Louisiana Checking Log

Category:

State:

Multi-State

Control #:

US-130-AZ

Format:

Word;

PDF;

Rich Text

Instant download

Description

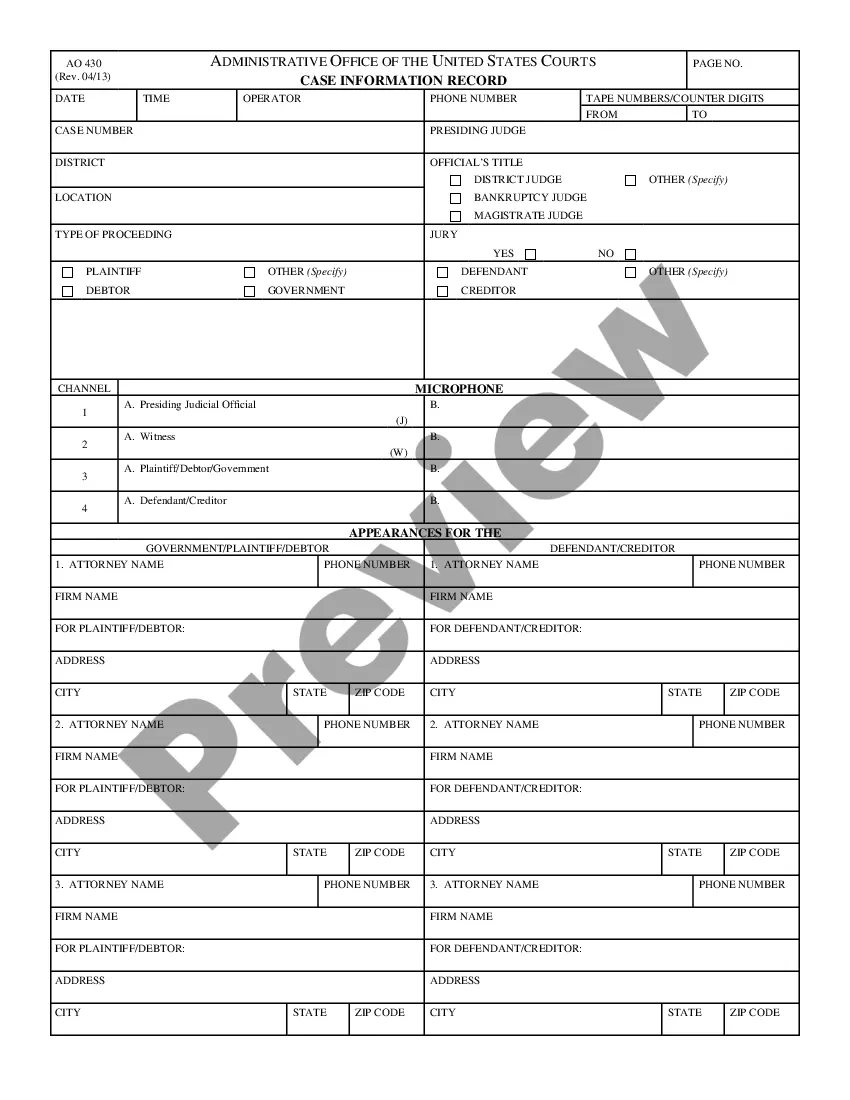

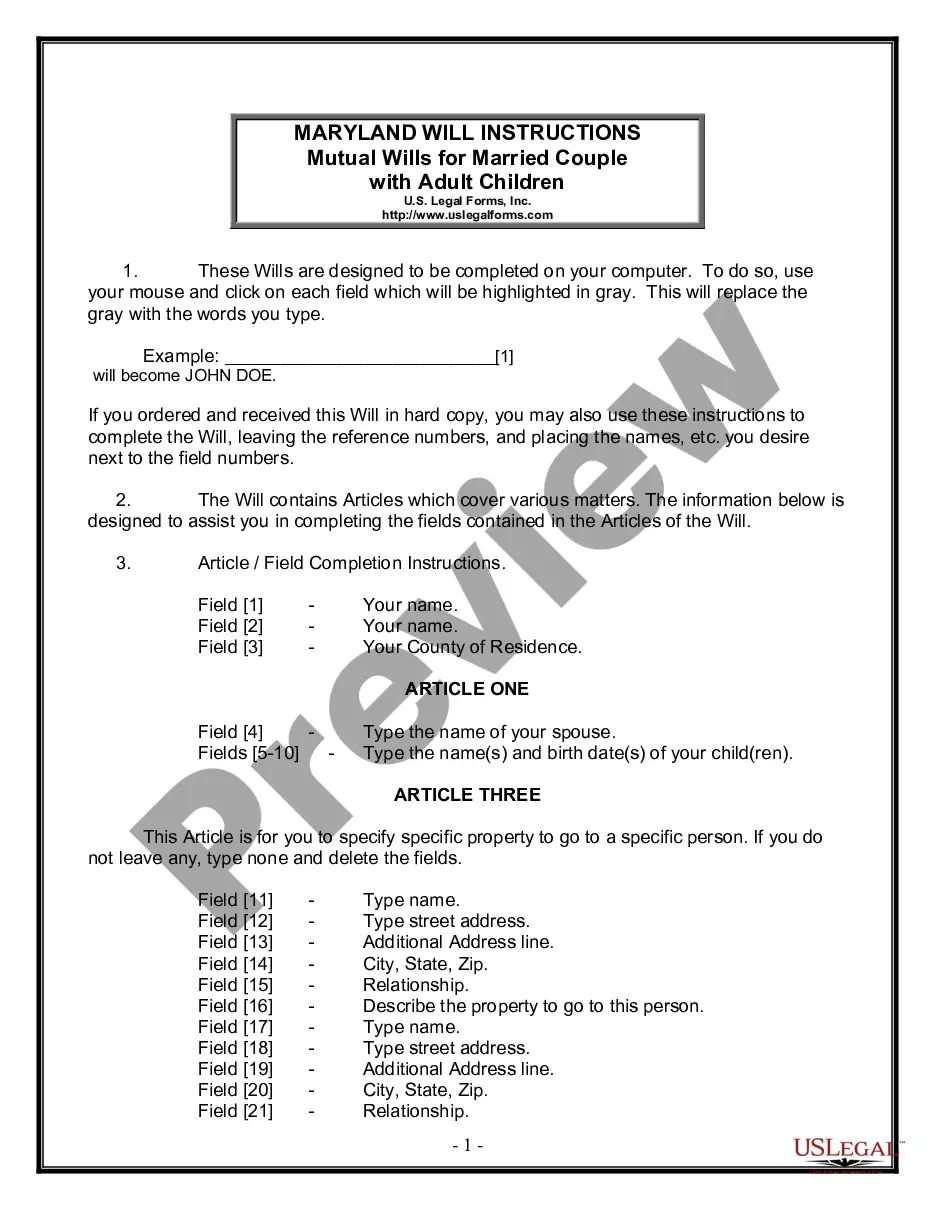

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

How to fill out Checking Log?

It is feasible to spend numerous hours online trying to locate the official document template that meets the state and federal criteria you will require.

US Legal Forms offers thousands of legal templates that have been vetted by professionals.

You can easily download or print the Louisiana Checking Log from our service.

If available, utilize the Review button to browse through the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Louisiana Checking Log.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city you choose.

- Check the form description to verify you have chosen the right form.