The bylaws of a corporation are the internal rules and guidelines for the day-to-day operation of a corporation, such as when and where the corporation will hold directors' and shareholders' meetings and what the shareholders' and directors' voting requirements are. Typically, the bylaws are adopted by the corporation's directors at their first board meeting. They may specify the rights and duties of the officers, shareholders and directors, and may deal, for example, with how the company may enter into contracts, transfer shares, hold meetings, pay dividends and make amendments to corporate documents. They generally will identify a fiscal year for the corporation.

Louisiana Bi-Laws of a Non-Profit Church Corporation

Description

How to fill out Bi-Laws Of A Non-Profit Church Corporation?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a diverse selection of legal document models that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can find the most current versions of forms such as the Louisiana Bi-Laws of a Non-Profit Church Corporation in just moments.

If you have an account, Log In and download Louisiana Bi-Laws of a Non-Profit Church Corporation from the US Legal Forms repository. The Download button will appear on every form you examine. You can retrieve all previously downloaded forms from the My documents section of your profile.

Process the payment. Use your Visa, Mastercard, or PayPal account to complete the transaction.

Select the format and download the form to your device. Make alterations. Fill out, edit, print, and sign the downloaded Louisiana Bi-Laws of a Non-Profit Church Corporation. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, just visit the My documents section and click on the form you need. Access the Louisiana Bi-Laws of a Non-Profit Church Corporation with US Legal Forms, the most extensive collection of legal document models. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your region/county.

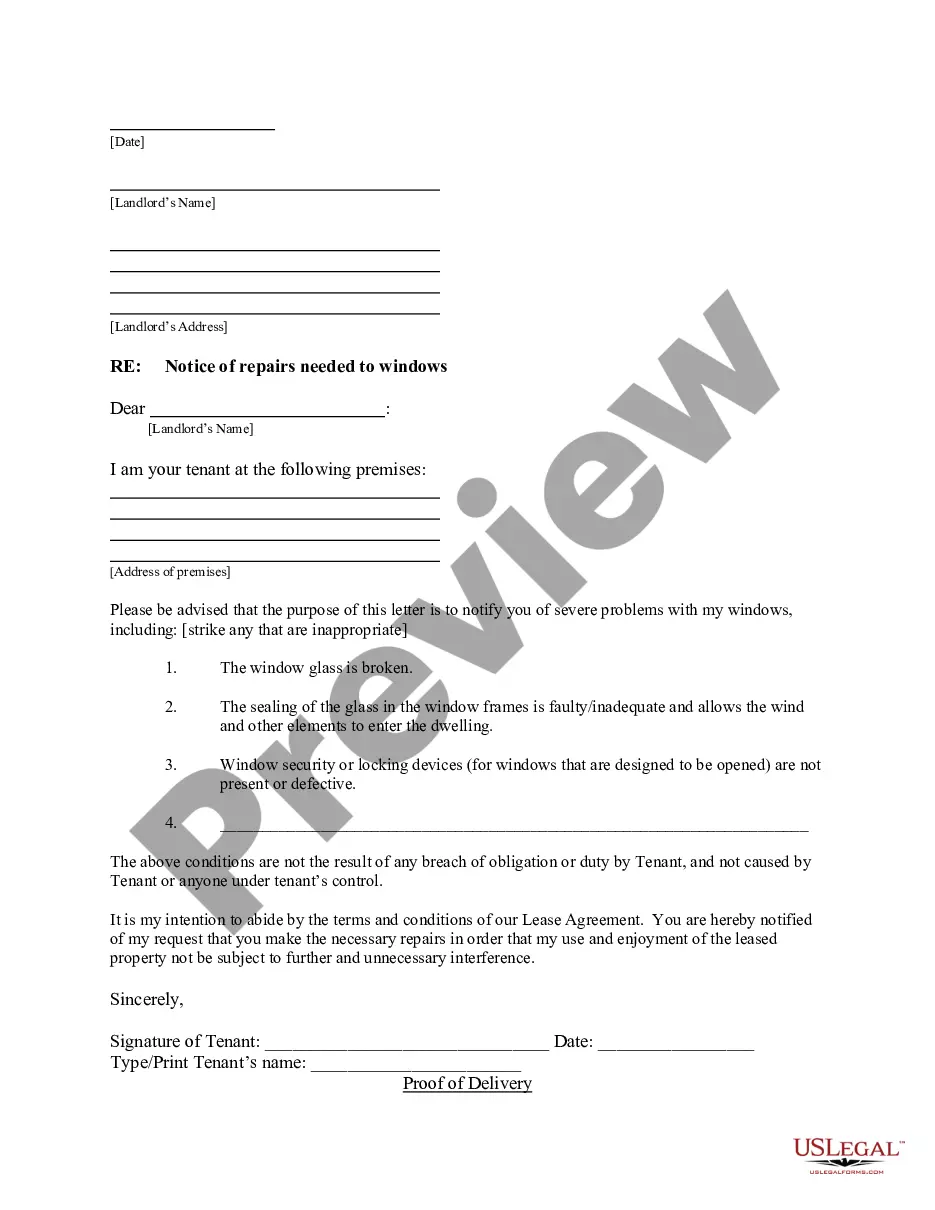

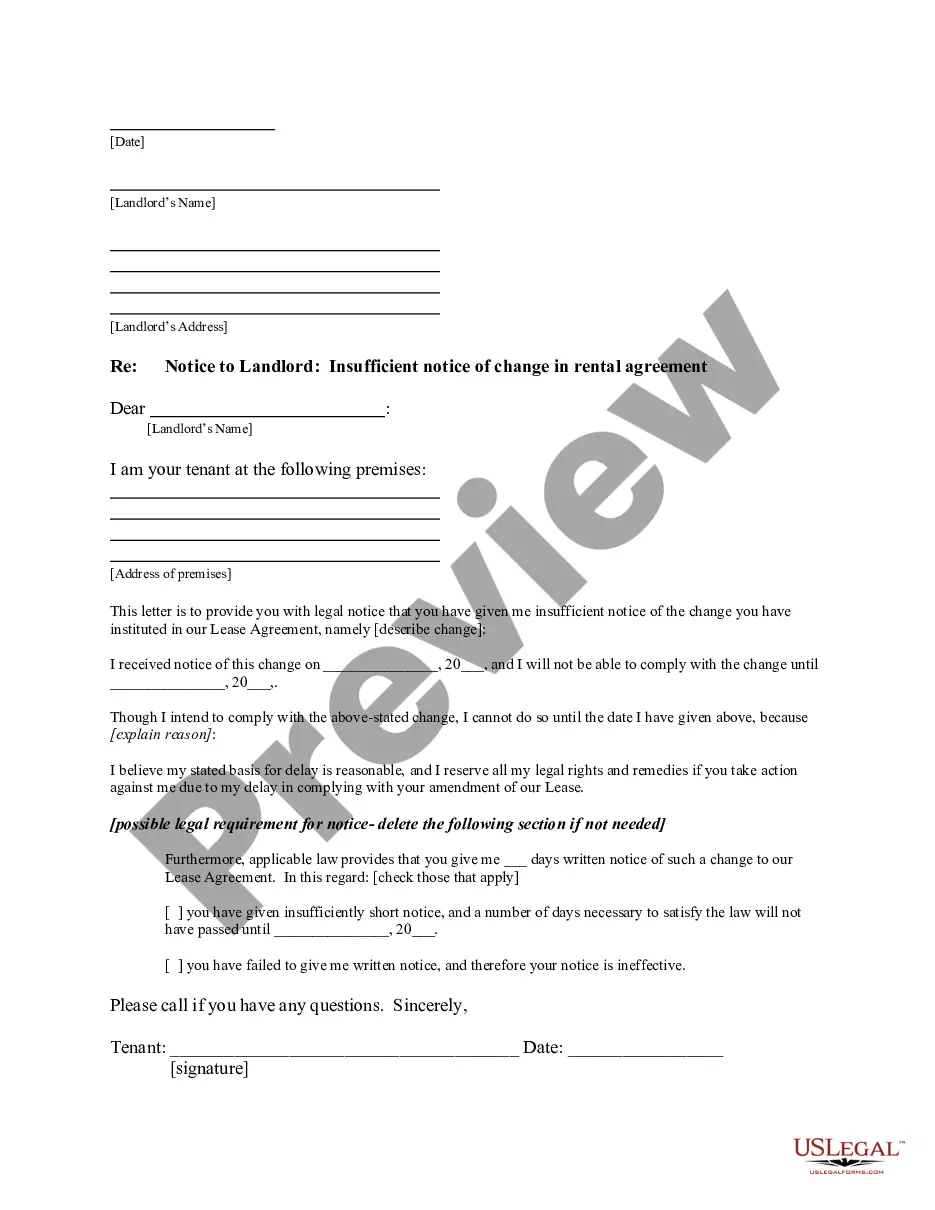

- Click the Preview button to review the form's content.

- Check the form details to confirm you have chosen the correct document.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- When you are pleased with the form, confirm your choice by clicking the Get now button.

- Then, choose your payment plan and provide your details to register an account.

Form popularity

FAQ

Drafting non-profit bylaws involves a clear understanding of your organization's mission and governance structure. Begin by outlining the purpose, membership requirements, and board responsibilities. Ensure your bylaws comply with state and federal regulations under Louisiana bi-laws of a non-profit church corporation. Utilizing a platform like uslegalforms can help streamline this process and provide templates tailored to your unique needs.

It is possible for an individual to hold two separate offices, with the exception that the President cannot also serve as the Secretary, which is prohibited in most states' nonprofit corporate law. CALIFORNIA.

1. Choose who will be on the initial board of directors for your nonprofit corporation. In Louisiana, your nonprofit corporation must have three or more directors. In a membership corporation, if there are less than three members, then there must be the same number of directors as there are members.

Section 501(c)(3) is one of the tax law provisions granting exemption from the federal income tax to nonprofit organizations that exist for religious, charitable, scientific, literary, or educational purposes, among others. See the IRS's website for more information on the designation of charitable organizations.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your Louisiana Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: File with the Recorder of Mortgages.More items...?

State laws determine the minimum number of board directors, which is usually two or three. Depending on the state, there could be a board of one, but it might be difficult to attain 501(c)(3) status with just one board member. Nonprofit organizational budgets are sometimes a factor in the number of board members.

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.