The Louisiana Petty Cash Form is a document designed to track and document small cash transactions within an organization or business based in the state of Louisiana. It serves as a tool for managing and controlling petty cash funds effectively. This form allows businesses to maintain proper financial records and ensures transparency in cash handling activities. The Louisiana Petty Cash Form contains various sections to capture essential information. These may include the date, amount of cash disbursed, purpose or description of the expense, and the name of the person responsible for the cash withdrawal. Additionally, there may be fields to record the name of the department, project, or account charged for the expense. Using the Louisiana Petty Cash Form helps organizations keep track of expenses that do not warrant the use of traditional payment methods such as checks or credit cards. Petty cash funds are generally used for small, incidental expenses like office supplies, postage, or refreshments for meetings. While there may not be different types of Louisiana Petty Cash Forms, organizations might customize the form layout or add extra fields based on their specific needs. For instance, some businesses may include authorization signatures or require additional documentation to support the expense request. By utilizing the Louisiana Petty Cash Form, businesses can have better control over their cash flow, maintain accurate records, and ensure accountability for petty cash expenditures. Keeping detailed records allows for easy auditing and facilitates the preparation of financial reports. Keywords: Louisiana Petty Cash Form, cash transactions, small cash, organization, business, financial records, transparency, cash handling, disbursed, purpose, description, expense, responsible, withdrawal, department, project, account charged, traditional payment methods, checks, credit cards, incidental expenses, office supplies, postage, refreshments, meetings, authorized signatures, additional documentation, cash flow, accurate records, accountability, auditing, financial reports.

Louisiana Petty Cash Form

Description

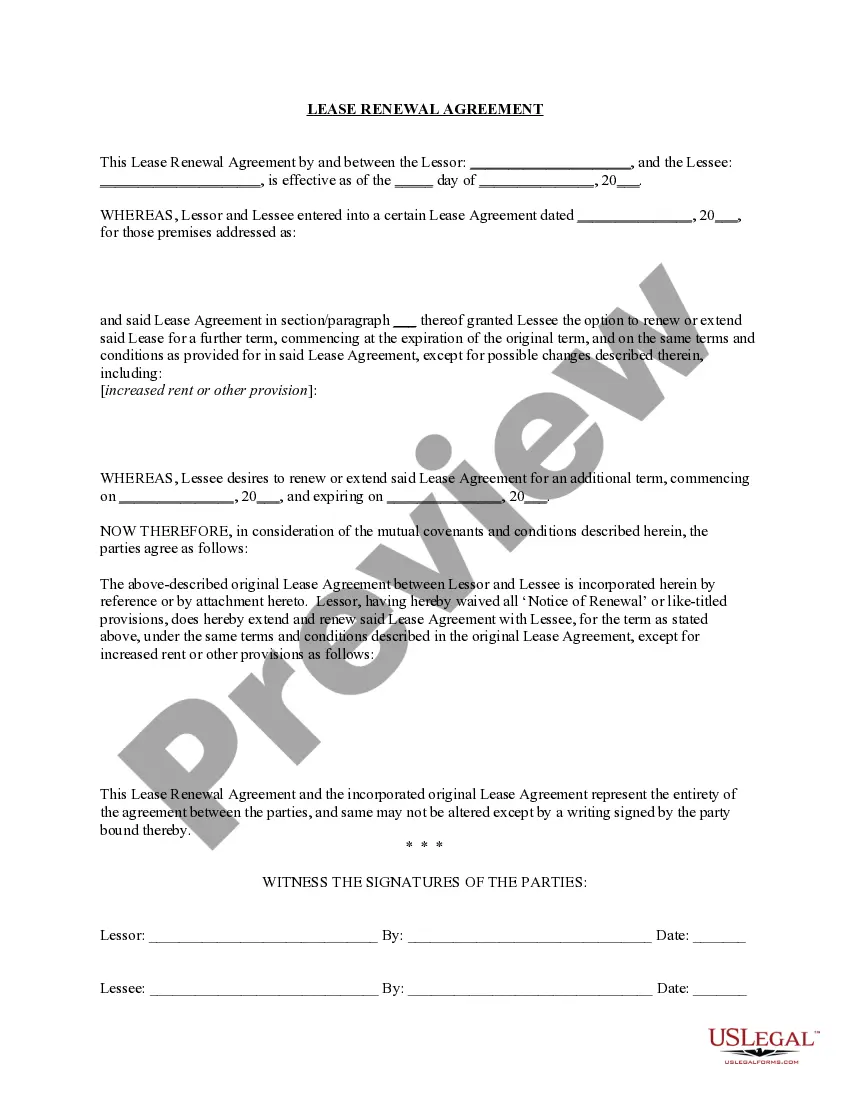

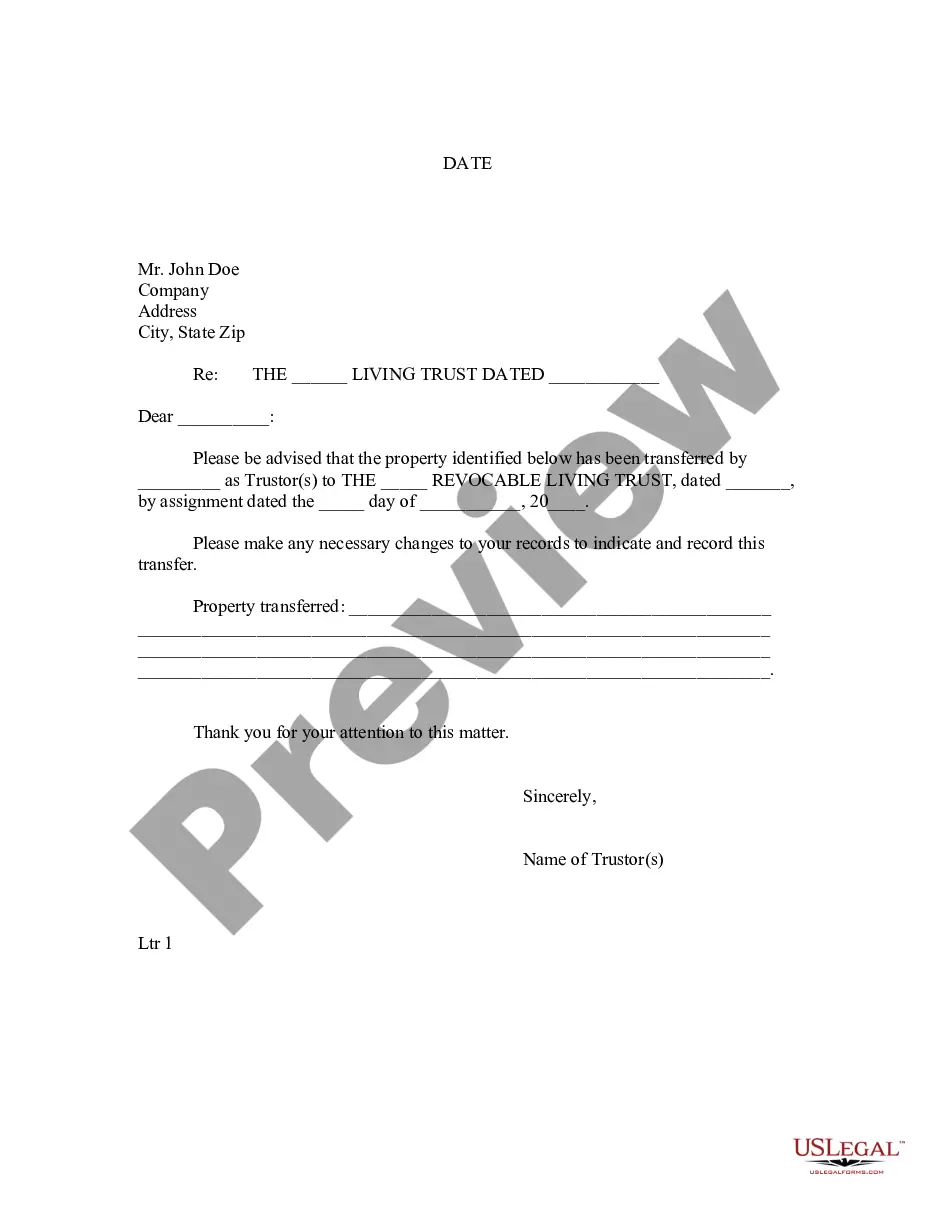

How to fill out Louisiana Petty Cash Form?

Choosing the right legitimate record design can be a struggle. Needless to say, there are a variety of web templates available on the Internet, but how can you discover the legitimate form you will need? Make use of the US Legal Forms web site. The services delivers 1000s of web templates, including the Louisiana Petty Cash Form, that you can use for company and private requirements. All of the types are examined by experts and meet up with federal and state requirements.

Should you be already signed up, log in to the profile and click on the Acquire button to obtain the Louisiana Petty Cash Form. Make use of your profile to check from the legitimate types you possess acquired formerly. Proceed to the My Forms tab of your respective profile and get yet another duplicate in the record you will need.

Should you be a brand new consumer of US Legal Forms, listed here are straightforward directions so that you can follow:

- Initially, be sure you have chosen the correct form to your town/county. You can look through the shape using the Review button and look at the shape explanation to make sure it is the best for you.

- In case the form is not going to meet up with your requirements, take advantage of the Seach industry to obtain the appropriate form.

- When you are certain that the shape is suitable, click on the Buy now button to obtain the form.

- Choose the pricing prepare you would like and enter the needed information. Make your profile and buy the order with your PayPal profile or bank card.

- Opt for the document file format and down load the legitimate record design to the product.

- Total, change and print out and indicator the received Louisiana Petty Cash Form.

US Legal Forms is definitely the biggest catalogue of legitimate types in which you can find various record web templates. Make use of the company to down load skillfully-produced papers that follow express requirements.

Form popularity

FAQ

The procedure for petty cash funding is outlined below:Complete reconciliation form. Complete a petty cash reconciliation form, in which the petty cash custodian lists the remaining cash on hand, vouchers issued, and any overage or underage.Obtain cash.Add cash to petty cash fund.Record vouchers in general ledger.

The petty cash amount may appear as the first or second item listed in the current asset section of the balance sheet. However, the petty cash amount might be combined with the balances in the other cash accounts and their total reported as Cash or as Cash and cash equivalents as the first current asset.

An employee using petty cash should provide a receipt for the purchase to the petty cash custodian. Give the receipt to your finance department or the person who handles your small business books. You typically evaluate your petty cash fund at the end of each month for more accurate balances.

A credit card receipt can be used as evidence for a disbursement of funds from petty cash.

Petty cash provides convenience for small transactions for which issuing a check or a corporate credit card is unreasonable or unacceptable. The small amount of cash that a company considers petty will vary, with many companies keeping between $100 and $500 as a petty cash fund.

The procedure for petty cash funding is outlined below:Complete reconciliation form. Complete a petty cash reconciliation form, in which the petty cash custodian lists the remaining cash on hand, vouchers issued, and any overage or underage.Obtain cash.Add cash to petty cash fund.Record vouchers in general ledger.

Each time a payment is made from the petty cash fund, a pre-numbered voucher must be prepared as proof of payment. True. For internal control reasons, at least two people should be responsible for the petty cash fund, and the petty cash box should be kept in a locked desk drawer or safe.

Petty cash funds should be properly secured at all times. Access to the funds should be restricted to one person (e.g., the petty cash custodian or a specified cashier). Cash on hand and receipts for disbursements made should always equal the assigned amount of the petty cash fund.

The petty cash voucher shows the voucher number,amount, purpose of the expenditure, and account to debit. The person receiving the funds signs the voucher, and the person who controls the petty cash fund initials the voucher. used by most businesses to record transactions involving petty cash.

The original Petty Cash Voucher is stapled to the original supporting documents (retail store sales slip, cash register tape, or other original receipt) and forwarded to Accounts Payable with the Petty Cash Replenishment Request (see Procedure 4-006, Preparation of Petty Cash Replenishment Request) at the time of petty