Louisiana Exemption Statement

Description

How to fill out Exemption Statement?

US Legal Forms - one of the biggest libraries of legitimate types in America - offers a wide range of legitimate record themes you can down load or print out. Utilizing the web site, you can find 1000s of types for enterprise and person functions, sorted by classes, claims, or keywords and phrases.You can find the most up-to-date models of types much like the Louisiana Exemption Statement - Texas in seconds.

If you have a monthly subscription, log in and down load Louisiana Exemption Statement - Texas through the US Legal Forms library. The Acquire key can look on each and every kind you view. You have accessibility to all earlier acquired types inside the My Forms tab of your account.

If you want to use US Legal Forms the first time, allow me to share easy directions to help you started:

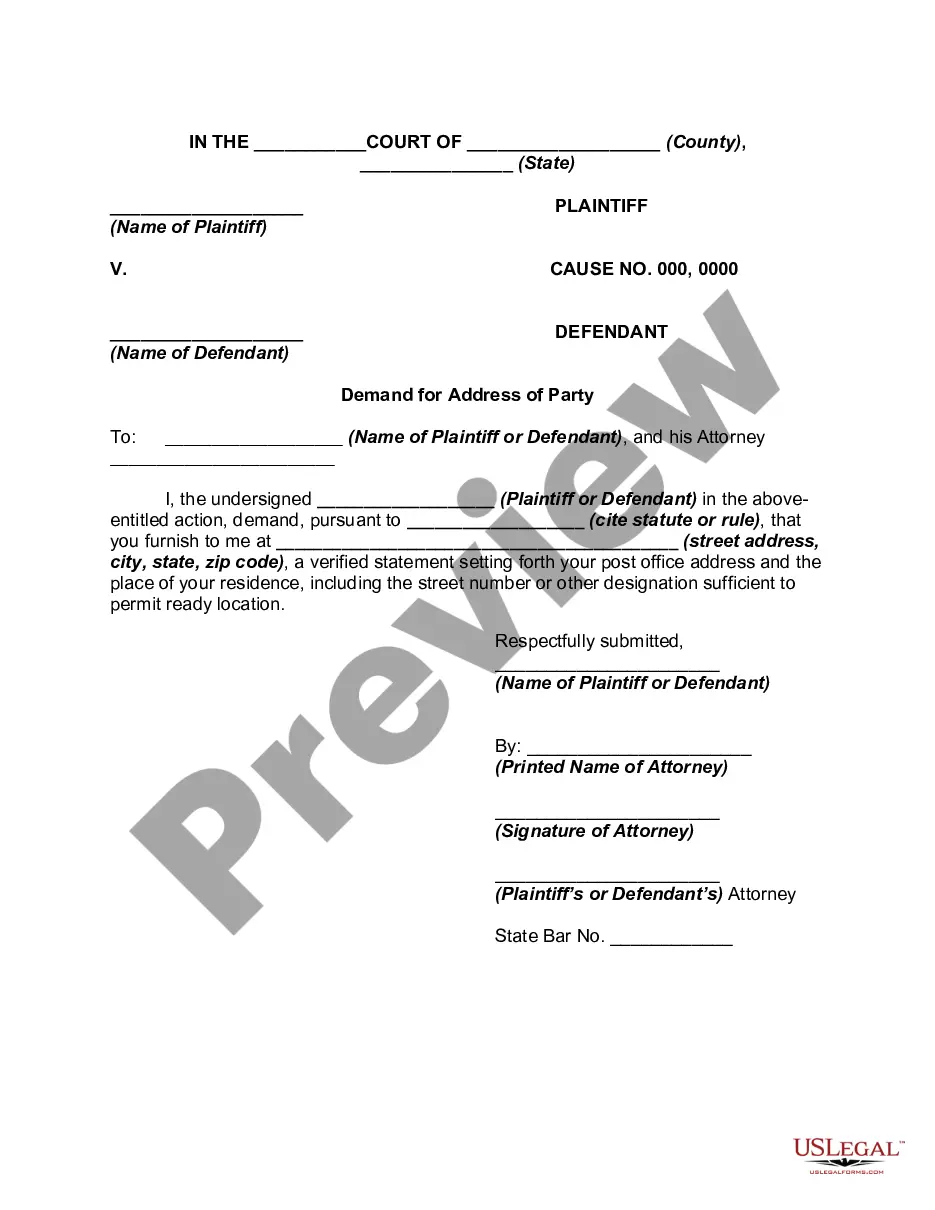

- Make sure you have picked out the best kind to your town/area. Go through the Review key to check the form`s content material. Browse the kind explanation to ensure that you have selected the proper kind.

- When the kind does not match your needs, make use of the Lookup area near the top of the screen to find the one that does.

- When you are satisfied with the shape, validate your option by visiting the Acquire now key. Then, choose the costs prepare you favor and offer your qualifications to sign up on an account.

- Process the purchase. Make use of credit card or PayPal account to finish the purchase.

- Find the file format and down load the shape in your system.

- Make changes. Fill up, edit and print out and signal the acquired Louisiana Exemption Statement - Texas.

Every single design you added to your bank account lacks an expiration particular date which is the one you have permanently. So, in order to down load or print out another copy, just proceed to the My Forms segment and click on about the kind you will need.

Gain access to the Louisiana Exemption Statement - Texas with US Legal Forms, one of the most considerable library of legitimate record themes. Use 1000s of professional and status-particular themes that fulfill your organization or person demands and needs.

Form popularity

FAQ

Texas. The Texas Constitution forbids personal income taxes. Instead of collecting income taxes, Texas relies on high sales and use taxes. When paired with local taxes, total sales taxes in some jurisdictions are as high as 8.25%.

The easy rule is that you must pay non-resident income taxes for the state in which you work and resident income taxes for the state in which you live, while filing income tax returns for both states.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Nonresident and Part-Year Resident Individual Income Tax Nonresident and part-year resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return, IT-540B, reporting all income earned from Louisiana sources.

INFORMATION ON APPLYING FOR TAX EXEMPTION IN LOUISIANA You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

Do I still pay LA income tax? Louisiana is a domicile state. All individuals who are domiciled, reside, or maintain a permanent place of residence are required to file a Louisiana individual income tax return and pay taxes on applicable income.

Employees who live and work in Texas will not have these deductions on their paychecks, since Texas does not have a state income tax.

Information on the form will include the child's name and date of birth; a list of required vaccines for which exemptions may be requested; a statement for the requesting parent or guardian to indicate their relationship to the child; and an acknowledgement that the parent or guardian has read the attached information ...