Louisiana Trust Agreement for Pension Plan with Corporate Trustee

Description

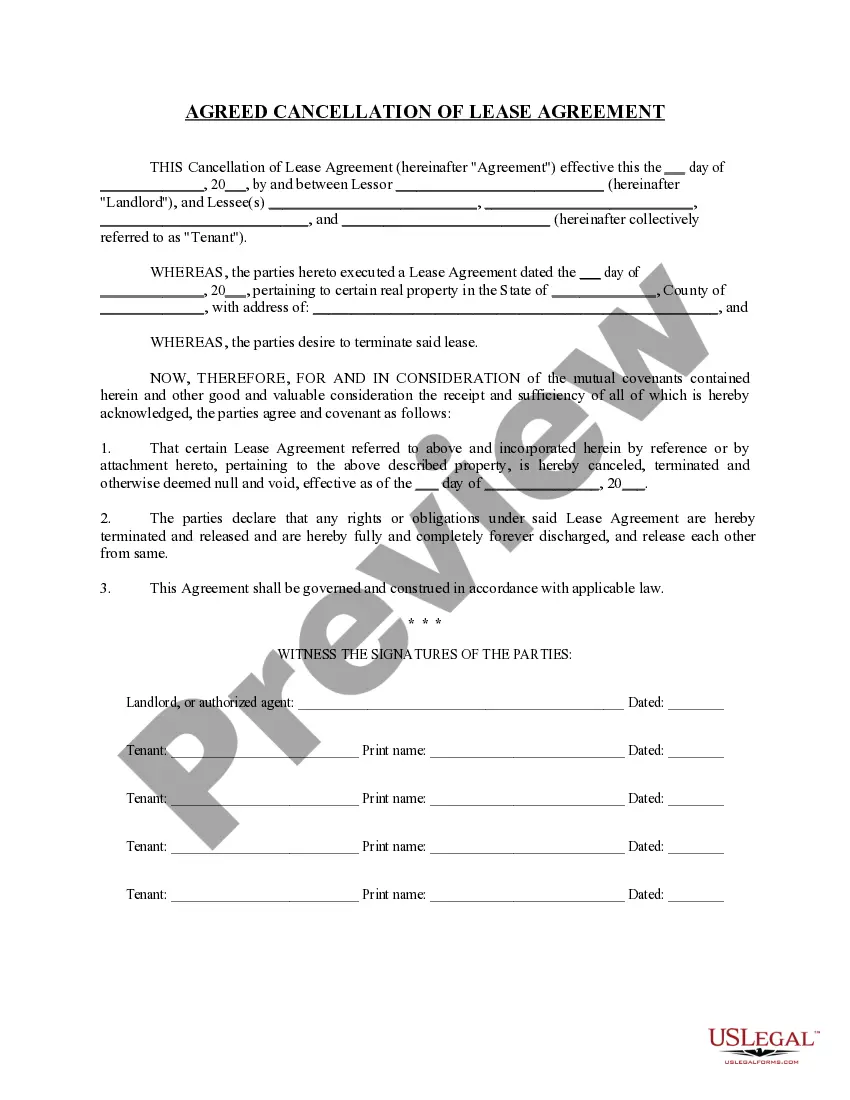

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document formats you can obtain or print. By using the website, you can access thousands of templates for business and personal purposes, organized by categories, jurisdictions, or specific terms.

You can find the most recent versions of documents like the Louisiana Trust Agreement for Pension Plan with Corporate Trustee in just moments. If you already have a monthly subscription, Log In and download the Louisiana Trust Agreement for Pension Plan with Corporate Trustee from the US Legal Forms library. The Acquire button will be visible on every document you review. You have access to all previously downloaded files within the My documents section of your account.

If you want to use US Legal Forms for the first time, here are simple steps to help you begin: Make sure you have selected the correct form for your city/region. Click on the Preview button to review the content of the form. Read the form description to confirm that you've chosen the right one.

Every template you add to your account has no expiration date and remains yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Louisiana Trust Agreement for Pension Plan with Corporate Trustee through US Legal Forms, the most extensive library of legal document formats. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements and preferences.

- If the form doesn't meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you're satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the payment. Use your Credit Card or PayPal account to finalize the purchase.

- Choose the format and download the document to your device.

- Make amendments. Fill out, edit, print, and sign the downloaded Louisiana Trust Agreement for Pension Plan with Corporate Trustee.

Form popularity

FAQ

trustee is a person or entity that serves as a legal owner of trust property. They hold and administers the property for the advantage of named beneficiaries. Trusts are created by property owners, aka grantor, trustor, or settlor. A property owner can be one individual or many, in the case of joint ownership.

Even if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire, or investment experience to manage your trust yourself, or perhaps you just feel that someone with more time and experience could do a better job than you.

Why Have a Corporate Trustee For a Family Trust? It is a common practice to have corporate trustees for family trusts for tax benefits. This ensures the limitation of the trustees' liability to the corporate asset. Generally, corporate trustees are shell corporations with no, or minimal, assets.

Even if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire, or investment experience to manage your trust yourself, or perhaps you just feel that someone with more time and experience could do a better job than you.

Corporate trustees are departments at banks or other investment firms hired to build and manage a trust. People hire corporate trustees for their professional experience in trust matters that a family member or friend may not have.

A trustee is the person or entity entrusted to make investment decisions in the best interests of plan participants. A trustee is assigned by another fiduciary, such as the employer who sponsors the qualified retirement plan, and should be named in the plan documents. Additional restrictions apply for a trustee.

What is a corporate trustee?Gain the advantage of years of experience.Enjoy the potential of even greater investment returns.Protect your wealth.Receive reliable, professional service.Benefit from their objectivity.Tap into their rich sources of advice and referrals.Enjoy peace of mind.

Corporate trust services can provide assistance with both the issuance and administration of corporate debt. Corporate trusts might distribute the interest payments from the corporation to the bondholders and ensure that the issuer is adhering to the covenants of the bond agreement.