A Louisiana Revocable Letter of Credit is a financial instrument widely used in international trade or business transactions. It serves as a payment guarantee given by a bank or financial institution, on behalf of a buyer, to a seller/exporter. This letter ensures that the seller will receive payment for goods or services rendered provided they meet the specified terms and conditions established in the agreement. The term "Revocable" implies that the letter of credit can be changed or canceled at any time by the buyer or issuing bank without prior notice to the seller. This flexibility allows the buyer to make amendments or terminate the letter of credit if the transaction circumstances change or if the parties involved agree to do so. There are several types of Louisiana Revocable Letter of Credit, each catering to different trade requirements and circumstances. Some common types include: 1. Commercial Revocable Letter of Credit: This is the most frequently used letter of credit type, and it is issued to facilitate commercial transactions between buyers and sellers. It provides assurance to the seller that they will receive payment if the required documents are presented and comply with the terms stated. 2. Standby Revocable Letter of Credit: This type of letter of credit is intended to serve as a backup or secondary form of payment guarantee. It is commonly used when other primary methods of payment, such as cash or a traditional letter of credit, are not feasible or available. 3. Revolving Revocable Letter of Credit: A revolving letter of credit allows for multiple shipments or transactions within a predetermined time period, typically one year. It establishes a revolving balance, meaning that as long as the credit limit is not exceeded, the letter of credit can be used repeatedly. 4. Red Clause Revocable Letter of Credit: A red clause letter of credit provides an advance payment to the seller, usually before the goods are shipped. It allows the seller to obtain the necessary funds to fulfill the order and cover any initial costs, such as production or packaging expenses. In conclusion, a Louisiana Revocable Letter of Credit is a flexible payment guarantee provided by a bank or financial institution to a seller in international trade transactions. It can be revoked or modified by the buyer or issuing bank at any time. Different types of Louisiana Revocable Letters of Credit include commercial, standby, revolving, and red clause letters of credit, each catering to specific trade requirements and circumstances.

Louisiana Revocable Letter of Credit

Description

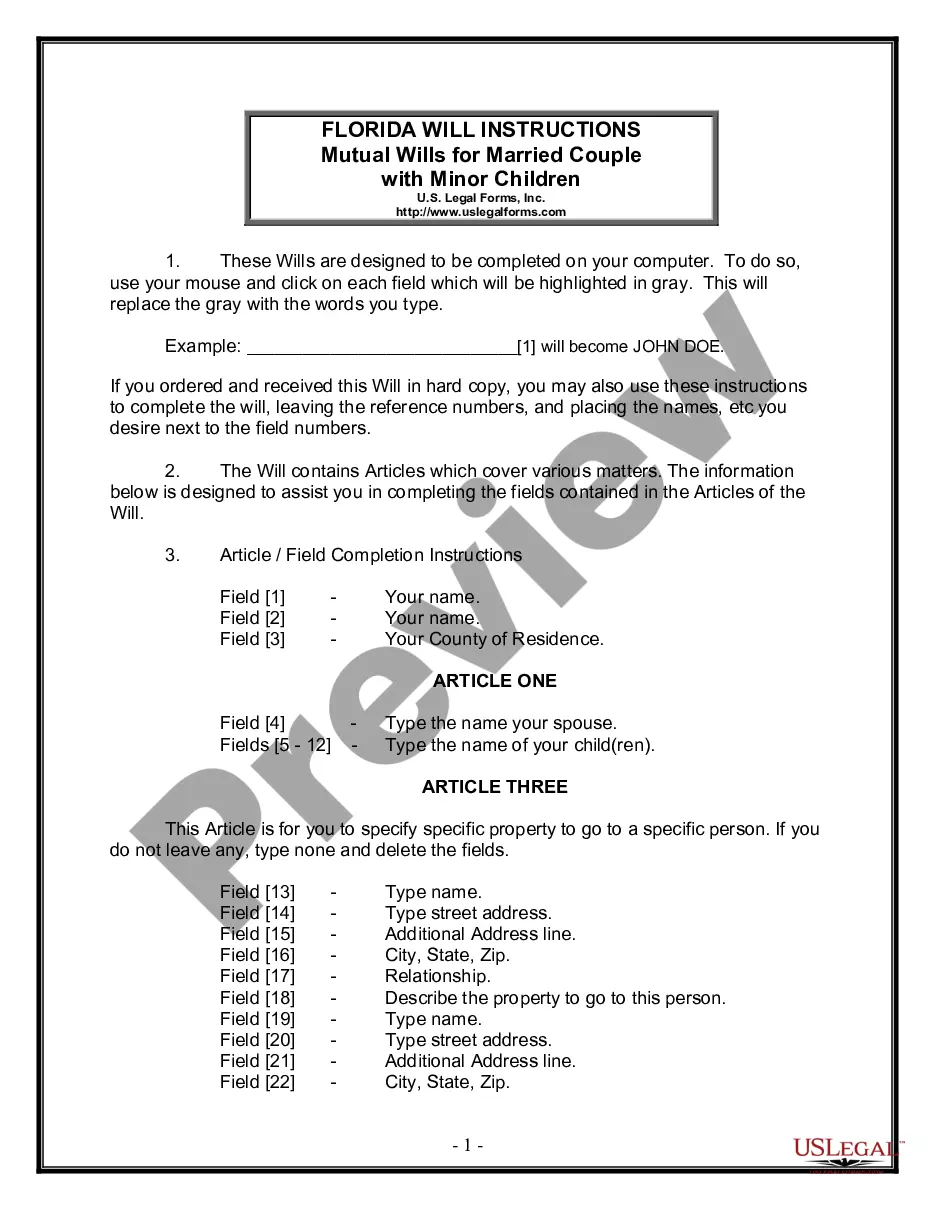

How to fill out Louisiana Revocable Letter Of Credit?

US Legal Forms - one of the most significant libraries of lawful varieties in the United States - delivers a wide range of lawful document layouts you may obtain or print. Making use of the internet site, you can get a large number of varieties for organization and individual purposes, sorted by types, claims, or key phrases.You will discover the newest models of varieties such as the Louisiana Revocable Letter of Credit in seconds.

If you have a registration, log in and obtain Louisiana Revocable Letter of Credit from the US Legal Forms catalogue. The Obtain switch will appear on each form you perspective. You have access to all formerly acquired varieties within the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, here are basic directions to obtain began:

- Make sure you have selected the right form for your personal town/area. Click on the Preview switch to analyze the form`s articles. See the form description to ensure that you have chosen the appropriate form.

- If the form does not match your needs, make use of the Research industry near the top of the display to obtain the one who does.

- When you are happy with the shape, confirm your selection by clicking the Acquire now switch. Then, select the prices plan you like and provide your accreditations to register for the profile.

- Approach the financial transaction. Use your credit card or PayPal profile to complete the financial transaction.

- Select the structure and obtain the shape on the device.

- Make alterations. Fill out, revise and print and signal the acquired Louisiana Revocable Letter of Credit.

Each and every template you put into your bank account does not have an expiration date and is also yours permanently. So, in order to obtain or print yet another duplicate, just check out the My Forms segment and click around the form you will need.

Gain access to the Louisiana Revocable Letter of Credit with US Legal Forms, by far the most comprehensive catalogue of lawful document layouts. Use a large number of skilled and condition-particular layouts that meet up with your business or individual requirements and needs.

Form popularity

FAQ

A revocable letter of credit is one which can be cancelled or amended by the issuing bank at any time and without prior notice to or consent of the beneficiary. From the exporter's point of view such LCs are not safe. Besides exporter cannot get such LCs confirmed as no bank will add confirmation to Revocable LCs.

Some of the disadvantages are listed below: Can be revoked anytime. Both parties are at a disadvantage position, and financial loss is expected. Non-transferable instrument due to lack of authority/security related to issuing bank. An unapproved document adds to the security risk.

A revocable LC is a credit, the terms and conditions of which can be amended/ cancelled by the Issuing Bank. This cancellation can be done without prior notice to the beneficiaries. An irrevocable credit is a credit, the terms and conditions of which can neither be amended nor cancelled.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

For example, under a revocable letter of credit, if the seller was unable to ship within the stipulated time period, he could simply amend the shipment date to whenever suits him. That may not suit the buyer, but he would be powerless.

For example, in an Irrevocable LC, the seller sends the shipment and gets his payment without showing any financial documents like proof of delivery. This document is generally used with established financial institutions and trading partners.

The basic letter of credit procedure: Purchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement. ... Buyer applies for letter of credit. ... Issue letter of credit. ... Advise letter of credit. ... Prepare shipment. ... Present documents. ... Payment. ... Document transfer.

When you have a transferable letter of credit, you can transfer the right of payment to one or more third parties. One example of a transferable letter of credit is in the case of exporting and importing goods. Let's say your business imports expensive parts from another country in order to build its products.