Louisiana Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

Locating the correct official document format can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you locate the official form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Louisiana Agreement to Sell Partnership Interest to Third Party, which can be utilized for both business and personal needs.

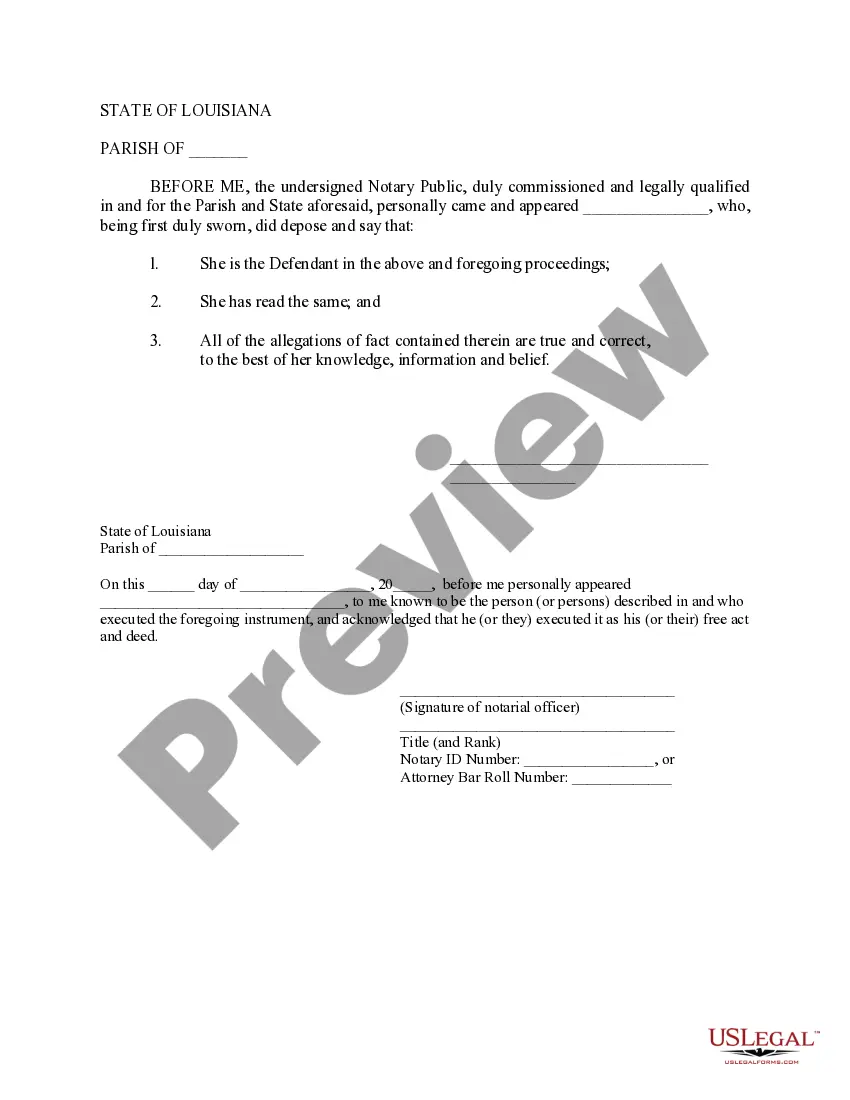

First, ensure you have selected the correct form for your area/county. You may browse the form using the Preview button and review the form details to confirm this is indeed the one for you.

- All of the forms are vetted by experts and meet state and federal regulations.

- If you are already a registered user, Log In to your account and then click the Download button to obtain the Louisiana Agreement to Sell Partnership Interest to Third Party.

- Use your account to view the official forms you have purchased previously.

- Navigate to the My documents tab of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are easy steps for you to follow.

Form popularity

FAQ

The non-solicitation law in Louisiana restricts former partners from soliciting clients or employees of the partnership for a specified period. This law is vital for protecting business interests and ensures partners cannot unfairly compete by poaching clients. Understanding this law is essential when drafting your partnership agreements and considerations for the Louisiana Agreement to Sell Partnership Interest to Third Party.

The liability of all the partners is joint and several even though the act of the firm may have been done by one of them. Thus a third party, if he so likes, can bring an action against any one of them severally or against any two or more of them jointly.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

2212 If a partner is selling his entire partnership interest, then his share of partnership liabilities will be reduced to zero and thus his amount realized will increase by at least the entire amount of his former share of partnership liabilities.

The Top 10 Issues Every Partnership Agreement Should CoverContributions. Money, money, money, and where is it coming from?Management.Decision-making.Authority of each partner.Division of profits.Admission of new partners.What if a partner wants to leave the business, or dies?Role of a spouse?More items...?

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

How to Report a Sale of a Share of a Partnership on a 1065Complete Part I and Part II, Items E through I, on each partner's K-1. This is used to provide personal information.Complete Part III of each partner's K-1.Complete the selling partner's K-1.Complete the remaining partners' K-1s.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.