Dear [Trustee's Name], I am writing to notify you of the upcoming sale of property as mandated by the Trust Agreement for [Property Address], situated in the state of Louisiana. As the duly appointed trustee, it is my responsibility to inform all interested parties about the impending sale. According to the terms outlined in the trust, the property will be sold to satisfy outstanding debts/obligations or to distribute the assets among the beneficiaries. The sale will be conducted in accordance with the relevant provisions specified in the Louisiana Revised Statutes. The purpose of this letter is to provide you with the necessary notice as required by law. In compliance with the regulations, this letter serves to formally notify any interested parties, such as beneficiaries, creditors, or other lien holders. This ensures that all concerned individuals are given appropriate time to submit claims or exercise their rights in regard to the sale. It is important to note that the date of the sale, starting bid price, and other pertinent details will be communicated separately, either through a public notice or personal communication. The sale will be conducted by a licensed auctioneer or real estate agent, following all legal requirements. Louisiana Revised Statutes define different types of notices that may be required in the process of selling trust property. Some variations include: 1. Notice to Beneficiaries: This type of notice is specific to beneficiaries mentioned in the trust agreement. It serves to inform them about the sale and provide an opportunity to assert any claims or interests they may have. 2. Notice to Creditors: If there are outstanding debts owed by the trust or decedent, this notice is sent to known creditors. It gives them an opportunity to make a claim against the trust prior to the sale. 3. Notice to Interested Parties: This notice is broad in scope and includes anyone who might have an interest in the trust property or a claim against it. It aims to ensure that all potential stakeholders are aware of the upcoming sale. 4. Notice to Lien holders: In cases where the property in question has a lien against it, such as a mortgage or judgement lien, this notice is sent to the lien holder(s) to notify them of the impending sale. Please note that all notifications will be sent as required by the Louisiana Revised Statutes, and any additional steps needed to comply with legal obligations will be taken. It is crucial to seek legal counsel to ensure compliance with all applicable laws and regulations while executing the sale of trust property. This correspondence serves as an initial notice, and subsequent details regarding the sale will be provided separately. Should you have any questions or require further clarification, please do not hesitate to contact me at your earliest convenience. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Title/Position] [Contact Information]

Louisiana Sample Letter for Trustee's Notice of Sale of Property

Description

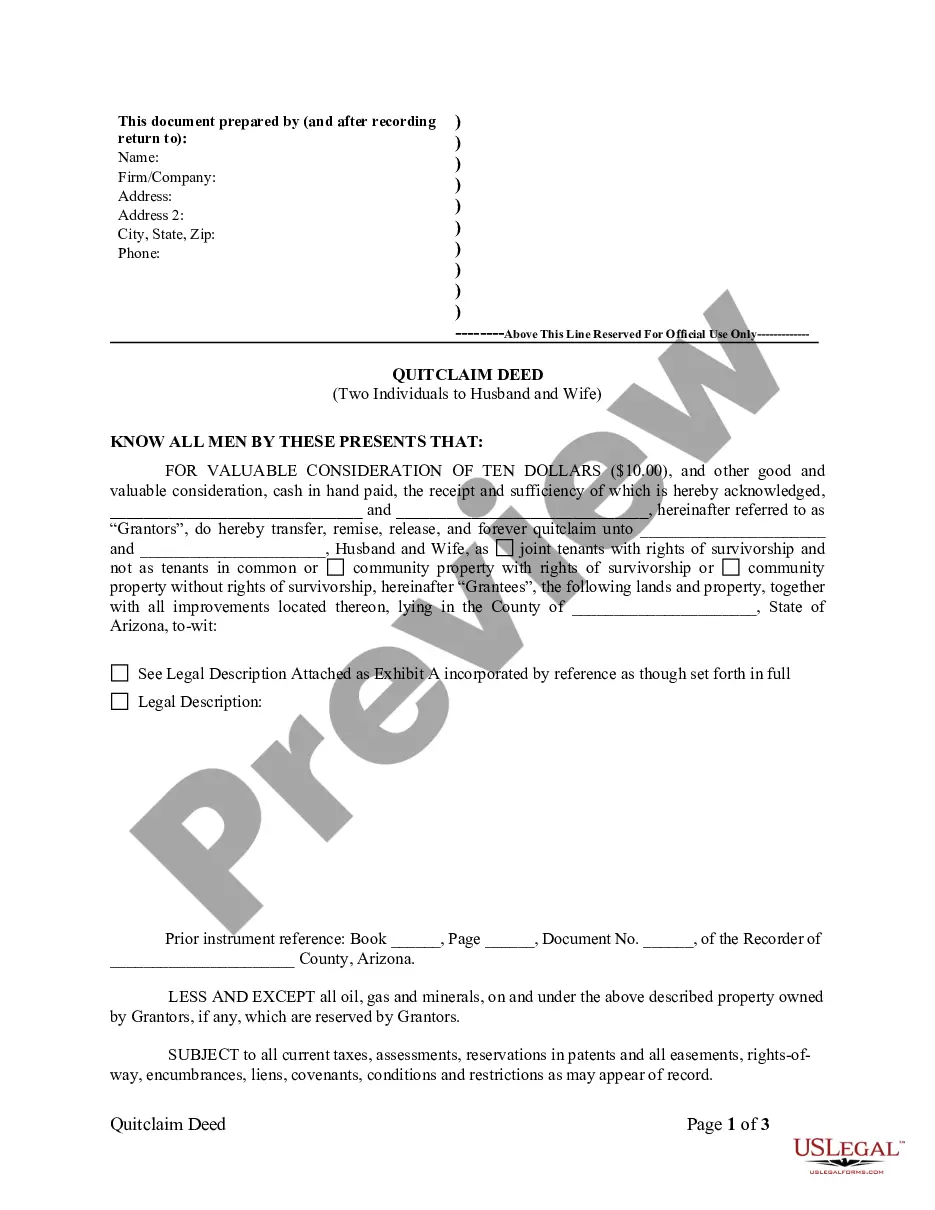

How to fill out Louisiana Sample Letter For Trustee's Notice Of Sale Of Property?

Are you currently inside a place the place you need to have files for either business or person functions almost every working day? There are a variety of lawful file web templates available online, but getting types you can depend on is not straightforward. US Legal Forms provides a huge number of form web templates, much like the Louisiana Sample Letter for Trustee's Notice of Sale of Property, that happen to be published in order to meet state and federal requirements.

When you are currently informed about US Legal Forms web site and have your account, merely log in. Following that, you are able to download the Louisiana Sample Letter for Trustee's Notice of Sale of Property template.

If you do not have an accounts and want to start using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for your right city/area.

- Use the Preview switch to analyze the shape.

- Browse the description to actually have chosen the correct form.

- In the event the form is not what you`re seeking, make use of the Research field to find the form that meets your needs and requirements.

- If you get the right form, click Purchase now.

- Choose the costs strategy you want, complete the desired info to make your money, and pay for the order making use of your PayPal or Visa or Mastercard.

- Decide on a handy paper file format and download your duplicate.

Discover all of the file web templates you might have bought in the My Forms menus. You can obtain a further duplicate of Louisiana Sample Letter for Trustee's Notice of Sale of Property at any time, if necessary. Just go through the required form to download or print the file template.

Use US Legal Forms, by far the most considerable selection of lawful types, to save lots of efforts and stay away from errors. The service provides expertly produced lawful file web templates which can be used for a range of functions. Produce your account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

A judicial foreclosure involves a judicial proceeding and court oversight of the foreclosure process. On the other hand, a trustee sale is a nonjudicial foreclosure of property and is based on a power of sale clause in a deed of trust or mortgage.

Nonjudicial Foreclosure: 90 Days ? When an association enforces an assessment lien through nonjudicial foreclosure (aka ?trustee sale?), the applicable redemption period is ninety (90) days. (Civ. Code § 5715(b); Code Civ. Pro § 729.035.)

A trustee deed conveys the home as-is. The winning bidder at the auction should be prepared to satisfy the liens ? that is, pay off any debts recorded against the title. The prior owner might have left without paying repair and construction workers, the IRS, or the local property tax assessor.

What is a Trustee Sale? A trustee sale is the sale of real estate property through a public auction. In most cases, trustee sales are only possible because homeowners are in some financial crisis, such as a homeowner defaulting on their mortgage payments and the property going into foreclosure.

If you believe there is a defense to the trustee sale or if you have an objection to the trustee sale, you must file an action and obtain a court order pursuant to rule 65, Arizona rules of civil procedure, stopping the sale no later than p.m. mountain standard time of the last business day before the scheduled ...

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. ... Describe key players in the family. ... What matters to you? ... Give your trustee the power to make decisions, even when that means saying no.