The Louisiana Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners is a legal document that outlines the process of ending a partnership in the state of Louisiana. This agreement specifies the responsibilities of each partner, the division of assets, and the steps necessary to dissolve the partnership in a fair and organized manner. During the dissolution of a partnership, it is important to have a clear understanding of the different types of agreements that can be used. In Louisiana, there are two main types of dissolution agreements: 1. Formal Dissolution Agreement: This type of agreement is typically used when partners have mutually agreed to dissolve the partnership and are willing to cooperate throughout the process. It outlines the terms and conditions under which the partnership will be dissolved and the assets divided. A formal dissolution agreement must be signed by all partners to be legally binding. 2. Involuntary Dissolution Agreement: In some cases, a partnership may be involuntarily dissolved due to a breach of the partnership agreement or other unforeseen circumstances. An involuntary dissolution agreement outlines the reasons for the dissolution and the steps that will be taken to divide the partnership assets. This type of agreement is often more complex and may involve legal proceedings to resolve any disputes. Keywords: Louisiana, Agreement to Dissolve, Wind up Partnership, Division of Assets, Partners, Formal Dissolution Agreement, Involuntary Dissolution Agreement, Legal Document, Responsibilities, Cooperation, Fair, Organized, Mutually Agreed, Involuntarily Dissolved, Partnership Agreement, Unforeseen Circumstances, Breach, Complex, Disputes, Legal Proceedings.

Louisiana Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

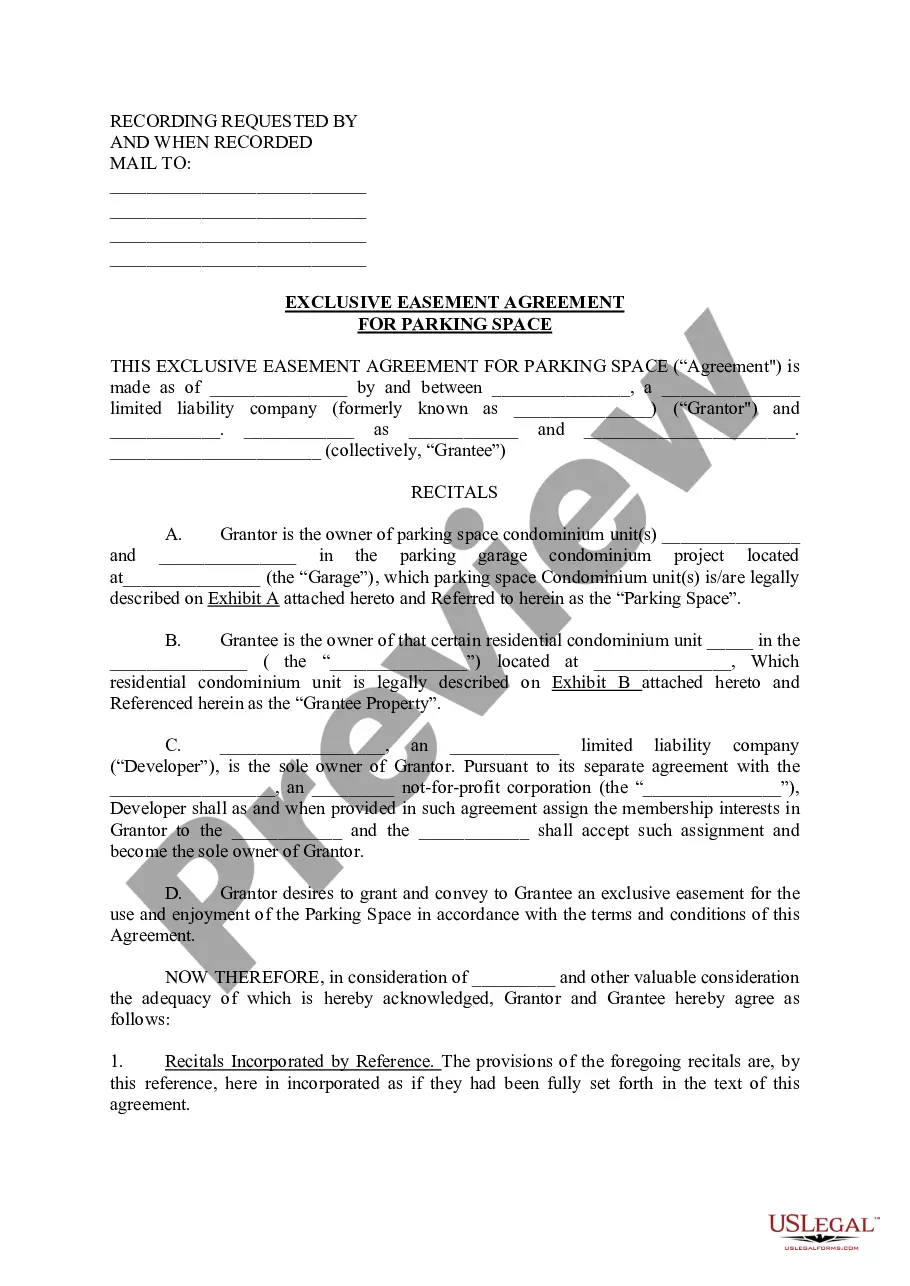

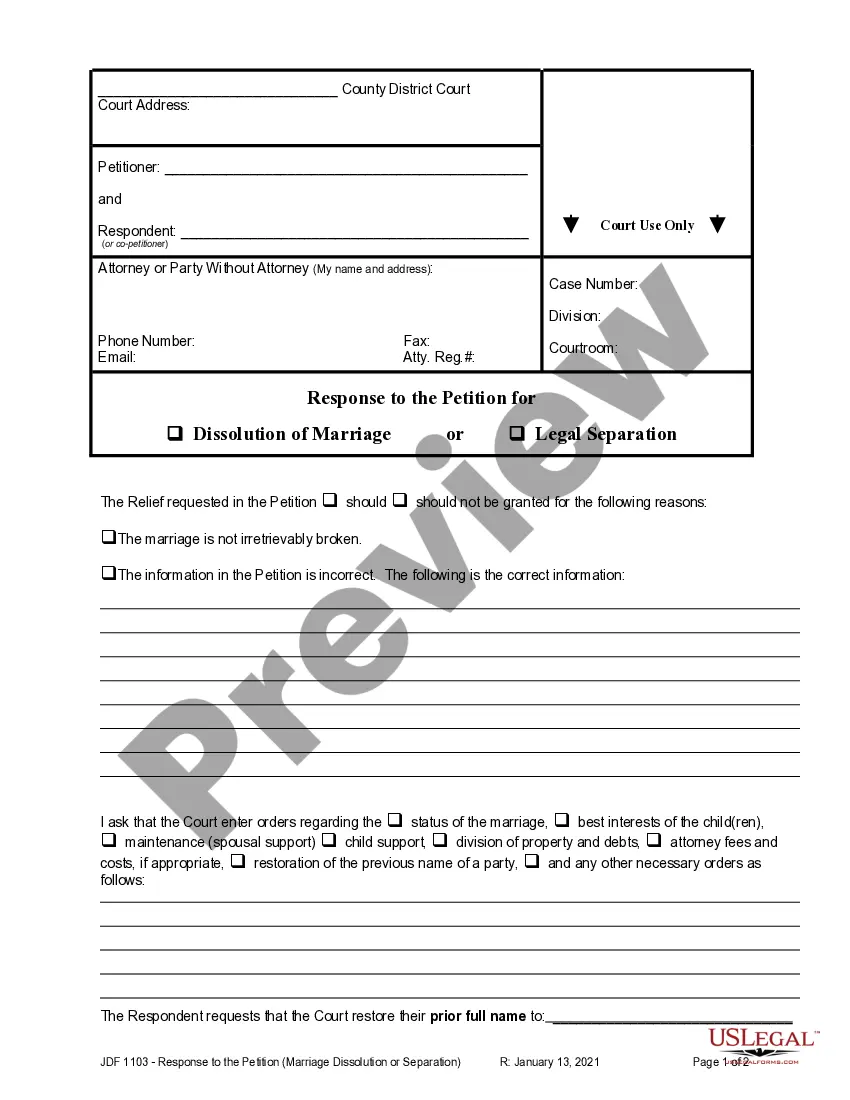

How to fill out Louisiana Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

US Legal Forms - one of many largest libraries of lawful forms in the United States - offers a wide array of lawful file templates you can obtain or print. While using website, you can get a large number of forms for company and individual uses, sorted by types, states, or search phrases.You can get the most up-to-date models of forms just like the Louisiana Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners in seconds.

If you currently have a membership, log in and obtain Louisiana Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners through the US Legal Forms library. The Obtain switch can look on every single type you perspective. You have accessibility to all earlier saved forms in the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed here are easy instructions to help you get started out:

- Be sure you have picked the proper type for your town/state. Click the Review switch to examine the form`s content. See the type information to actually have selected the proper type.

- In case the type does not satisfy your demands, make use of the Look for industry towards the top of the display to find the one that does.

- Should you be pleased with the shape, confirm your choice by visiting the Acquire now switch. Then, pick the prices plan you want and provide your credentials to register to have an bank account.

- Method the purchase. Make use of your bank card or PayPal bank account to complete the purchase.

- Select the file format and obtain the shape on the product.

- Make changes. Fill out, edit and print and signal the saved Louisiana Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners.

Each format you added to your money does not have an expiry particular date and it is your own forever. So, if you wish to obtain or print another version, just visit the My Forms portion and click on on the type you need.

Gain access to the Louisiana Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners with US Legal Forms, one of the most comprehensive library of lawful file templates. Use a large number of professional and condition-certain templates that meet up with your small business or individual requires and demands.

Form popularity

FAQ

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

On the dissolution of a partnership every partner is entitled, as against the other partners in the firm, and all persons claiming through them in respect of their interests as partners, to have the property of the partnership applied in payment of the debts and liabilities of the firm, and to have the surplus assets

In Louisiana, you must file an Affadavit to Dissolve Limited Liability Company with the Secretary of State. The state will then send you a Certificate of Dissolution. Louisiana requires business owners to submit their Certificate of Dissolution by mail, fax, in person, or online.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.