The Louisiana Gift of Stock to Spouse for Life with Remainder to Children is a type of estate planning strategy that allows individuals to transfer ownership of their stocks to their spouse for their lifetime, while ensuring that the remaining value is eventually transferred to their children. This is achieved through a legal structure known as a "Life Estate with Remainder Interest." In this arrangement, the donor transfers the ownership of their stock portfolio to their spouse, who becomes the lifetime beneficiary. The spouse is entitled to receive any income generated from the stocks, such as dividends and capital gains, during their lifetime. They also have the authority to make decisions regarding the management and sale of the stocks. Upon the death of the surviving spouse, the ownership and control of the stock portfolio pass to the children, who are known as the "remainder men." The remainder men receive the stocks outright and have complete control over their disposal, whether it be selling, holding, or transferring them. This estate planning technique provides several benefits. Firstly, it ensures that the surviving spouse has financial security during their lifetime, as they receive income from the stocks. It also protects the interests of the children, as they ultimately receive ownership of the stocks, preventing them from potentially being disinherited or losing the value of the assets. Furthermore, this structure can provide potential tax advantages, as it allows for the reduction or deferral of capital gains taxes. It's important to note that there are various alternative types of Louisiana Gift of Stock to Spouse for Life with Remainder to Children, each with slightly different legal and financial implications. These variations include the Irrevocable Life Insurance Trust (IIT), Charitable Remainder Trust (CRT), Qualified Personnel Residence Trust (PRT), and Granter Retained Annuity Trust (GREAT). Each of these options may be more suitable depending on an individual's specific circumstances, financial goals, and preferences. Overall, the Louisiana Gift of Stock to Spouse for Life with Remainder to Children is a valuable estate planning tool for individuals looking to provide financial security to their spouse while ensuring their children receive the remaining value of their stock portfolio. It is crucial to consult with an experienced estate planning attorney or financial advisor to determine the most appropriate strategy and structure for your individual needs.

Louisiana Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Louisiana Gift Of Stock To Spouse For Life With Remainder To Children?

You can spend hours online trying to find the legal document template which fits the federal and state demands you will need. US Legal Forms offers thousands of legal types which are examined by experts. You can easily acquire or produce the Louisiana Gift of Stock to Spouse for Life with Remainder to Children from the service.

If you currently have a US Legal Forms profile, it is possible to log in and click the Obtain option. Next, it is possible to comprehensive, edit, produce, or signal the Louisiana Gift of Stock to Spouse for Life with Remainder to Children. Every legal document template you get is yours forever. To obtain an additional version for any obtained kind, go to the My Forms tab and click the related option.

Should you use the US Legal Forms site the first time, adhere to the straightforward recommendations listed below:

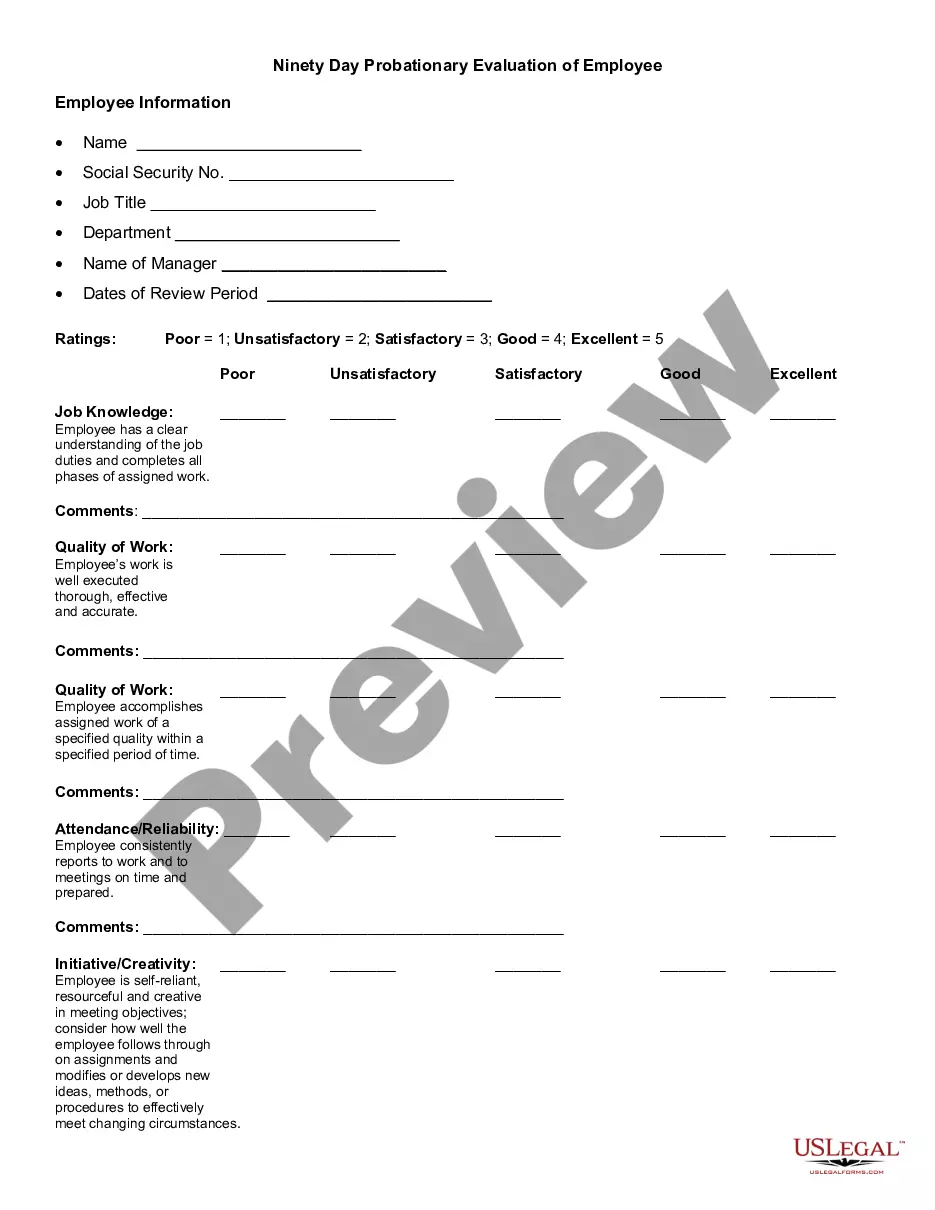

- First, make certain you have selected the proper document template for the area/area that you pick. See the kind description to make sure you have picked out the proper kind. If readily available, use the Preview option to appear through the document template too.

- If you wish to discover an additional edition from the kind, use the Research field to find the template that suits you and demands.

- Once you have discovered the template you want, simply click Purchase now to move forward.

- Pick the prices program you want, key in your credentials, and register for an account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal profile to pay for the legal kind.

- Pick the file format from the document and acquire it in your device.

- Make adjustments in your document if required. You can comprehensive, edit and signal and produce Louisiana Gift of Stock to Spouse for Life with Remainder to Children.

Obtain and produce thousands of document templates while using US Legal Forms web site, which offers the biggest collection of legal types. Use expert and state-certain templates to handle your organization or specific requires.