Louisiana Business Trust is a unique legal entity established under the laws of the state of Louisiana, defined as a trust formed for the sole purpose of conducting business activities. This type of trust is specifically designed to provide business owners with numerous advantages and flexibility in managing their commercial affairs. A Louisiana Business Trust is governed by the Louisiana Business Corporation Act (LBC) and allows individuals or groups to engage in various business activities while enjoying the benefits of limited liability and certain tax advantages. It operates as a business organization with its own legal identity, separate from its trustees or beneficiaries. One of the significant advantages of a Louisiana Business Trust is its ability to provide limited liability protection to its trustees. This means that the trustees' personal assets are shielded from business-related liabilities, minimizing their financial risk to the extent of their investment in the trust. Additionally, a business trust can enhance privacy as public disclosure requirements are typically less stringent compared to other business forms. The Louisiana Business Trust can have multiple types or classifications based on its intended purpose or composition. Some key types are: 1. Revocable Business Trust: A trust that allows the settler (creator) to modify or revoke the trust's terms during their lifetime. This flexibility makes it a versatile option as it can adapt to changing circumstances and business needs. 2. Irrevocable Business Trust: A trust that cannot be modified or revoked once it is established. This trust structure offers asset protection and estate planning benefits, ensuring stability and preserving the trust's intentions. 3. Charitable Business Trust: This type of trust is created for charitable purposes, allowing individuals or organizations to contribute to charitable causes while enjoying some financial benefits. It facilitates philanthropy and can provide certain tax advantages to the granter and beneficiaries. 4. Family Business Trust: A trust formed specifically to manage and protect family-owned businesses. It helps ensure smooth succession planning, asset protection, and the preservation of family wealth for future generations. 5. Real Estate Investment Trust (REIT): A specialized form of a business trust primarily focused on acquiring and managing income-generating properties such as commercial buildings, apartments, or shopping centers. Rests offer investors an opportunity to participate in real estate ventures with the advantage of pass-through taxation. These various types of Louisiana Business Trusts provide business owners and individuals with a range of choices when it comes to structuring and managing their commercial activities while enjoying legal protection, tax benefits, and flexibility tailored to their specific needs.

Louisiana Business Trust

Description

How to fill out Louisiana Business Trust?

Are you presently in a placement that you need paperwork for possibly business or person functions virtually every time? There are a variety of authorized document templates available on the net, but locating types you can trust is not effortless. US Legal Forms offers 1000s of type templates, such as the Louisiana Business Trust, that are published to meet federal and state needs.

Should you be currently informed about US Legal Forms website and possess your account, just log in. Following that, you are able to acquire the Louisiana Business Trust template.

Should you not have an account and want to begin using US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for your right city/area.

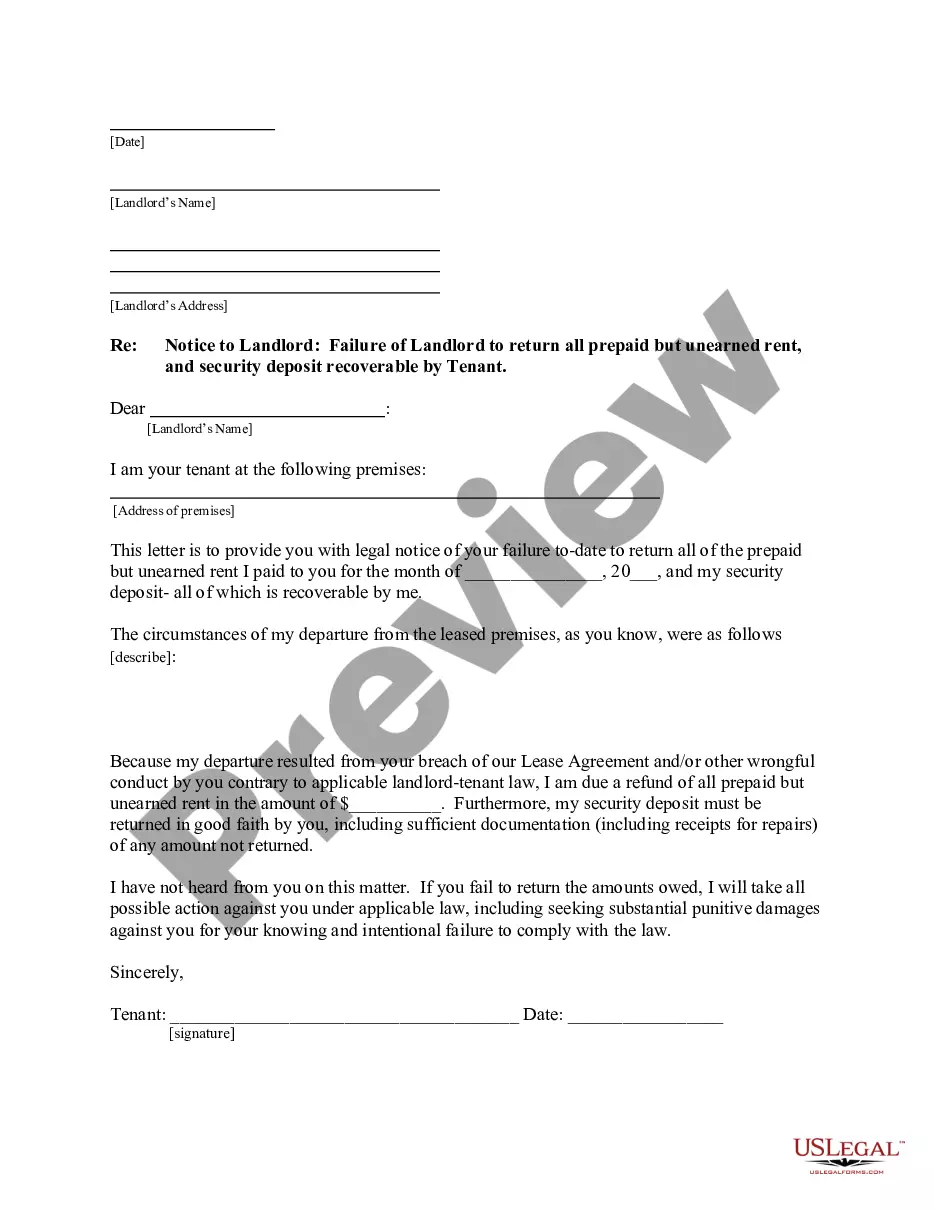

- Take advantage of the Review button to analyze the form.

- Browse the information to actually have selected the correct type.

- In case the type is not what you are trying to find, take advantage of the Research field to get the type that meets your requirements and needs.

- If you obtain the right type, click Acquire now.

- Select the prices prepare you desire, complete the necessary information and facts to create your account, and pay for your order using your PayPal or credit card.

- Decide on a practical file format and acquire your backup.

Find all the document templates you may have bought in the My Forms food list. You may get a further backup of Louisiana Business Trust whenever, if required. Just select the necessary type to acquire or print out the document template.

Use US Legal Forms, one of the most extensive assortment of authorized types, to conserve some time and steer clear of blunders. The services offers skillfully made authorized document templates that you can use for a variety of functions. Generate your account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

By placing a business into a living trust -- a trust that is created for you and your family's benefit while you are alive -- you transfer legal ownership of your business to the trustee, which is usually a third party but can also be the business owner.

Considering the current estate and gift tax exemption, the ability to utilize the annual gift tax exclusion, and there being no inheritance tax in Louisiana the vast majority of Louisiana residents do not need a trust to protect their estates from estate or inheritance taxes.

The price of making a living trust depends on the method you use to form it. One way is to use a online program and create the trust document yourself. This will cost you a few hundred dollars or so. You can also use the services of a lawyer, for which you'll probably pay more than $1,000.

A Louisiana living trust passes the assets in the trust to your beneficiaries without going through probate, the process in which a will is verified and enacted by a court. Probate can take many months and incurs the expense of an executor and attorney as well as court fees.

Advantages of a trust A trust provides asset protection and limits liability in relation to the business. Trusts separate the control of an asset from the owner of the asset and so may be useful for protecting the income or assets of a young person or a family unit. Trusts are very flexible for tax purposes.

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries.

How Does a Business Trust Work? A trust is an agreement that allows one party, known as a trustee, to hold, manage, and direct assets or property on behalf of another party, called the beneficiary. In a business trust, a trustee manages a business and conducts transactions for the benefit of its beneficiaries.

Meaning of business trust in Englisha legal arrangement in which a person or organization controls property, investments, etc., for another person or business: Houses can be purchased in the name of a business trust to disguise the name of the actual owner.

Functionally, a business trust is quite similar to an individual or family trust. It helps delegate control of assets to a trustee, who manages the trust and its contents on behalf of the grantor.

The main purpose of a trust is to transfer assets from one person to another. Trusts can hold different kinds of assets. Investment accounts, houses and cars are examples. One advantage of a trust is that it usually avoids having your assets (and your heirs) go through probate when you die.