Louisiana Basic Joint-Venture Agreement

Description

How to fill out Basic Joint-Venture Agreement?

Finding the appropriate authentic document template can be a challenge.

Naturally, there are numerous templates available online, but how do you locate the genuine form you desire.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Louisiana Basic Joint-Venture Agreement, which can be applied for both business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If the form does not meet your expectations, use the Search field to find the right form. Once you are confident the form is suitable, click on the Buy now button to obtain the form. Choose your pricing plan and enter the necessary information. Create your account and finalize the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your system. Complete, edit, print, and sign the acquired Louisiana Basic Joint-Venture Agreement. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted papers that adhere to state requirements.

- If you are currently registered, sign in to your account and click on the Download button to access the Louisiana Basic Joint-Venture Agreement.

- Use your account to browse the legal forms you have previously ordered.

- Visit the My documents section of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the appropriate form for your city/state.

- You can view the document using the Preview feature and read the form details to confirm it is the correct one for you.

Form popularity

FAQ

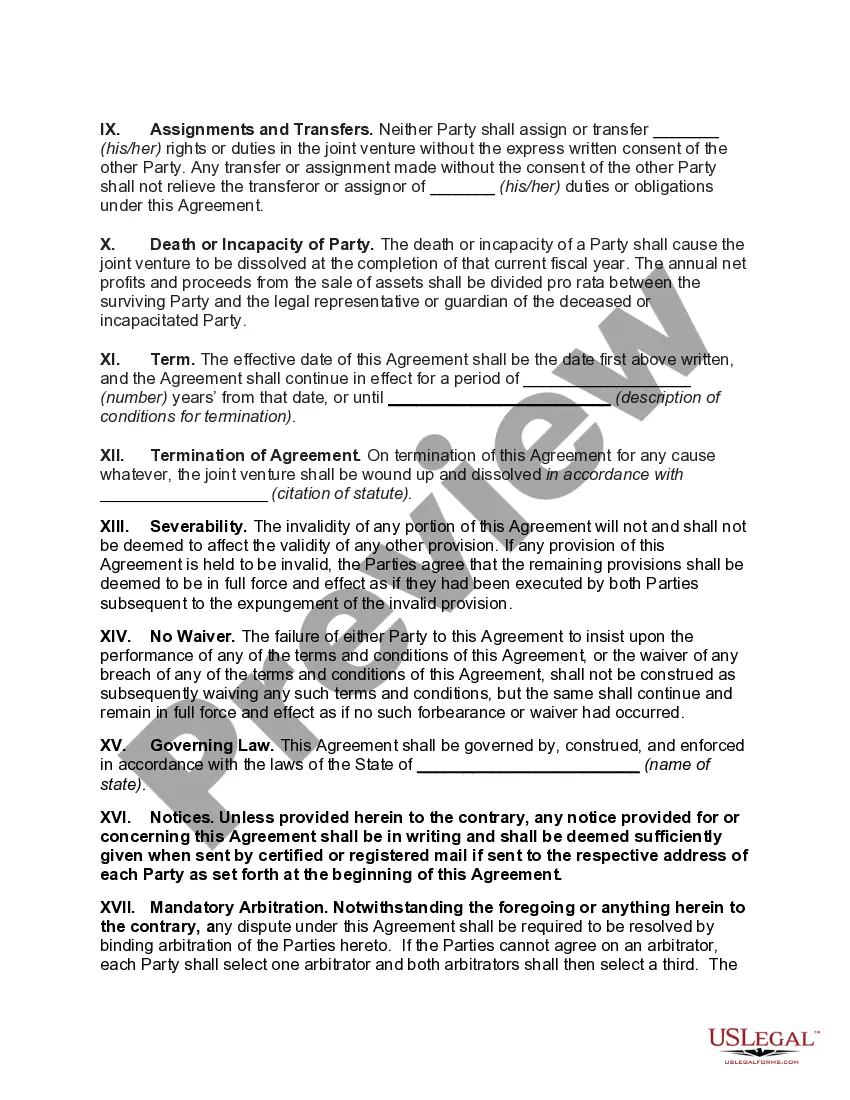

The basics of joint ventures involve collaboration between entities who share resources and expertise to achieve mutual objectives. This arrangement allows partners to leverage each other's strengths while minimizing risk. With a Louisiana Basic Joint-Venture Agreement in place, businesses can strategically navigate the challenges of joint ventures, fostering trust and promoting successful partnerships.

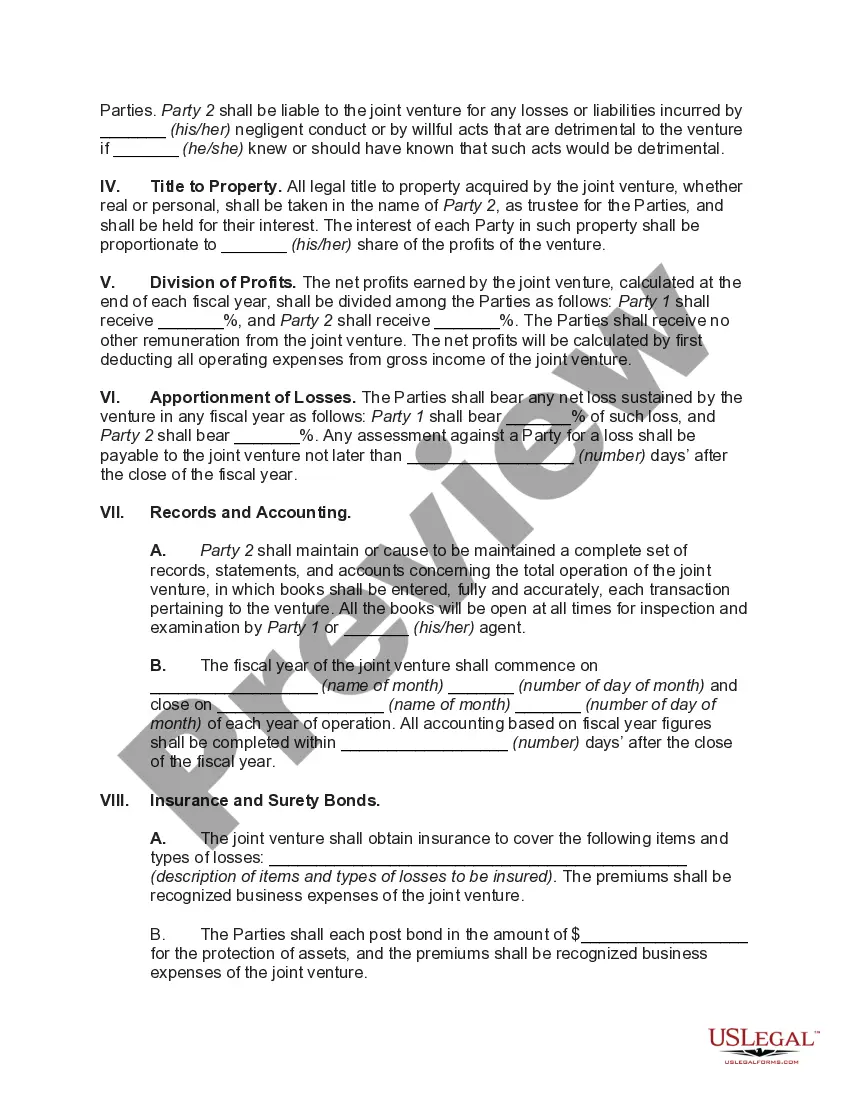

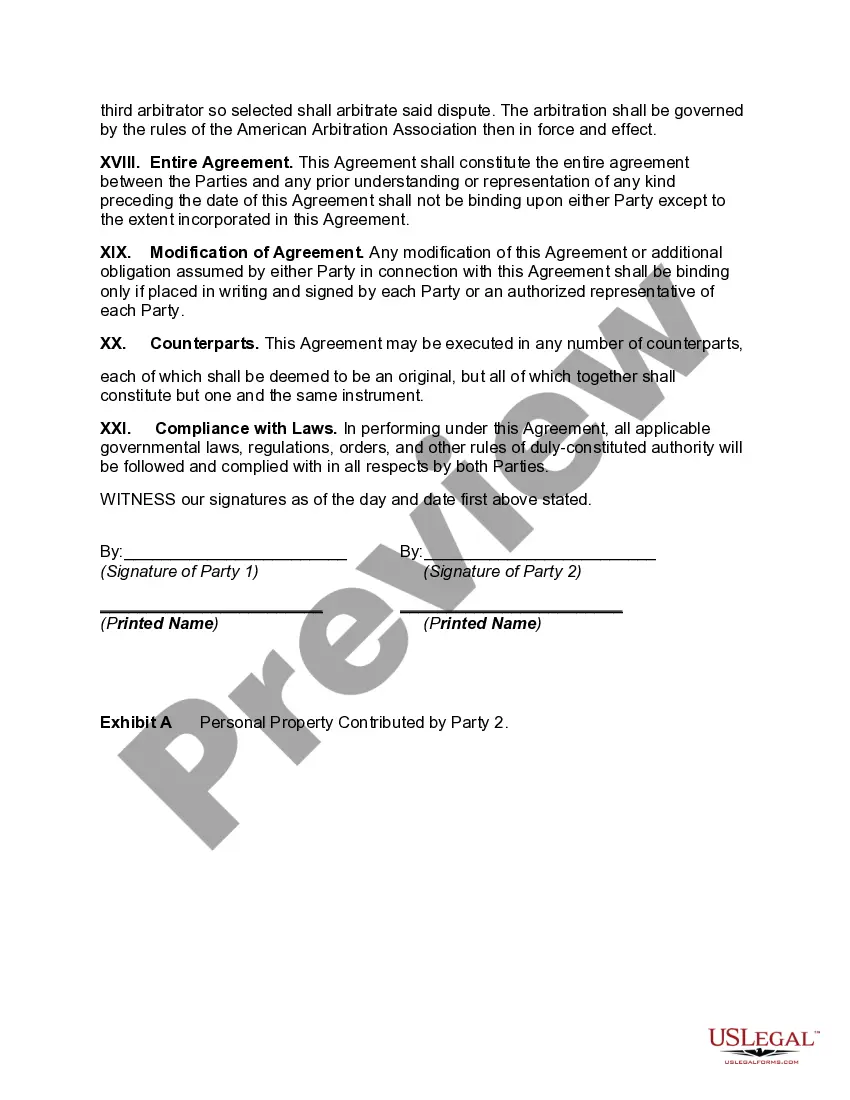

The basic joint venture agreement establishes the foundation for cooperation between parties in a business venture. This agreement typically includes key elements such as the purpose of the joint venture, profit-sharing arrangements, and the duration of the partnership. By utilizing a Louisiana Basic Joint-Venture Agreement, businesses can set clear expectations and mitigate potential disputes.

A typical joint venture agreement outlines the collaboration between two or more parties to achieve a specific business goal. It defines the roles, responsibilities, and contributions of each party involved. In the context of a Louisiana Basic Joint-Venture Agreement, this document helps ensure clarity and alignment among the partners, protecting their interests while driving the venture forward.

You do not necessarily need to form an LLC to create a joint venture, but doing so can offer liability protection for the partners involved. An LLC structure also simplifies tax filing and protects personal assets from business debts. If you choose to proceed with an LLC, incorporating this aspect into your Louisiana Basic Joint-Venture Agreement can create a formal framework for your business relationship.

To legally form a joint venture, you must draft and sign an appropriate agreement that outlines the terms and conditions of the partnership. Include details on contributions, responsibilities, and profit sharing, making sure each partner reviews the document thoroughly. A Louisiana Basic Joint-Venture Agreement from uslegalforms can provide a solid foundation and ensure compliance with legal requirements.

Filing a joint venture typically involves creating a separate legal entity and registering it with the state if applicable. You will need to prepare the necessary documentation and ensure all partners sign off on the Louisiana Basic Joint-Venture Agreement. This agreement should detail the operational framework, which is crucial for smooth filing and compliance.

Forming a joint venture involves several key steps, starting with identifying potential partners who share similar goals. Next, you engage in discussions to outline roles, contributions, and expectations. Finally, document these agreements in a Louisiana Basic Joint-Venture Agreement to protect the interests of all parties involved and provide a clear framework for cooperation.

To set up a joint venture agreement, you should first identify the purpose and goals of the venture. Next, draft a document that outlines each partner's contributions, responsibilities, and profit-sharing arrangements. Using a well-structured Louisiana Basic Joint-Venture Agreement template from uslegalforms can simplify this process, ensuring all legal requirements are met.

Filing taxes for a joint venture involves treating the venture as a separate entity. Typically, you report income and expenses from the joint venture on IRS Form 1065, which is used for partnerships. Remember, the partners in the joint venture will include their share of profits or losses on their individual tax returns. An effective Louisiana Basic Joint-Venture Agreement can help clarify tax obligations for all partners.

A joint venture is not always structured as a 50/50 partnership. The ratio depends on the contributions, interests, and agreements made by the parties involved. It's essential to address the share distribution in your Louisiana Basic Joint-Venture Agreement to ensure all partners have clear expectations regarding ownership and profits.