Louisiana Detailed Assignment of Leases Rents Income and Cash Collateral

Description

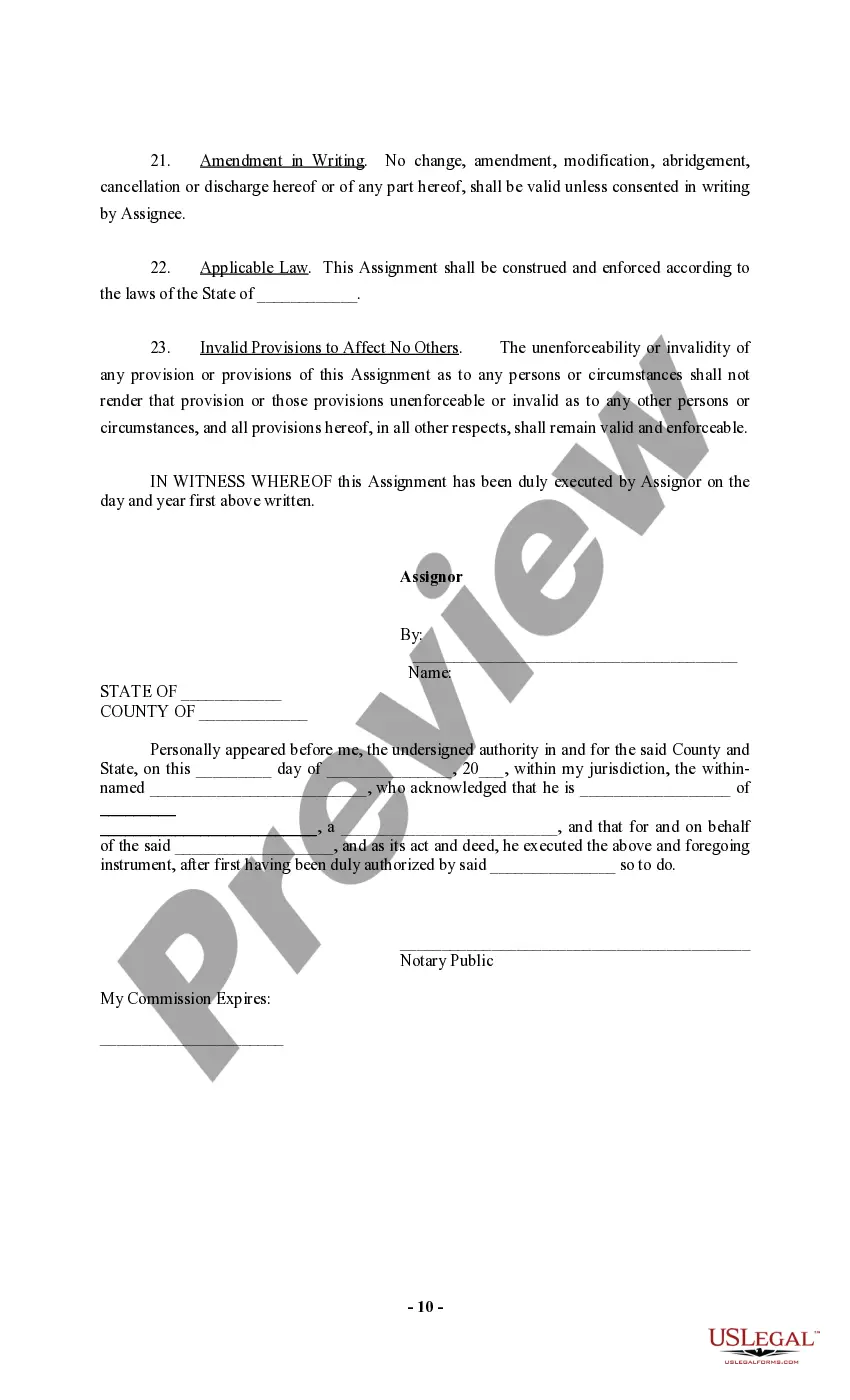

How to fill out Detailed Assignment Of Leases Rents Income And Cash Collateral?

US Legal Forms - one of many biggest libraries of lawful forms in America - offers a variety of lawful papers templates it is possible to acquire or print out. Using the web site, you will get thousands of forms for business and person uses, categorized by categories, states, or keywords and phrases.You will find the latest types of forms such as the Louisiana Detailed Assignment of Leases Rents Income and Cash Collateral within minutes.

If you have a subscription, log in and acquire Louisiana Detailed Assignment of Leases Rents Income and Cash Collateral from the US Legal Forms local library. The Download button will appear on each kind you view. You get access to all earlier saved forms from the My Forms tab of your respective account.

If you want to use US Legal Forms initially, allow me to share basic directions to obtain began:

- Be sure you have picked out the proper kind for the metropolis/county. Click on the Review button to review the form`s articles. Look at the kind description to actually have selected the right kind.

- When the kind doesn`t match your requirements, take advantage of the Search discipline towards the top of the screen to get the one that does.

- Should you be satisfied with the form, verify your decision by clicking the Acquire now button. Then, select the pricing plan you like and give your qualifications to register for an account.

- Process the deal. Make use of your Visa or Mastercard or PayPal account to accomplish the deal.

- Select the format and acquire the form in your product.

- Make changes. Complete, edit and print out and indicator the saved Louisiana Detailed Assignment of Leases Rents Income and Cash Collateral.

Each design you put into your money does not have an expiry time and it is yours permanently. So, if you would like acquire or print out another version, just go to the My Forms section and then click in the kind you need.

Obtain access to the Louisiana Detailed Assignment of Leases Rents Income and Cash Collateral with US Legal Forms, the most extensive local library of lawful papers templates. Use thousands of skilled and state-certain templates that fulfill your small business or person requires and requirements.

Form popularity

FAQ

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

Which of the following statements best describes the use of oral leases in Louisiana? Leases may be entered into orally; however, an oral lease does not affect third parties.

When it comes to a lease, the landlord cannot evict their tenant from the property in retaliation. This could make the tenant seek an attorney for help; in severe cases, these claims can go to a court in Louisiana.

Single-Net Leases: In this kind of lease, the tenant is responsible for paying property taxes. Double-Net Leases: These leases make a tenant responsible for property taxes and insurance. Triple-Net Leases: Tenants who sign these leases pay property taxes, insurance, and maintenance costs.

(1) An assignment relating to a lease or rent of an immovable is given the effect of recordation when an original or a certified copy of the instrument creating the assignment is filed in the conveyance records of the parish in which the immovable is situated; however, an assignment contained in an act of mortgage ...

Louisiana Lease and Rent Information There are two types of leases, written and oral with written being the most binding and common.

An ?assignment of rents? allows the lender to collect the rent payments, if the borrower defaults on their loan payments.

A lease of immovable property does not affect third parties unless the lease is recorded. A lease may be made orally or in writing. A lease of an immovable is not effective against third persons until filed for recordation in the manner prescribed by legislation. La.