Louisiana Daily Accounts Receivable refers to the financial records that document the money owed to a business or government entity for goods or services provided on a daily basis within the state of Louisiana. Maintaining accurate and up-to-date accounts receivable is crucial for businesses to effectively manage their cash flow and ensure that outstanding debts are collected in a timely manner. The Louisiana Daily Accounts Receivable system plays a vital role in the financial management of businesses across various industries, including retail, healthcare, construction, hospitality, and more. It helps track the receivables generated each day, allowing businesses to monitor any overdue payments or delinquent accounts in order to take appropriate actions, such as sending reminders or escalating collection efforts. Keeping track of Louisiana Daily Accounts Receivable enables businesses to analyze their revenue streams, identify trends, and make informed decisions regarding credit policies, customer relationships, and financial planning. By closely monitoring their daily receivables, businesses can proactively manage potential financial risks, improve cash flow, and optimize their overall financial performance. Different types of Louisiana Daily Accounts Receivable may include invoices for products sold or services rendered, payment plans or installment agreements, past-due accounts, uncollectible debts, and outstanding bills with various payment terms. Each type requires specific attention and management techniques to ensure accurate recording, efficient collection, and proper follow-up. Businesses may employ specialized software or utilize manual accounting methods to maintain their Louisiana Daily Accounts Receivable records. This may involve creating detailed customer profiles, tracking payment history, managing adjustments or disputes, and generating reports to evaluate the efficiency of collections processes and the overall health of the accounts receivable portfolio. By effectively managing Louisiana Daily Accounts Receivable, businesses can minimize the risk of bad debts and late payments, maintain positive relationships with customers, and foster a financially stable operation. Regular assessment and analysis of daily accounts receivable enable businesses to make informed decisions, adapt their credit policies, improve cash flow, and streamline their financial operations for sustained success in the competitive Louisiana market.

Louisiana Daily Accounts Receivable

Description

How to fill out Louisiana Daily Accounts Receivable?

If you need to comprehensive, acquire, or print out lawful file templates, use US Legal Forms, the biggest collection of lawful forms, which can be found on-line. Utilize the site`s basic and practical look for to get the papers you require. A variety of templates for business and personal uses are categorized by categories and claims, or key phrases. Use US Legal Forms to get the Louisiana Daily Accounts Receivable with a few mouse clicks.

In case you are currently a US Legal Forms consumer, log in for your account and then click the Down load key to obtain the Louisiana Daily Accounts Receivable. You may also accessibility forms you earlier delivered electronically from the My Forms tab of the account.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for your appropriate city/nation.

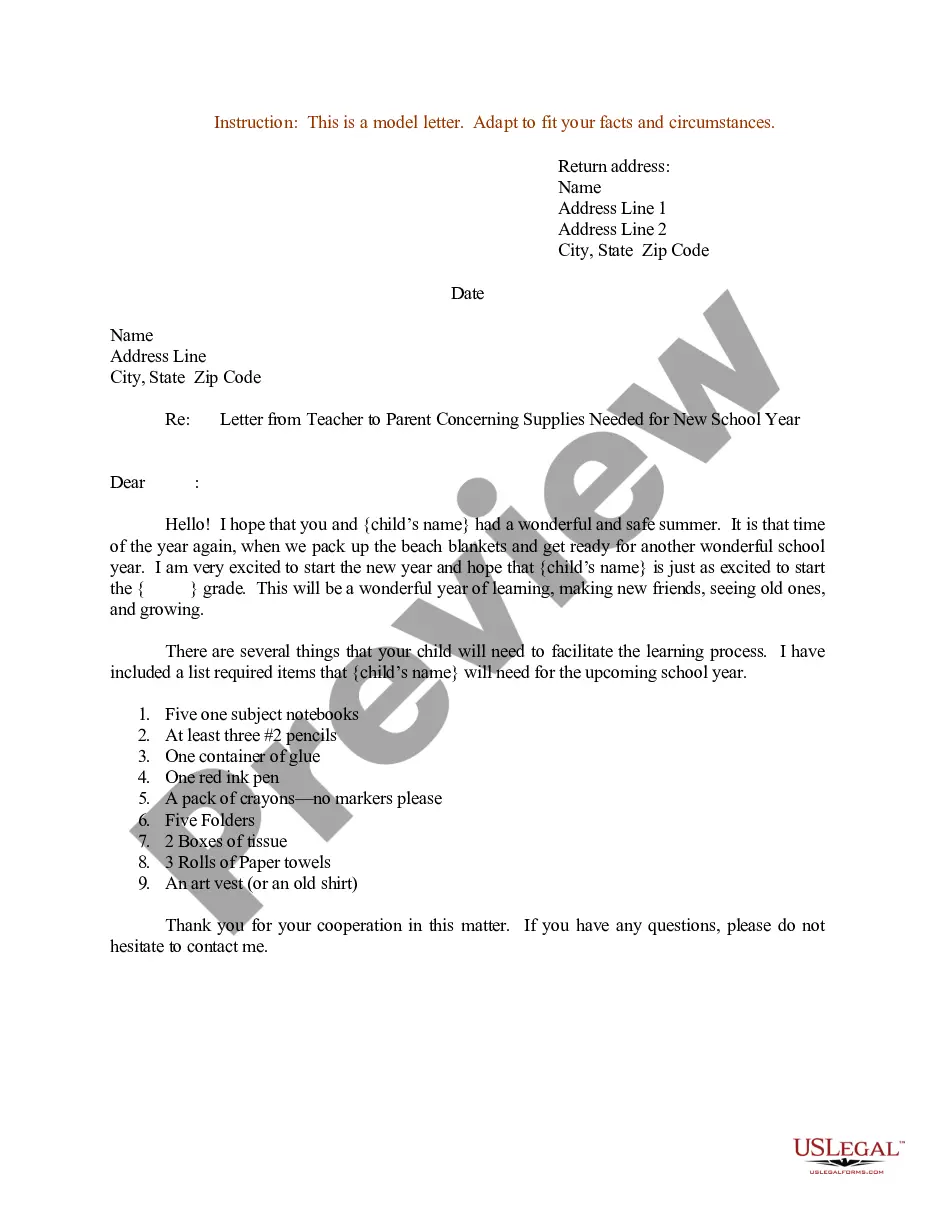

- Step 2. Use the Review solution to look through the form`s content material. Don`t neglect to learn the information.

- Step 3. In case you are not happy together with the form, make use of the Search industry near the top of the monitor to discover other types of the lawful form format.

- Step 4. Once you have discovered the form you require, click the Get now key. Choose the rates strategy you prefer and add your qualifications to register for the account.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal account to perform the financial transaction.

- Step 6. Choose the structure of the lawful form and acquire it in your product.

- Step 7. Full, modify and print out or indicator the Louisiana Daily Accounts Receivable.

Each and every lawful file format you purchase is your own property eternally. You possess acces to each and every form you delivered electronically within your acccount. Click on the My Forms section and choose a form to print out or acquire yet again.

Contend and acquire, and print out the Louisiana Daily Accounts Receivable with US Legal Forms. There are many specialist and condition-distinct forms you may use for your business or personal demands.