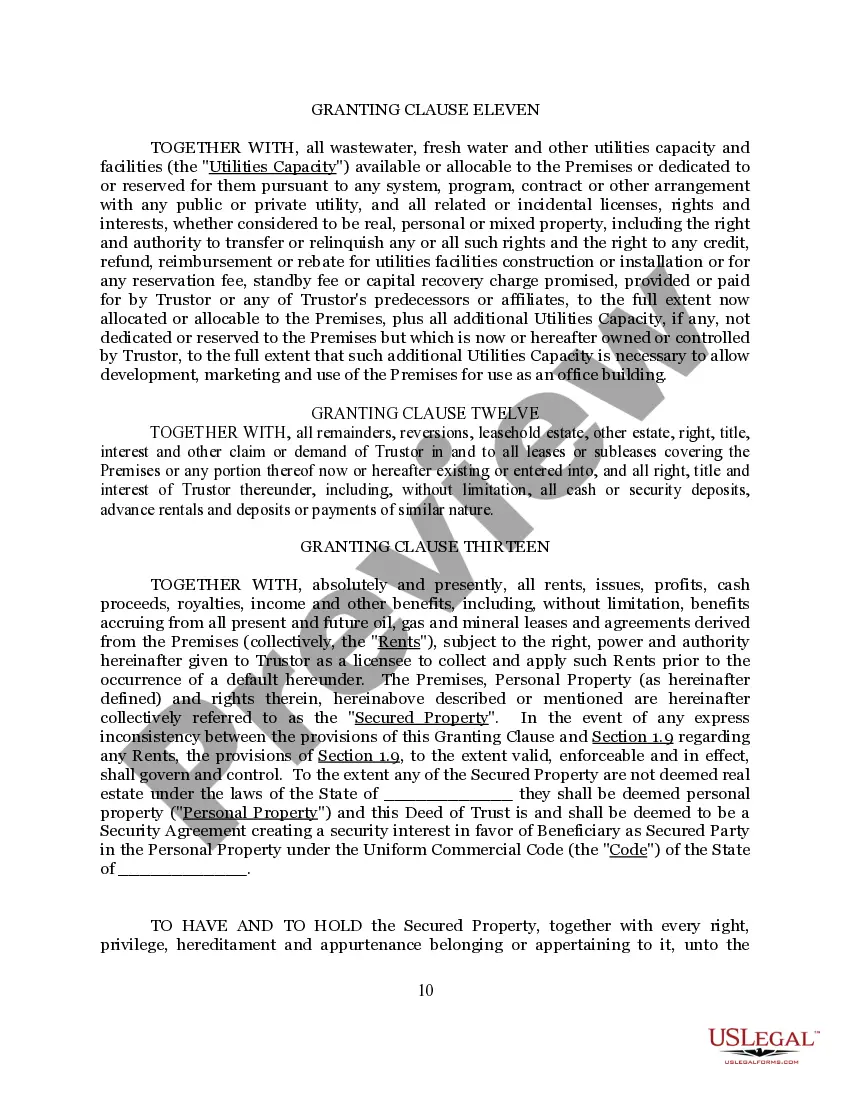

Louisiana Complex Deed of Trust and Security Agreement

Description

How to fill out Complex Deed Of Trust And Security Agreement?

If you want to full, acquire, or produce authorized document web templates, use US Legal Forms, the largest assortment of authorized kinds, that can be found on-line. Make use of the site`s basic and hassle-free look for to find the papers you want. Different web templates for company and specific uses are categorized by groups and states, or search phrases. Use US Legal Forms to find the Louisiana Complex Deed of Trust and Security Agreement in just a few mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your accounts and then click the Acquire switch to find the Louisiana Complex Deed of Trust and Security Agreement. You can also access kinds you formerly downloaded inside the My Forms tab of your own accounts.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form to the right metropolis/region.

- Step 2. Use the Preview choice to examine the form`s content. Never neglect to learn the description.

- Step 3. Should you be not happy together with the develop, utilize the Search area near the top of the monitor to locate other types of the authorized develop template.

- Step 4. Upon having identified the form you want, click the Get now switch. Select the prices strategy you prefer and add your references to sign up to have an accounts.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Pick the formatting of the authorized develop and acquire it on your own gadget.

- Step 7. Comprehensive, edit and produce or indication the Louisiana Complex Deed of Trust and Security Agreement.

Each and every authorized document template you purchase is yours eternally. You have acces to each and every develop you downloaded in your acccount. Click on the My Forms area and select a develop to produce or acquire once more.

Be competitive and acquire, and produce the Louisiana Complex Deed of Trust and Security Agreement with US Legal Forms. There are many expert and express-certain kinds you can utilize to your company or specific requirements.

Form popularity

FAQ

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee. Other states have no limitations.

Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

The security is held by a neutral third party known as the trustee. With a deed of trust, the mortgagor (borrower) is called the trustor and the mortgagee (lender) is called the beneficiary. The correct answer is: The trustee.

Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

This document may be called the Security Instrument, Deed of Trust, or Mortgage. When you sign this document, you are giving the lender the right to take your property by foreclosure if you fail to pay your mortgage ing to the terms you've agreed to.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.