Louisiana Surety Agreement

Description

How to fill out Surety Agreement?

Have you ever found yourself in a situation where you require documents for either business or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't straightforward.

US Legal Forms provides thousands of template options, including the Louisiana Surety Agreement, which can be filled out to meet state and federal requirements.

Once you find the appropriate template, click on Acquire now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and hold an account, simply Log In.

- Following that, you can download the Louisiana Surety Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the template you need and make sure it applies to the correct city/county.

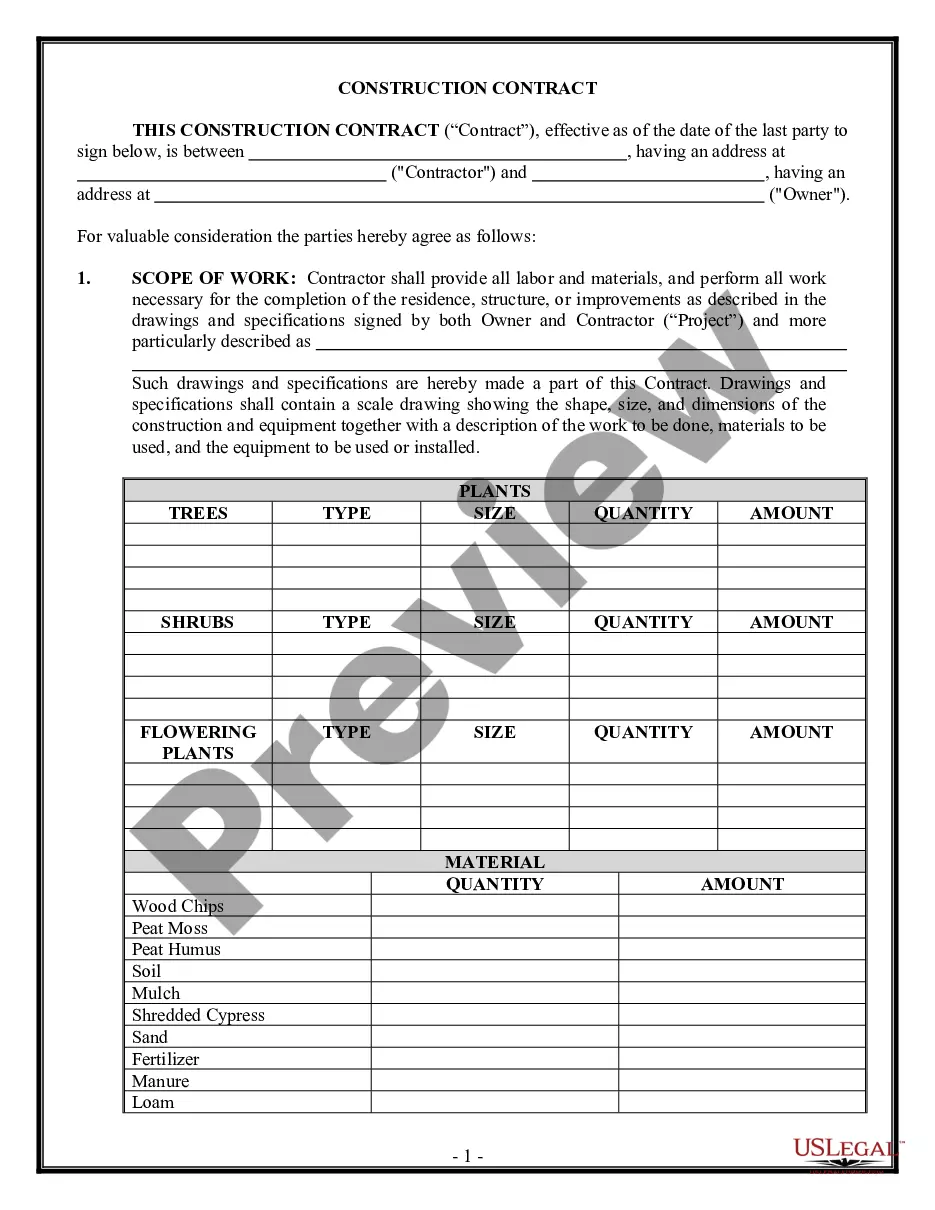

- Utilize the Preview button to view the form.

- Read the description to ensure you have selected the right template.

- If the template doesn't satisfy your requirements, use the Search field to find the document that meets your needs.

Form popularity

FAQ

Filling out a surety form requires attention to detail and accuracy. Start by reading the entire form to understand the required information, then gather the necessary documentation, such as business and financial details. Complete each section of the form diligently and ensure all information aligns with what is required. Using a platform like uslegalforms can help provide guidance and templates for completing a Louisiana Surety Agreement form correctly.

A: Surety bonds provide financial guarantees that contracts and other business deals will be completed according to mutual terms. Surety bonds protect consumers and government entities from fraud and malpractice. When a principal breaks a bond's terms, the harmed party can make a claim on the bond to recover losses.

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor.

Surety Bond RequirementsThe bond must be issued by an insurer admitted to write surety business in Louisiana.Each bond must be executed on the form provided by the LDI.The original bond must be filed with the LDI.Each bond must provide for a cancellation notice of not less than thirty day.More items...

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.

Most Popular Surety Bonds in Louisiana You will need an auto dealer bond between $10,000 and $30,000, depending on the type of business. If you'd like to get licensed as a mortgage broker in Louisiana, you will need a mortgage broker bond of $25,000 or $50,000, depending on your loan volume.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

There are two main categories of surety bond: Contract Bonds and Commercial Bonds. Contract bonds guarantee a specific contract. Examples include Performance Bonds, Bid Bonds, Supply bonds, Maintenance Bonds, and Subdivision Bonds. Commercial Bonds guarantee per the terms of the bond form.

The three most common types of contract surety bonds are bid bonds, performance bonds, and payment bonds.