The Louisiana Security Agreement regarding Member Interests in a Limited Liability Company (LLC) is a legal document that outlines the rights and obligations of members with respect to their ownership interests in an LLC. This agreement ensures the protection of the interests of both the LLC and its members, enforces compliance with the Louisiana state laws, and safeguards the investment made by the members. In Louisiana, there are two primary types of Security Agreements for Member Interests in an LLC: 1. Pledge Agreement: A Pledge Agreement is a common type of security agreement where a member pledges their LLC interest as collateral for a loan or other financial obligation. By signing a Pledge Agreement, the member grants the lender a security interest in their LLC interest, giving the lender the right to seize or sell the interest to satisfy the debt if the member defaults on their payment obligations. 2. Security Agreement with Perfection: Another type of Security Agreement in Louisiana is a more comprehensive document that involves the filing or recording of the agreement with the appropriate state office. This creates a public record of the security interest and establishes priority for the creditor, ensuring that the debtor's LLC interest will be secured against any subsequent claims or liens. The Louisiana Security Agreement addresses various key aspects, including: 1. Identification of Parties: The agreement clearly identifies the LLC and the member(s) who are party to the agreement, including their names, addresses, and relevant contact information. 2. Description of Member Interests: The agreement describes the member's ownership interest in the LLC, including their percentage of ownership, membership units, or any other relevant details. 3. Grant of Security Interest: The agreement outlines the member's grant of a security interest in their LLC interest to the creditor, detailing the collateral's identification and the extent of the security interest. 4. Obligations of the Member: The agreement specifies the member's obligations, including the repayment terms, interest rates, and any penalties or consequences for default or non-compliance. 5. Rights and Remedies: The agreement outlines the creditor's rights and remedies in case of default, including the right to foreclose on the pledged membership interest and sell it to recover the debt. 6. Notice and Consent: The agreement may require the member to provide timely notice to the LLC and any other relevant parties, informing them of the security interest and any actions taken by the creditor. 7. Governing Law: The agreement specifies that it is governed by the laws of the State of Louisiana and identifies the appropriate court for any disputes or legal actions. It is essential for LLC members in Louisiana to understand the implications of signing a Security Agreement regarding their member interests and seek legal counsel to ensure their rights and interests are adequately protected.

Louisiana Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Louisiana Security Agreement Regarding Member Interests In Limited Liability Company?

Finding the right legal record template might be a have difficulties. Needless to say, there are a variety of web templates accessible on the Internet, but how will you find the legal develop you require? Make use of the US Legal Forms internet site. The services delivers 1000s of web templates, including the Louisiana Security Agreement regarding Member Interests in Limited Liability Company, that can be used for company and private requirements. All of the types are checked out by experts and meet federal and state requirements.

Should you be already signed up, log in to your profile and click the Download switch to have the Louisiana Security Agreement regarding Member Interests in Limited Liability Company. Make use of your profile to check with the legal types you may have ordered previously. Check out the My Forms tab of the profile and acquire an additional version from the record you require.

Should you be a brand new end user of US Legal Forms, listed below are basic recommendations that you can comply with:

- Very first, ensure you have chosen the proper develop for the area/county. You can look through the form utilizing the Review switch and read the form information to make sure it is the right one for you.

- In the event the develop is not going to meet your preferences, take advantage of the Seach area to obtain the appropriate develop.

- When you are certain that the form would work, click on the Buy now switch to have the develop.

- Select the rates program you would like and enter in the needed information and facts. Make your profile and buy your order making use of your PayPal profile or credit card.

- Opt for the data file format and download the legal record template to your device.

- Complete, edit and print out and sign the acquired Louisiana Security Agreement regarding Member Interests in Limited Liability Company.

US Legal Forms may be the most significant catalogue of legal types where you can see various record web templates. Make use of the service to download expertly-produced documents that comply with status requirements.

Form popularity

FAQ

Under this definition, a membership interest in an LLC is a security for California law purposes unless all of the members are actively engaged in management. Thus, interests in a manager-managed LLC where not all members are managers are securities under California law.

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

As a result, lenders desiring to secure their loans with an equity pledge (typically either in the borrower itself or its subsidiaries) are increasingly taking pledges of LLC membership interests as part of their collateral.

If the membership interests are securities, then you perfect by taking possession or control of the securities or both. If the membership interests are certificated, then you perfect by taking possession of the certificates and by taking control by having the security interest noted in the company's records.

Limited liability companies (LLCs) do not have stock, nor can they issue it. Despite this fact, LLCs may have advantages over corporations, depending on your particular business needs and goals.

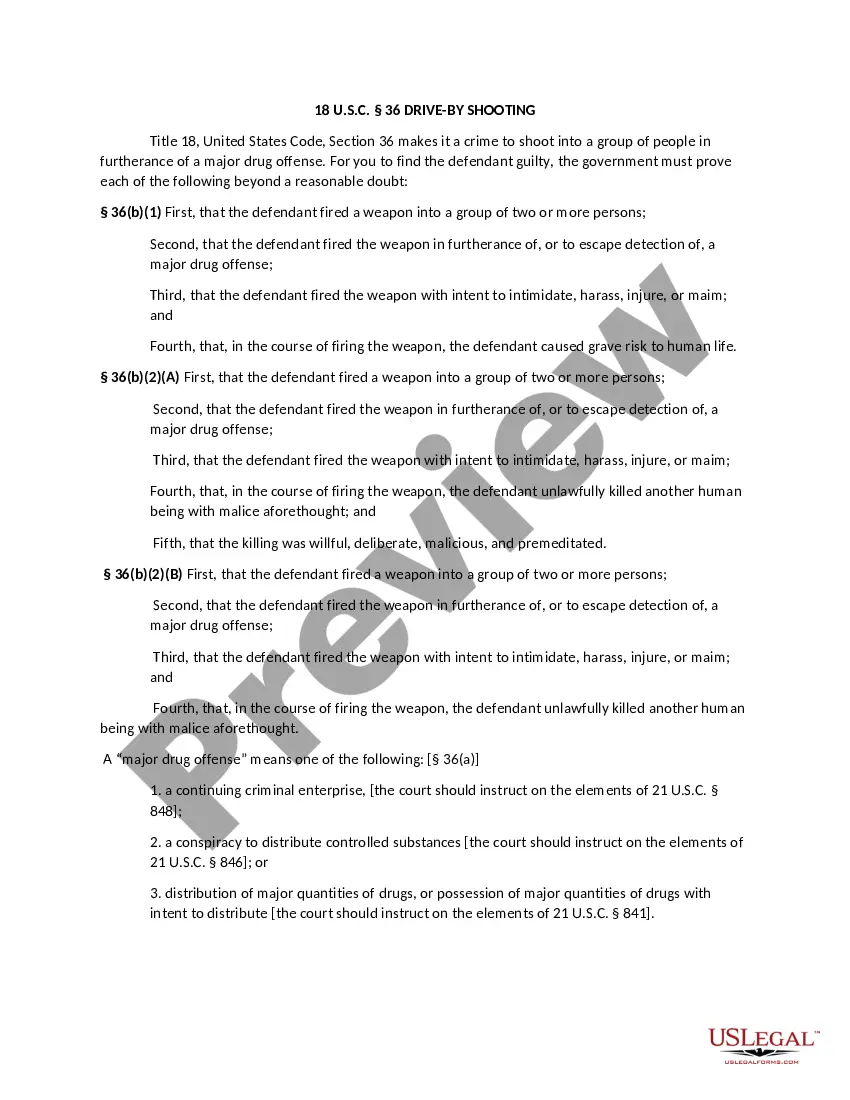

Under Article 9, a security interest is created by a security agreement, under which the debtor grants a security interest in the debtor's property as collateral for a loan or other obligation.

But because interests in these kinds of entities are not listed within the definition of a security under the Securities Act, a partnership or LLC interest will only be considered a security if it constitutes an investment contract.

Under Division 8 of the California Commercial Code, an interest in an LLC is NOT a security unless: it is dealt in or traded on securities exchanges or in securities markets, its terms expressly provide that it is a security governed by this division, or. it is an investment company security.

In California, shares of an LLC in which any member is not continuously actively involved in the management of the LLC would qualify as securities.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.