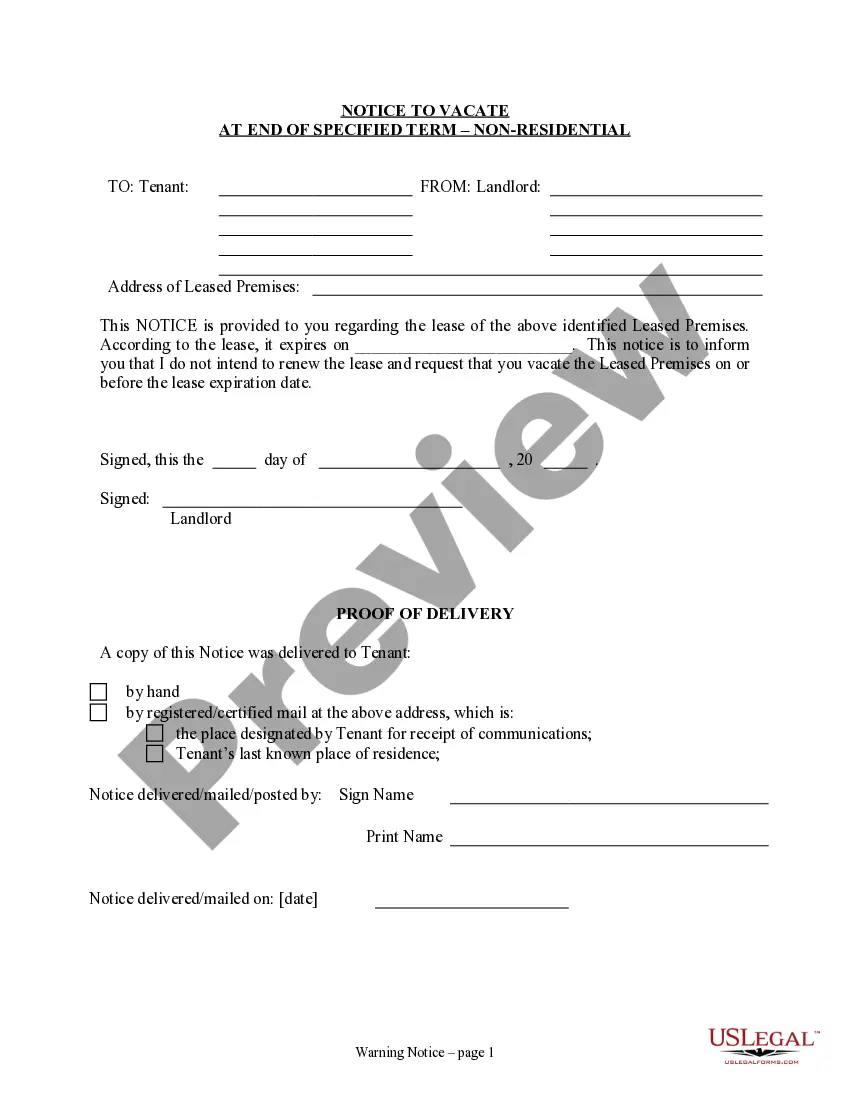

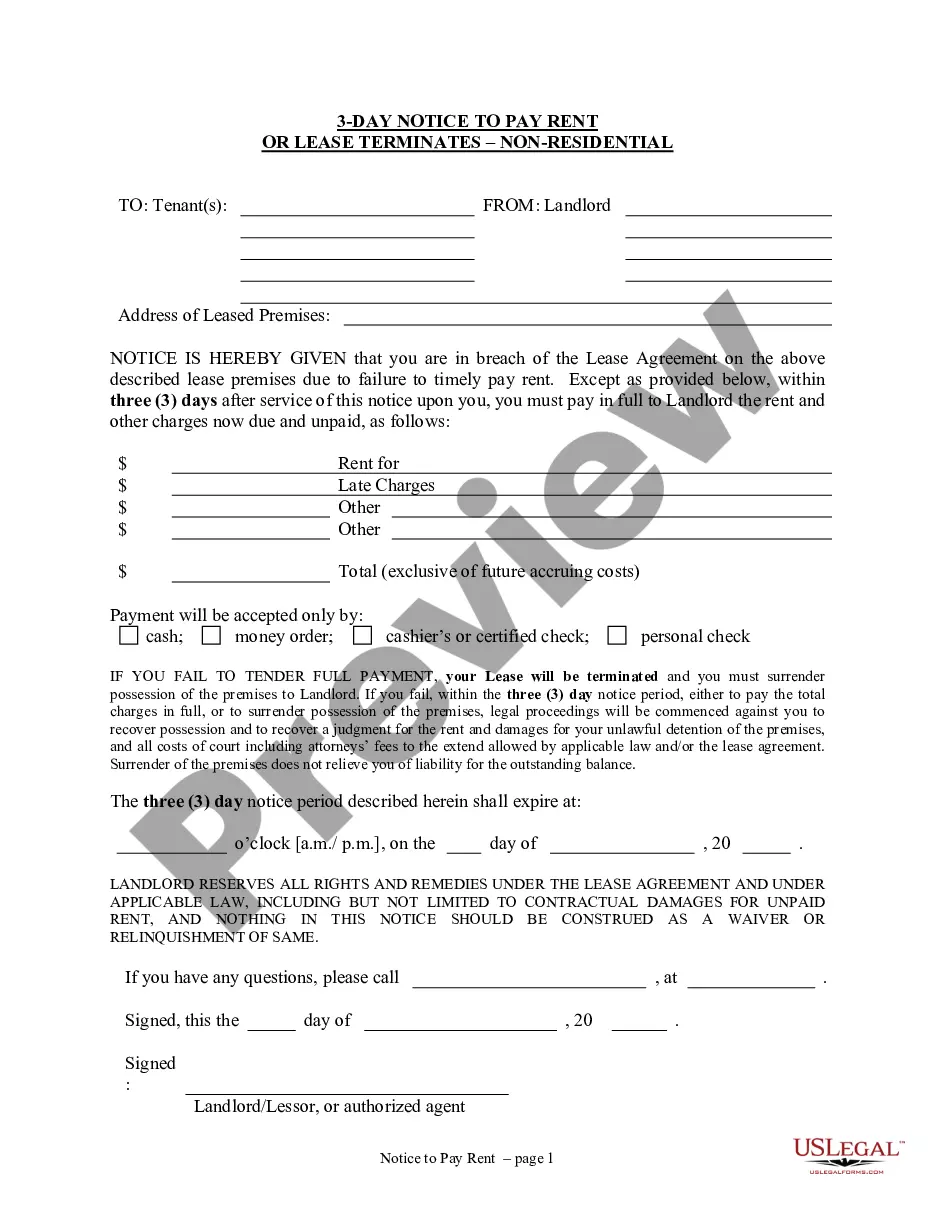

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

Louisiana Yearly Expenses by Quarter refer to the comprehensive breakdown of financial costs incurred by individuals or organizations residing in or operating within the state of Louisiana over a one-year period. These expenses are categorized and analyzed according to the different quarters or three-month periods of the year, namely Q1 (January to March), Q2 (April to June), Q3 (July to September), and Q4 (October to December). By examining these expenses across each quarter, individuals and businesses can gain valuable insights into their spending patterns, budgeting strategies, and financial health. The Louisiana Yearly Expenses by Quarter can be further divided into various types, depending on the specific aspects of expenditure being considered. Some prominent categories or types of Louisiana Yearly Expenses by Quarter may include: 1. Personal Expenses: This type encompasses the day-to-day costs incurred by individuals that are essential for their livelihood, such as housing costs (rent or mortgage payments), utility bills (electricity, water, etc.), transportation expenses (fuel, public transportation fares), groceries, insurance premiums, healthcare expenses, and personal care products. 2. Business Expenses: For organizations operating in Louisiana, this category covers various costs associated with running a business, including office or workspace rent, utilities, payroll expenses (wages, salaries, and benefits), marketing and advertising expenses, supplies and equipment, permits and licenses, insurance, professional fees, and travel expenses. 3. Educational Expenses: This category focuses on the costs related to education, including tuition fees, textbooks, school supplies, transportation costs to and from educational institutions, and other related expenses. 4. Entertainment and Leisure Expenses: This category encompasses costs incurred for leisure activities and entertainment purposes. It may include expenses related to dining out, attending events or concerts, sports activities, vacations, hobbies, membership fees for clubs or gyms, and other similar recreational activities. 5. Tax Expenses: This type consists of various taxes imposed by the state of Louisiana, such as income tax, sales tax, property tax, and other levies. Tracking these expenses by quarter helps individuals and businesses estimate their tax liabilities accurately. 6. Miscellaneous Expenses: This category includes any other expenses not covered by the above types, such as charity donations, personal investments, legal fees, repair and maintenance costs, subscriptions (newspapers, magazines, online services), and other unforeseen expenditures. Analyzing Louisiana Yearly Expenses by Quarter provides valuable data for individuals, businesses, and policymakers to assess and optimize their financial decision-making. By monitoring these expenses, individuals can identify areas of overspending or potential cost-cutting measures, while businesses can strategize more effectively to maximize profitability and overall financial performance.