Louisiana Employee Payroll Record

Description

How to fill out Employee Payroll Record?

Selecting the appropriate legal document template can be challenging.

Of course, there is an abundance of templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Louisiana Employee Payroll Record, that can be utilized for business and personal purposes.

If the form does not fulfill your requirements, use the Search field to find the correct document. Once you are confident that the form is accurate, click the Get Now button to acquire the form. Select the pricing plan you need, input the necessary information, create your account, and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Louisiana Employee Payroll Record. US Legal Forms is the largest collection of legal documents where you can find numerous document templates. Use the service to download professionally crafted documents that meet state requirements.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Louisiana Employee Payroll Record.

- Use your account to browse the legal documents you have previously purchased.

- Go to the My documents section of your account to acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

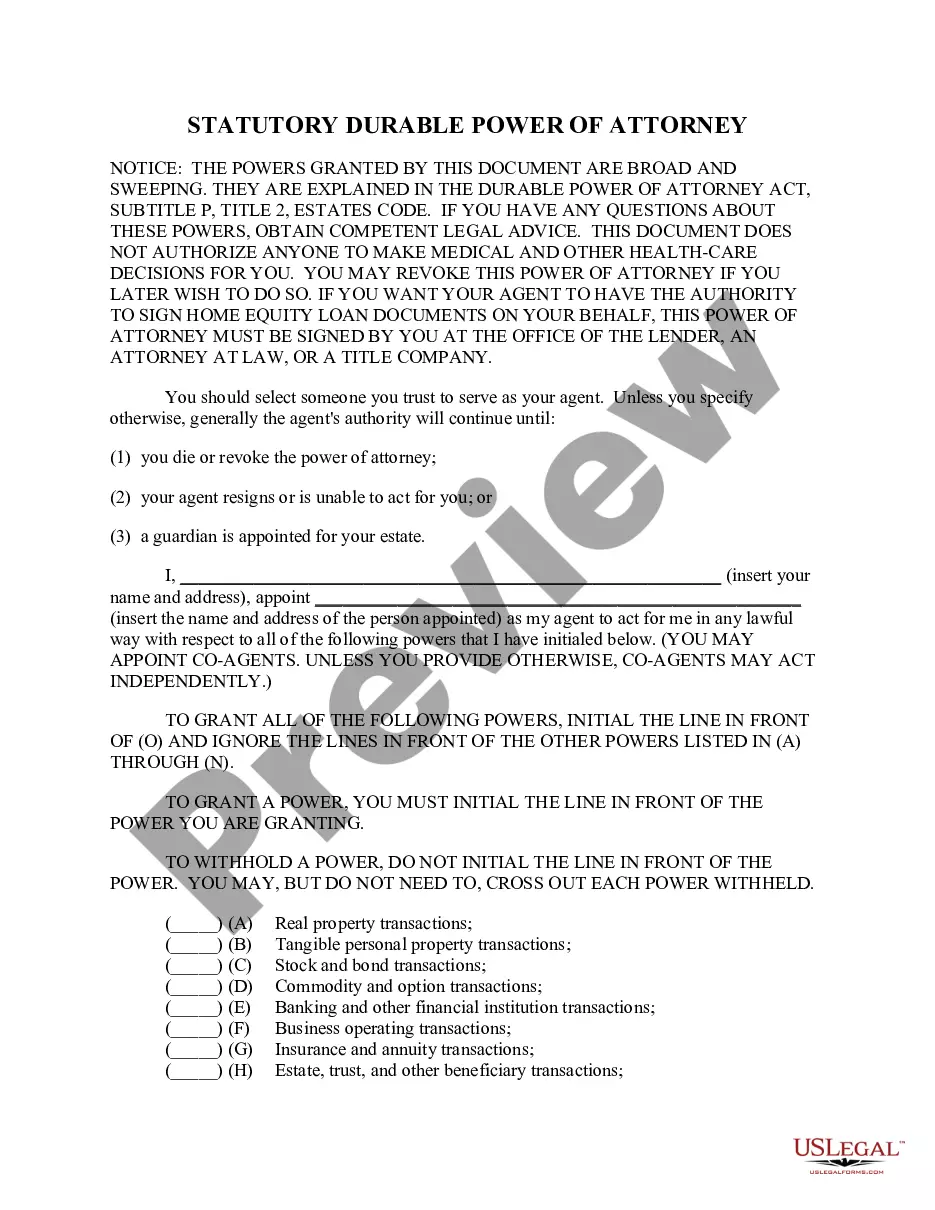

- First, ensure you have chosen the correct form for your area/region. You can preview the form using the Preview button and read the form description to ensure it is the right one for you.

Form popularity

FAQ

Destroy paper and electronic personnel records and confidential employee data after the retention deadlines have passed. Because employment records contain confidential and sensitive information, employers should establish specific policies and procedures for disposing of records safely.

The OSUP staff coordinates efforts to ensure accurate and timely payments to employees and vendors; to expedite payroll payable liquidation; to establish, maintain and monitor all statewide actions associated with garnished wages; and to assist agency personnel with all phases of the payroll process.

Louisiana, however, has no such laws. An employer may allow its employees to view their personnel files, or it may forbid it. The only requirement is that an employer act consistently.

1) A company is under no obligation to provide anyone, including the affected employee, with a copy of any write-ups, disciplinary notes, the personnel file more generally, etc. 2) The company's notes or write-up is not a legal document, and so have not legal effect per se.

The short answer is 'yes'. You have a right to make a SAR to your employer, asking to see your personnel files, at any time. Your employer has the right to ask why you want to see your files, but must then provide all your records to you.

An employee's personnel file usually contains information related to their performance, salary, and any investigations of misconduct or medical issues. As a result, these records are generally considered private and can be accessed by only the employer and the employee.

Howevber, the law states that employers must retain employee records in certain situations (for example working time and tax) and employers are advised to retain the records for themselves for six years in case they are sued for breach of contract.

Personal employee information will be considered confidential and as such will be shared only as required and with those who have a need to have access to such information. All hard copy records will be maintained in locked, secure areas with access limited to those who have a need for such access.

Payroll related records should be maintained for at least five calendar years. Agencies are encouraged to review exceptions in existing law or regulations, as well as any federal grant requirements to ensure that any applicable laws, regulations, or grants do not require longer retention periods.

Company Name employee files are maintained by the human resource (HR) department and are considered confidential. Managers and supervisors, other than the HR director and his or her subordinates, may only have access to personnel file information on a need-to-know basis.