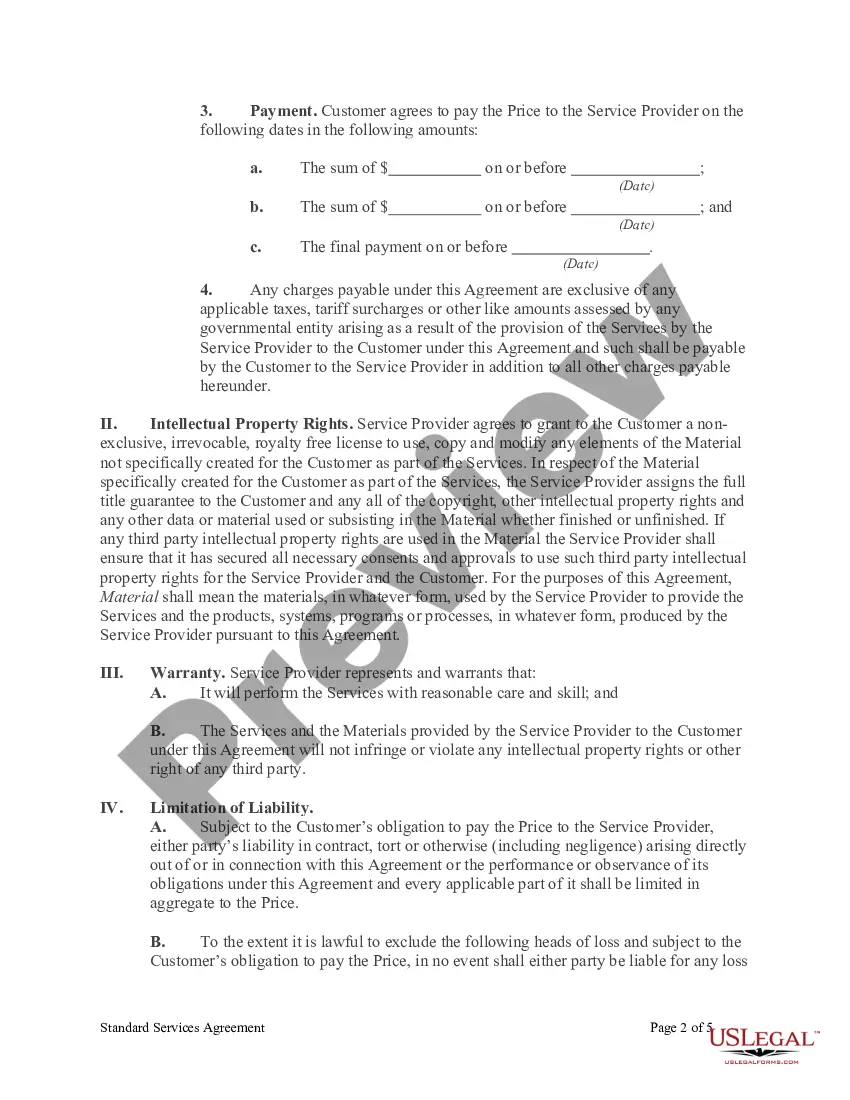

The Louisiana Standard Services Agreement (SSA) is a legally binding contract used to establish a professional relationship between a service provider and a client within the state of Louisiana. This agreement outlines the terms and conditions for the provision of services, ensuring that both parties have a clear understanding of their roles, responsibilities, and expectations. The Louisiana SSA is designed to regulate service agreements across various industries, including but not limited to consulting, technology, marketing, accounting, legal, and maintenance services. Here are some different types of Louisiana Standard Services Agreement: 1. Consulting Services Agreement: This type of SSA applies to businesses or individuals providing expert advice, guidance, and solutions to clients seeking professional consultation. 2. Technology Services Agreement: This agreement is specifically tailored for technology-related services, such as software development, IT support, network installations, cybersecurity, and technological consulting. 3. Marketing Services Agreement: This SSA is relevant to marketing agencies or freelancers providing marketing strategies, advertising campaigns, market research, branding, and promotional services to clients. 4. Accounting Services Agreement: This type of SSA encompasses professional accounting services, including bookkeeping, tax preparation, auditing, financial analysis, and advisory services. 5. Legal Services Agreement: Lawyers or law firms often utilize this SSA to document terms and conditions of legal representation, including areas such as contract drafting, litigation, intellectual property, and estate planning. 6. Maintenance Services Agreement: This agreement is commonly used by service providers offering maintenance and repair services, such as HVAC technicians, plumbers, electricians, or general contractors. The Louisiana SSA typically covers various essential aspects, including scope of work, project timelines, payment terms, intellectual property rights, liability and indemnification clauses, termination conditions, dispute resolution, and confidentiality agreements. It ensures that both the service provider and the client are protected by clearly defining their rights, obligations, and potential legal recourse. It is important for service providers and clients in Louisiana to carefully review and customize the standard SSA according to their specific requirements to ensure a fair and transparent working relationship. Legal advice from qualified professionals is recommended to ensure compliance with Louisiana laws and regulations.

Louisiana Standard Services Agreement

Description

How to fill out Louisiana Standard Services Agreement?

Are you inside a place that you need paperwork for possibly enterprise or individual reasons just about every time? There are plenty of legitimate document layouts available online, but locating kinds you can rely isn`t straightforward. US Legal Forms provides a large number of form layouts, just like the Louisiana Standard Services Agreement, which are created in order to meet federal and state requirements.

In case you are previously knowledgeable about US Legal Forms internet site and also have an account, just log in. Afterward, you can acquire the Louisiana Standard Services Agreement format.

If you do not come with an account and wish to begin to use US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for your right area/region.

- Use the Review button to examine the shape.

- See the outline to actually have selected the proper form.

- If the form isn`t what you are searching for, make use of the Look for industry to get the form that fits your needs and requirements.

- When you obtain the right form, click on Get now.

- Pick the costs strategy you desire, fill out the desired info to produce your account, and pay money for your order making use of your PayPal or charge card.

- Choose a practical data file file format and acquire your version.

Get every one of the document layouts you have bought in the My Forms food selection. You may get a extra version of Louisiana Standard Services Agreement anytime, if possible. Just click on the essential form to acquire or print out the document format.

Use US Legal Forms, probably the most considerable collection of legitimate forms, to save lots of time and prevent mistakes. The support provides expertly manufactured legitimate document layouts that you can use for a range of reasons. Make an account on US Legal Forms and begin making your daily life a little easier.