The Louisiana Certificate of Borrower regarding Commercial Loan is a legal document that verifies the borrower's information and authorizes the lender to proceed with the commercial loan agreement. This certificate is a crucial part of the loan process as it provides the lender with essential details about the borrower and their capacity to fulfill their loan obligations. The Louisiana Certificate of Borrower includes relevant keywords such as: 1. Louisiana: This keyword indicates that the certificate follows the regulations specific to the state of Louisiana. Each state may have its own requirements and guidelines for borrower certificates, making it essential to comply with state laws. 2. Certificate: This keyword suggests that the document is an official statement that confirms certain details about the borrower in relation to the commercial loan. 3. Borrower: This keyword refers to the individual or entity seeking the commercial loan from the lender. 4. Commercial Loan: This keyword specifies that the loan is intended for commercial purposes, such as starting or expanding a business, purchasing commercial property, or investing in business-related ventures. Different types of Louisiana Certificates of Borrower regarding Commercial Loan may exist depending on the specific requirements of the lender or the purpose of the loan. Some possible types of certificates may include: 1. Financial Statement Certificate: This type of certificate requires the borrower to provide detailed financial information, including income, assets, liabilities, and credit history. It aims to assess the borrower's financial stability and ability to repay the loan. 2. Business Plan Certificate: In cases where the loan is intended for business purposes, a business plan certificate might be required. The borrower needs to provide a detailed plan outlining their business model, marketing strategies, financial projections, and other relevant information. 3. Collateral Certificate: When the loan is secured by collateral, such as real estate or valuable assets, a collateral certificate may be necessary. It requires the borrower to provide documentation and proof of ownership or value of the collateral. 4. Personal Guarantee Certificate: In situations where the borrower is an individual rather than a company, a personal guarantee certificate may be required. This certificate confirms that the borrower personally guarantees repayment of the loan, making them personally liable in case of default. It is important to note that the specific types and requirements of certificates may vary depending on the lender, loan amount, and purpose of the loan. Borrowers should carefully review the lender's guidelines and work with legal professionals to ensure their compliance with the Louisiana Certificate of Borrower regarding Commercial Loan.

Louisiana Certificate of Borrower regarding Commercial Loan

Description

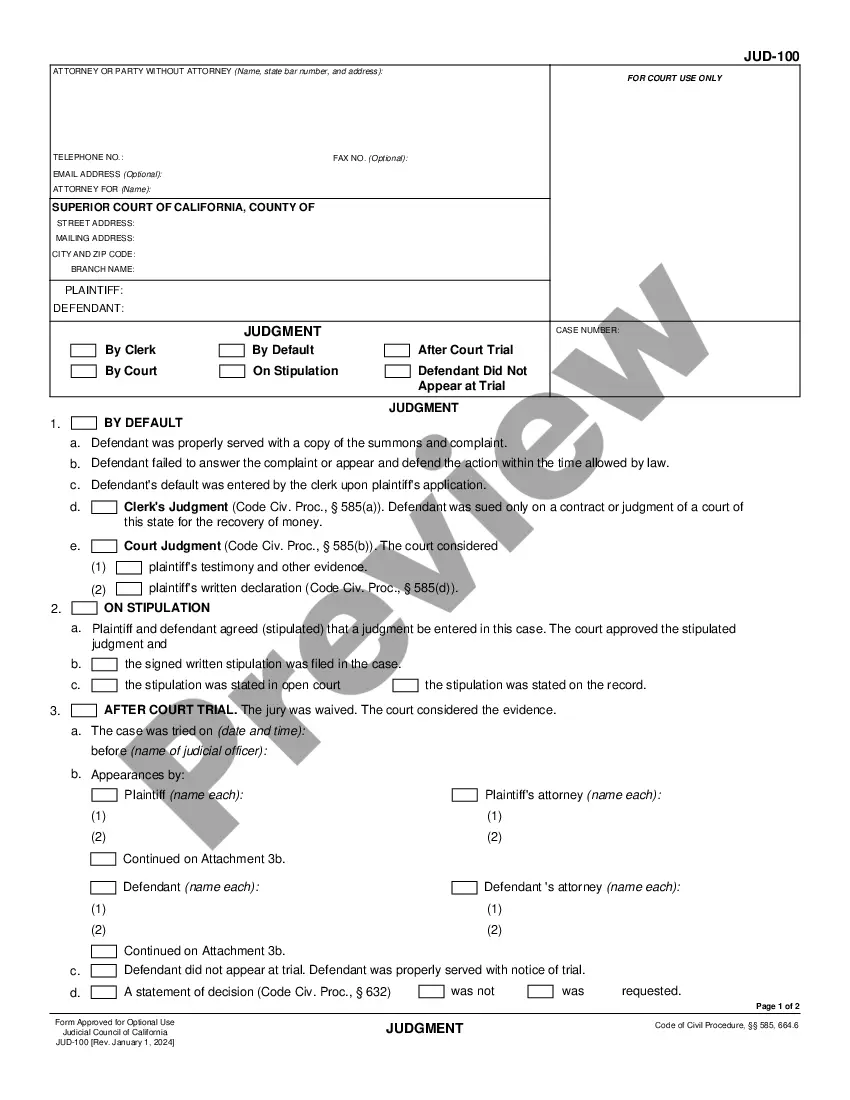

How to fill out Louisiana Certificate Of Borrower Regarding Commercial Loan?

If you wish to comprehensive, down load, or produce lawful file themes, use US Legal Forms, the greatest selection of lawful varieties, which can be found on-line. Utilize the site`s basic and convenient search to get the documents you want. Various themes for enterprise and person reasons are categorized by categories and says, or keywords. Use US Legal Forms to get the Louisiana Certificate of Borrower regarding Commercial Loan in a number of click throughs.

Should you be presently a US Legal Forms client, log in to the profile and click on the Down load button to obtain the Louisiana Certificate of Borrower regarding Commercial Loan. Also you can access varieties you formerly saved from the My Forms tab of the profile.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for the right town/region.

- Step 2. Take advantage of the Review option to examine the form`s content material. Do not forget to see the description.

- Step 3. Should you be not satisfied together with the develop, make use of the Search industry on top of the display screen to find other versions from the lawful develop template.

- Step 4. After you have identified the form you want, click the Purchase now button. Opt for the prices prepare you choose and include your accreditations to register for the profile.

- Step 5. Approach the deal. You may use your charge card or PayPal profile to complete the deal.

- Step 6. Choose the format from the lawful develop and down load it on your system.

- Step 7. Comprehensive, revise and produce or sign the Louisiana Certificate of Borrower regarding Commercial Loan.

Each lawful file template you purchase is your own property for a long time. You may have acces to every single develop you saved in your acccount. Click on the My Forms segment and select a develop to produce or down load once more.

Contend and down load, and produce the Louisiana Certificate of Borrower regarding Commercial Loan with US Legal Forms. There are many skilled and condition-distinct varieties you can use for your enterprise or person requirements.