Louisiana Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

Are you in a situation where you require documents for potential business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions is not simple.

US Legal Forms provides a vast array of form templates, including the Louisiana Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, which can be crafted to fulfill federal and state regulations.

Upon finding the correct form, select Purchase now.

Choose the payment plan you prefer, provide the required information to create your account, and complete the payment using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Louisiana Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years anytime, if necessary. Just follow the required form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and prevent errors. The service offers expertly crafted legal document templates that you can utilize for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Louisiana Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you require and ensure it is for the appropriate city/state.

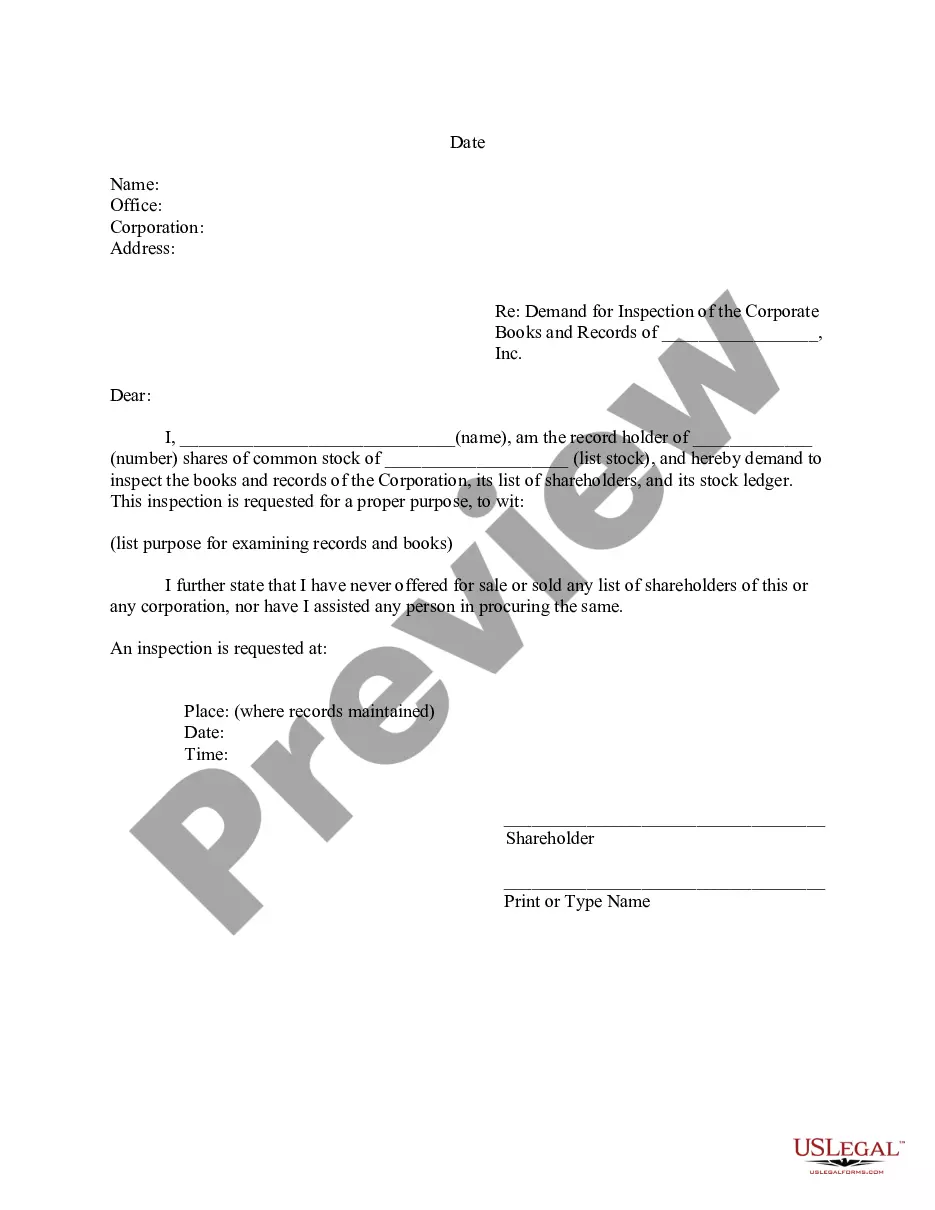

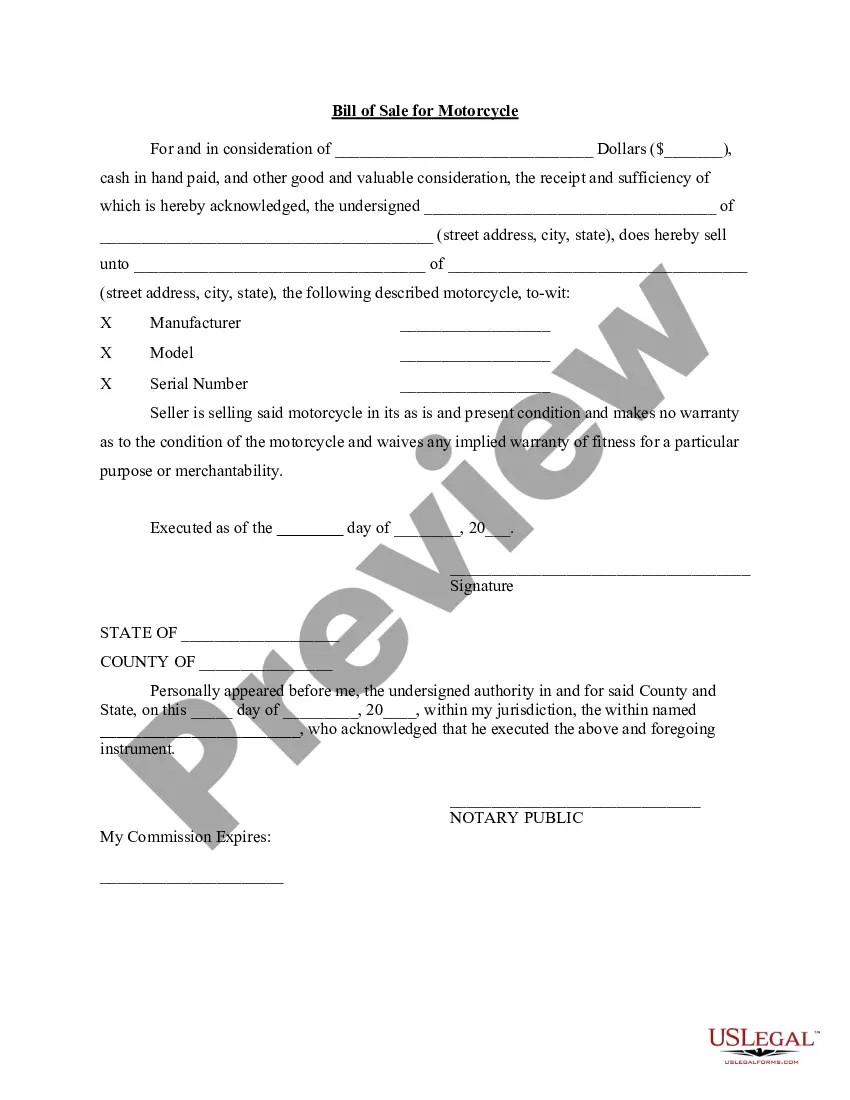

- Use the Review button to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you're looking for, utilize the Research field to locate the form that suits your needs.

Form popularity

FAQ

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

How Are GRATs Taxed? GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

The creator of the trust (the Grantor) transfers assets to the GRAT while retaining the right to receive fixed annuity payments, payable at least annually, for a specified term of years. After the expiration of the term, the Grantor will no longer receive any further benefits from the GRAT.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).

GRATs may provide payments for a term of years or for the life of the Grantor.