Louisiana Agreement for Auditing Services between Accounting Firm and Municipality

Description

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

Have you been in the place in which you require papers for possibly business or person reasons nearly every working day? There are tons of lawful file themes available on the net, but locating ones you can depend on isn`t simple. US Legal Forms provides thousands of form themes, just like the Louisiana Agreement for Auditing Services between Accounting Firm and Municipality, that are created to fulfill federal and state specifications.

Should you be currently knowledgeable about US Legal Forms internet site and also have an account, simply log in. Following that, it is possible to download the Louisiana Agreement for Auditing Services between Accounting Firm and Municipality web template.

If you do not come with an account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is to the right city/region.

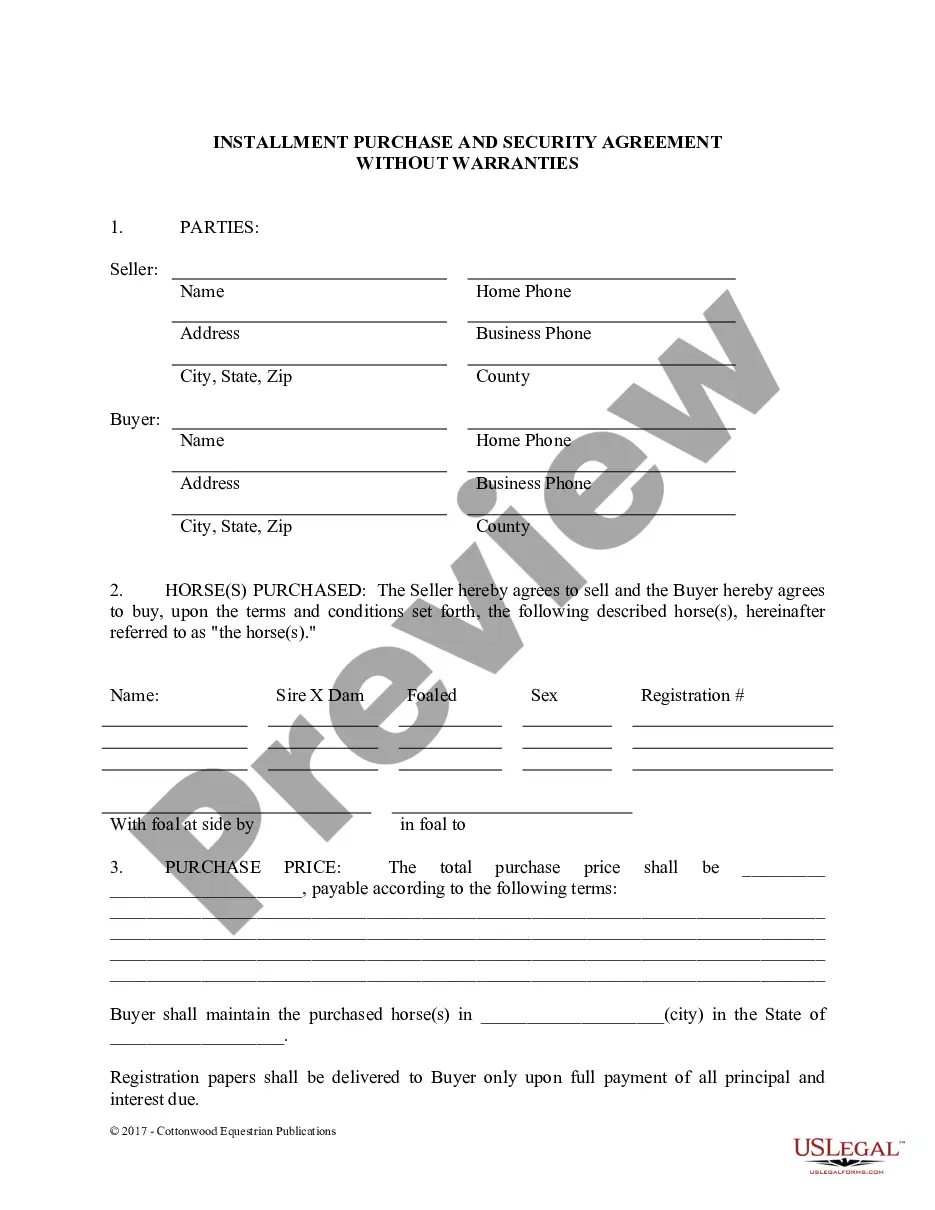

- Make use of the Preview key to examine the form.

- Look at the outline to actually have selected the correct form.

- In the event the form isn`t what you are seeking, take advantage of the Search area to obtain the form that meets your needs and specifications.

- When you discover the right form, just click Purchase now.

- Pick the pricing program you want, fill out the desired info to make your bank account, and buy your order using your PayPal or charge card.

- Pick a practical document formatting and download your backup.

Get each of the file themes you might have purchased in the My Forms food selection. You can aquire a more backup of Louisiana Agreement for Auditing Services between Accounting Firm and Municipality anytime, if necessary. Just click the required form to download or print out the file web template.

Use US Legal Forms, by far the most substantial assortment of lawful forms, to save lots of time and avoid mistakes. The assistance provides professionally created lawful file themes which can be used for an array of reasons. Generate an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

The Louisiana Legislative Auditor is a state legislative position in the Louisiana state government. Constitutionally established in 1964, the legislative auditor is elected by a majority of the members of both the state Senate and House. Prior to 1964, various agencies performed the role of the auditor.

The Louisiana Governmental Audit Guide (LAGAG) provides resources to set forth the standards by which the engagements of local governments and quasi-public organizations (local auditees) are to be performed.

The Louisiana Legislative Auditor (LLA) office has broad authority under the audit law to audit the records of state agencies, and local government agencies and quasi-public organization (local auditees); and to regulate the audits and other engagements of agencies that report to LLA that are performed by private CPA ...

We ultimately determine whether government agencies are efficient, effective, fulfilling their missions, and complying with the law.

Auditors of government entities and entities that receive government awards use our Government Auditing Standards, commonly referred to as generally accepted government auditing standards (GAGAS) or the Yellow Book, to perform their audits and produce their reports.