Louisiana Release from Liability under Guaranty

Description

How to fill out Release From Liability Under Guaranty?

Selecting the finest legal document template can be a challenge. Clearly, there are numerous templates accessible on the web, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Louisiana Release from Liability under Guaranty, which can be utilized for business and personal purposes. All the forms are validated by experts and comply with state and federal requirements.

If you are already registered, sign in to your account and click the Download button to obtain the Louisiana Release from Liability under Guaranty. Use your account to browse the legal forms you may have previously purchased. Proceed to the My documents section of your profile and obtain another copy of the document you need.

Choose the file format and download the legal document template to your device. Fill out, edit, and print and sign the acquired Louisiana Release from Liability under Guaranty. US Legal Forms is the largest repository of legal templates where you can find a variety of document forms. Take advantage of the service to download professionally crafted documents that adhere to state requirements.

- First, ensure you have chosen the correct form for your city/region.

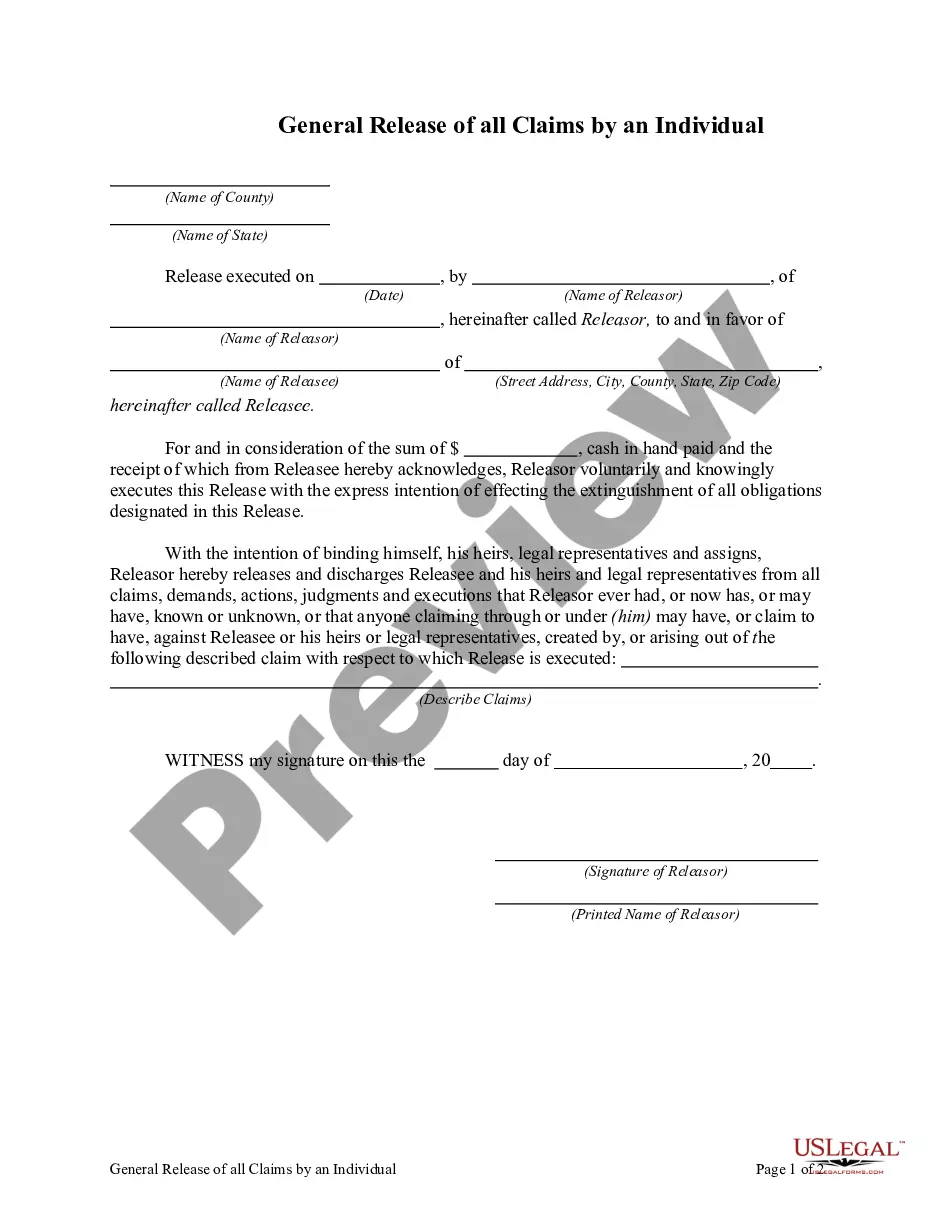

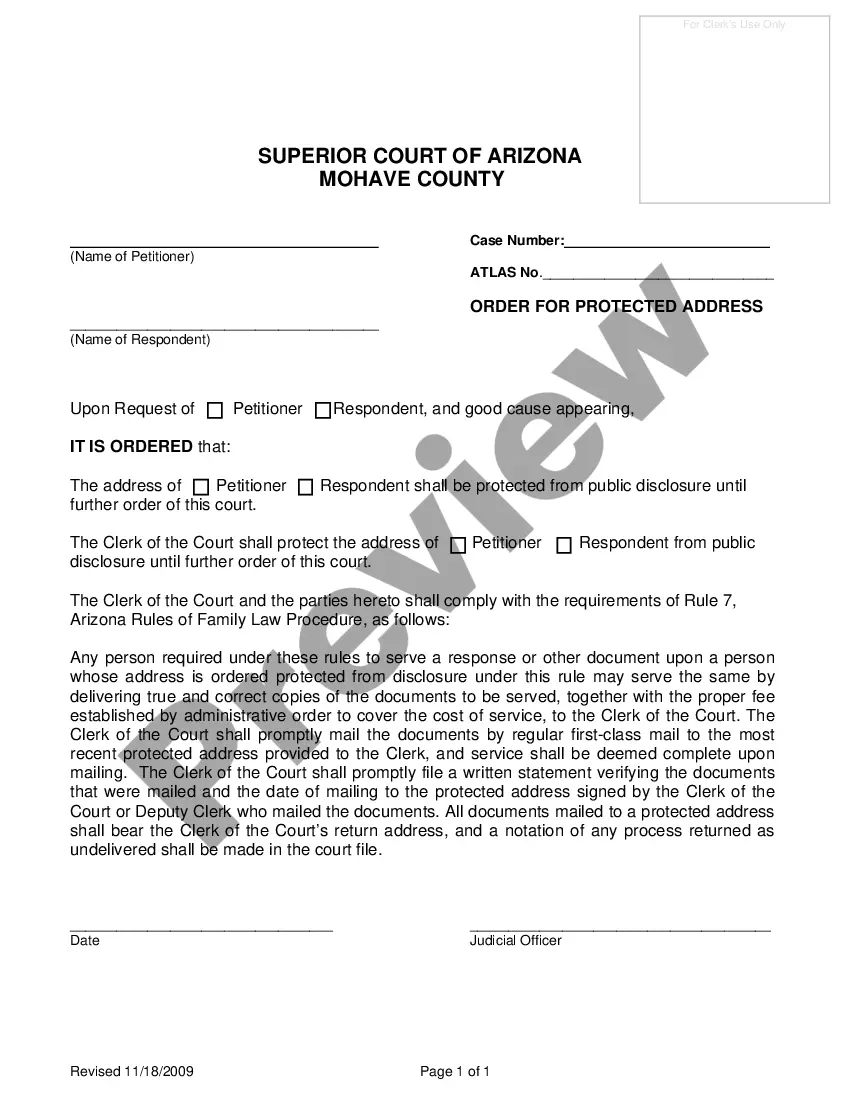

- You can review the form using the Preview option and examine the form details to confirm that it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Download now button to obtain the form.

- Select the pricing plan you want and enter the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Recording Loan Guarantees It states that a company should record a contingent liability if two things occur: The liability is subject to estimation (you can calculate it) It is probable that the liability will be paid.

With an unlimited personal guarantee, guarantors are liable for any part of the loan balance that is unpaid after the lender auctions off other collateral securing the loan.

Although most guarantors are individual co-borrowers on an account, a company sometimes serves as the guarantor of certain debts -- for example, work-related medical evaluations. Irrespective of the nature of the relationship, a creditor usually has the right to sue a guarantor to satisfy an outstanding debt.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

1. CONCEPT By payment or performance: By the loss of the thing due: By the condonation or remission of the debt; By the confusion or merger of the rights of creditor and debtor; By compensation; By novation. ( Article 1231, Civil Code)

An extension granted to the debtor by the creditor without the consent of the guarantor extinguishes the guaranty.

A reaffirmation of guaranty from a guarantor of the tenant's obligations under a lease can be as simple as a few sentences appended to the end of the lease amendment, whereby the guarantor certifies that it consents to the terms and conditions of the amendment, and affirms that its obligations under the guaranty remain

Guarantees tend to be more advantageous to the guarantor because they confer certain rights including: Right to indemnity. Once the guarantor pays the beneficiary under the terms of the guarantee, it has a right to claim indemnity from the principal provided that the guarantee was given at the principal's request.

An obligation is extinguished if the creditor accepts in lieu of performance another performance than agreed upon. If the debtor, for the purpose of satisfying the creditor, assumes a new obligation towards him, is not to be presumed, in case of doubt, that he assumes the obligation in lieu of performance.

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.