A Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose is a specific legal provision that can be included in a testamentary trust established in Louisiana. This provision allows for a charitable bequest to be made from the trust for a stated charitable purpose or cause. When creating a testamentary trust, individuals or testators can choose to include specific instructions on how their assets should be distributed to a charitable organization or cause. This provision ensures that the trust's assets are used for the intended charitable purpose and allows the testator to have a lasting impact on the charitable because they care about. One type of Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose is the Charitable Remainder Trust. In this type of provision, the testator sets up a trust that provides income to designated beneficiaries for a certain period of time. After that period, the remaining trust assets are paid to a charitable organization or cause. Another type is the Charitable Lead Trust, where the trust provides income payments to a charitable organization or cause for a specified period. Once that period ends, the trust assets are then distributed to non-charitable beneficiaries, such as family members or other individuals designated by the testator. The Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose ensures that the testator's wishes regarding their charitable contributions are carried out even after their passing. This provision adds an extra layer of control and accountability to ensure that the trust assets are used in alignment with the testator's charitable goals. It is important to consult with an experienced estate planning attorney when including a Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose to ensure that the provision is drafted correctly, complies with applicable laws, and accurately reflects the testator's intentions.

Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

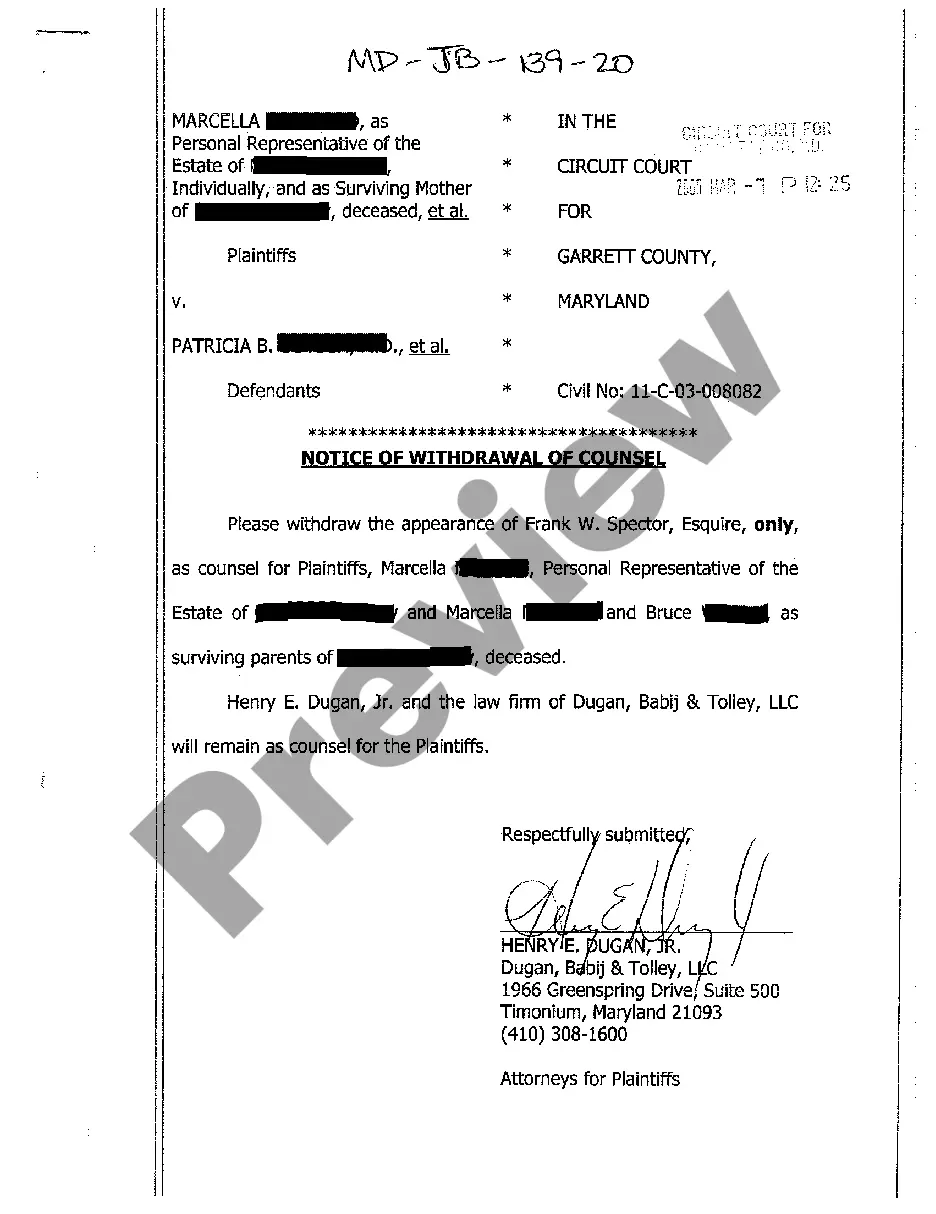

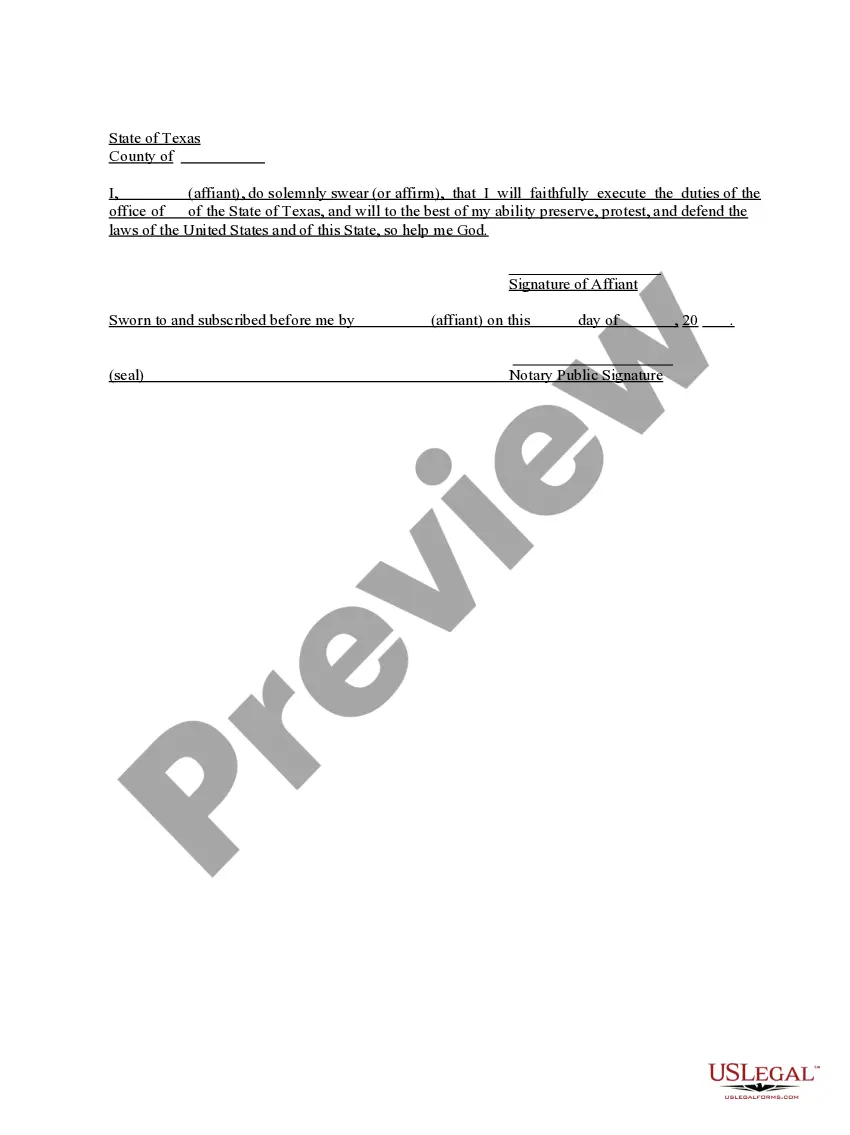

How to fill out Louisiana Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

If you want to comprehensive, down load, or print out lawful papers themes, use US Legal Forms, the biggest variety of lawful varieties, that can be found on the web. Make use of the site`s simple and easy handy research to get the files you need. A variety of themes for enterprise and personal functions are categorized by types and claims, or key phrases. Use US Legal Forms to get the Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose within a handful of clicks.

In case you are already a US Legal Forms customer, log in to your bank account and click the Obtain option to find the Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose. Also you can entry varieties you earlier downloaded in the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape to the right town/nation.

- Step 2. Make use of the Preview choice to check out the form`s articles. Do not overlook to see the outline.

- Step 3. In case you are unhappy with all the kind, take advantage of the Search discipline towards the top of the screen to find other types from the lawful kind design.

- Step 4. When you have located the shape you need, click on the Acquire now option. Choose the costs plan you choose and add your references to sign up for the bank account.

- Step 5. Method the transaction. You can utilize your charge card or PayPal bank account to perform the transaction.

- Step 6. Find the structure from the lawful kind and down load it on your product.

- Step 7. Comprehensive, edit and print out or indicator the Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose.

Each and every lawful papers design you purchase is the one you have for a long time. You may have acces to every kind you downloaded within your acccount. Select the My Forms section and pick a kind to print out or down load again.

Be competitive and down load, and print out the Louisiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose with US Legal Forms. There are thousands of expert and state-certain varieties you can utilize for your enterprise or personal needs.

Form popularity

FAQ

Charitable Beneficiary means one (1) or more beneficiaries of the Trust as determined pursuant to Section 5.9(iii)(f), provided that each such organization must be described in Section 501(c)(3) of the Code and contributions to each such organization must be eligible for deduction under each of Sections 170(b)(1)(A),

Beneficiary: Beneficiary(ies) refers to the person, persons, or organization that receives payments or assets from a trust. Beneficiaries can be either charitable or non-charitable, and can be either an income beneficiary or a remainder beneficiary. The beneficiary holds the beneficial title to the trust property.

Although we commonly think of trust beneficiaries as single individuals, it is also possible to name an organization, such as a charity, as the beneficiary of a revocable trust. The process of naming the charity as the beneficiary is virtually no different than the one used to name an individual.

Generally, you can name anyone, even a charity, as the beneficiary of your life insurance policy or retirement account. You can leave the entire amount of your death benefit to a charity or designate that only a portion of the proceeds goes to the charity and the remainder to a family member or other beneficiary.

As noted above, estates and some older trusts may be eligible for an expanded charitable deduction for amounts permanently set aside for charity. For an irrevocable trust to qualify for a charitable set-aside deduction, in general, (1) no assets may have been contributed to the trust after Oct.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

A testamentary trust is a trust contained in a last will and testament. It provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

Naming a charity as a life insurance beneficiary is simple: Write in the charity name and contact information when you choose or change your beneficiaries. You can name multiple beneficiaries and specify what percentage of the death benefit should go to each.