for Payment Schedule, that are written to satisfy federal and state specifications.

If you are currently familiar with US Legal Forms internet site and also have your account, just log in. After that, it is possible to down load the Louisiana Sample Letter for Payment Schedule format.

Unless you offer an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Find the form you will need and ensure it is for that correct metropolis/county.

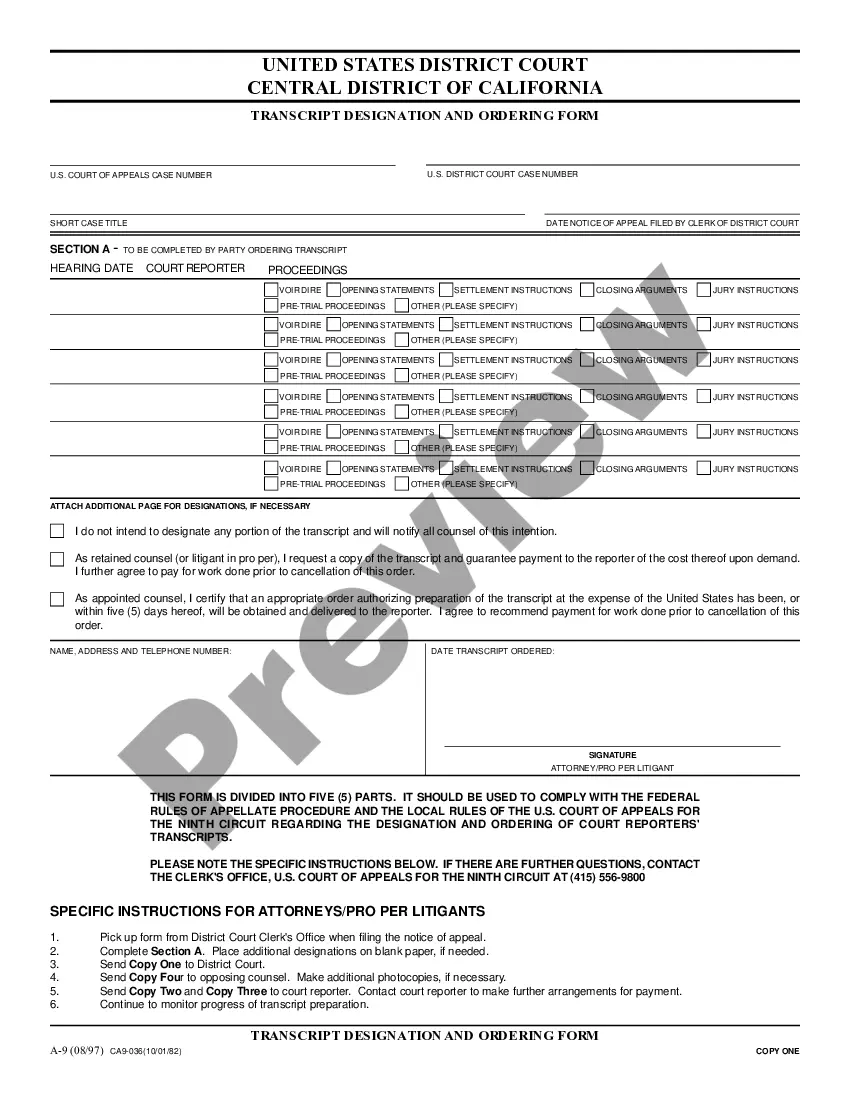

- Take advantage of the Review button to analyze the shape.

- Read the description to actually have chosen the right form.

- In case the form is not what you`re seeking, use the Research area to discover the form that meets your requirements and specifications.

- Whenever you discover the correct form, just click Get now.

- Opt for the rates prepare you would like, complete the specified information and facts to make your bank account, and purchase your order using your PayPal or bank card.

- Select a hassle-free paper format and down load your copy.

Locate all the papers web templates you possess purchased in the My Forms food list. You can aquire a more copy of Louisiana Sample Letter for Payment Schedule whenever, if required. Just click on the required form to down load or print the papers format.

Use US Legal Forms, probably the most substantial assortment of legal types, in order to save time and steer clear of faults. The services provides skillfully created legal papers web templates which you can use for a selection of reasons. Generate your account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

All you will need to do is: Provide details, such as how much you are owed, who owes you the money, and when it happened. Customize your letter by choosing how you want to be paid and deciding when you must be paid. Send your letter via certified mail, complete with tracking.

I am writing to you because your payment for invoice number is now days overdue. You have not raised any queries about your account, so I assume that you do not dispute the amount you owe. I have enclosed a copy of the unpaid invoice. This field is required.

A demand letter for payment is a request for money owed that is commonly the last notice given by the creditor. The party owed should include language that motivates the debtor to make payment. Examples include giving a discount if the debtor decides to pay or threatening to send the debt to collections.

What to include in a demand letter The date the letter is being sent. Your name and address, and the name and address of the debtor. A description of the facts of the case (such as, you signed a contract for a new roof dated X date and the contractor didn't do the work) The amount you are seeking to collect (see below)

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Here are some of the details a demand letter needs to include: Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment.

Using an Angry Tone. Writing in an angry tone or personally attacking the other party is the worst thing you can do in a demand letter. If you let your emotions speak, you'll only invite the receiver to respond in the same tone.

Here are the general elements that should be incorporated into your letter: Today's date. Client's contact information. Your contact information. Greeting with client's name. Brief description of services rendered and price. Your payment details. Payment due date. Terms and conditions including late fees.