Louisiana General Partnership for Business

Description

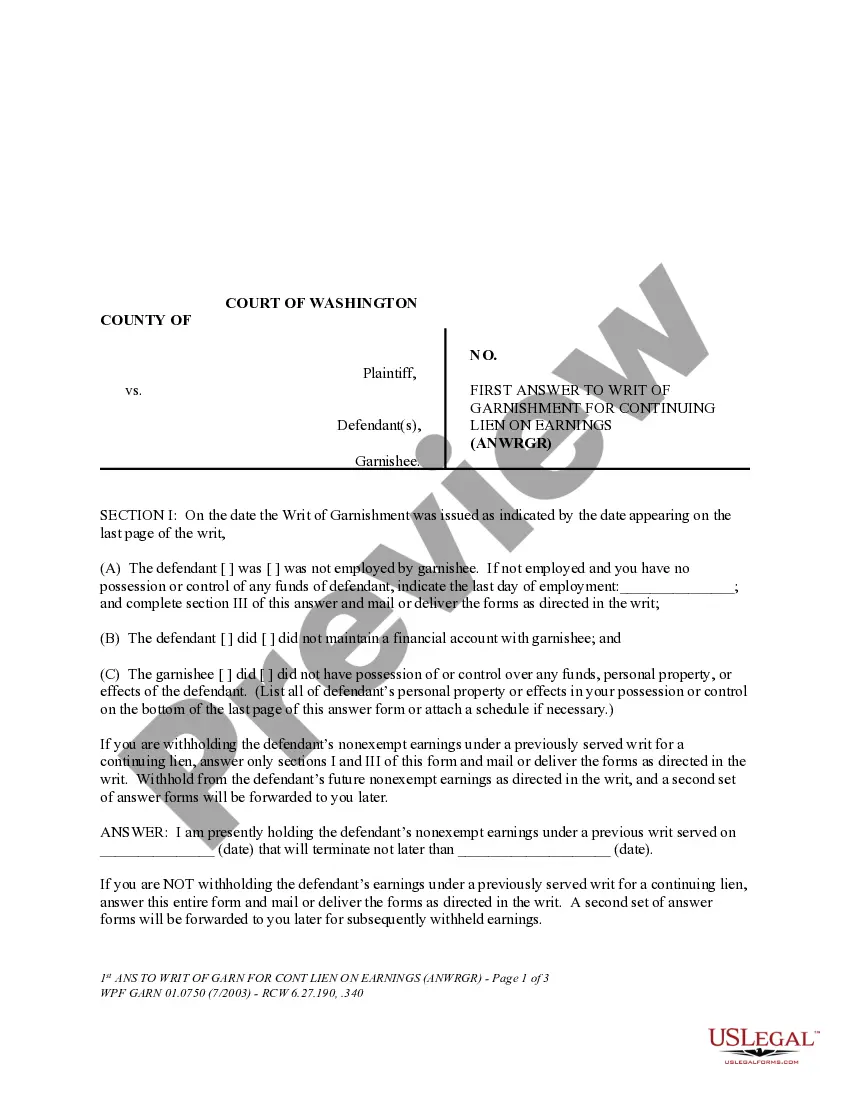

How to fill out General Partnership For Business?

If you need to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the website's user-friendly and convenient search feature to locate the documents you require.

Various templates for business and personal use are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you want, click the Get now button. Select your preferred pricing plan and enter your credentials to register for an account.

- Use US Legal Forms to access the Louisiana General Partnership for Business in just a few clicks.

- If you are an existing US Legal Forms user, Log Into your account and press the Acquire button to obtain the Louisiana General Partnership for Business.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you're new to US Legal Forms, follow the steps outlined below.

- Step 1. Ensure that you have selected the form for the proper region/country.

- Step 2. Use the Preview feature to review the form's content. Don't forget to examine the details.

Form popularity

FAQ

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Here are the basic steps to forming a partnership: Choose a business name. Register a fictitious business name. Draft and sign a partnership agreement.

To properly create a partnership, you will need to prepare your business name, register it, and file the correct paperwork.Step 1: Select a business name.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...?

To form a general partnership in Louisiana, all you need to do is form a contractual agreement with another person to share in the co-ownership of a for-profit business. No formal registration is required, but be sure to check for any licenses, permits, and tax accounts you may need.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

The state of Louisiana does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

Simplified taxes: The biggest advantage of a general partnership is the tax benefit. Businesses structured as partnerships do not pay income tax. Instead, all profits and losses are passed through to the individual partners.

General partnership disadvantages include:General Partners are Responsible for Other Partners' Actions. In a general partnership, each partner is liable for what the other does.You'll Have to Split the Profits.Disagreements Could Arise.Your Personal Assets are Vulnerable.