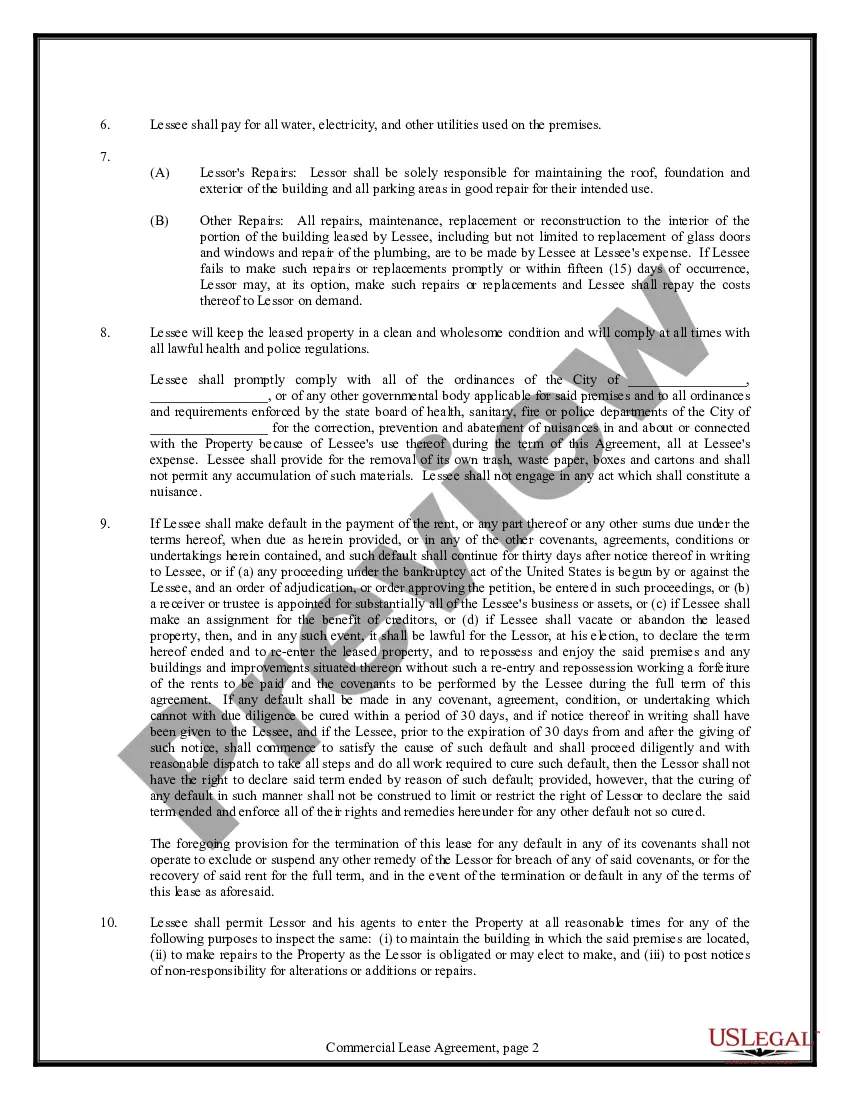

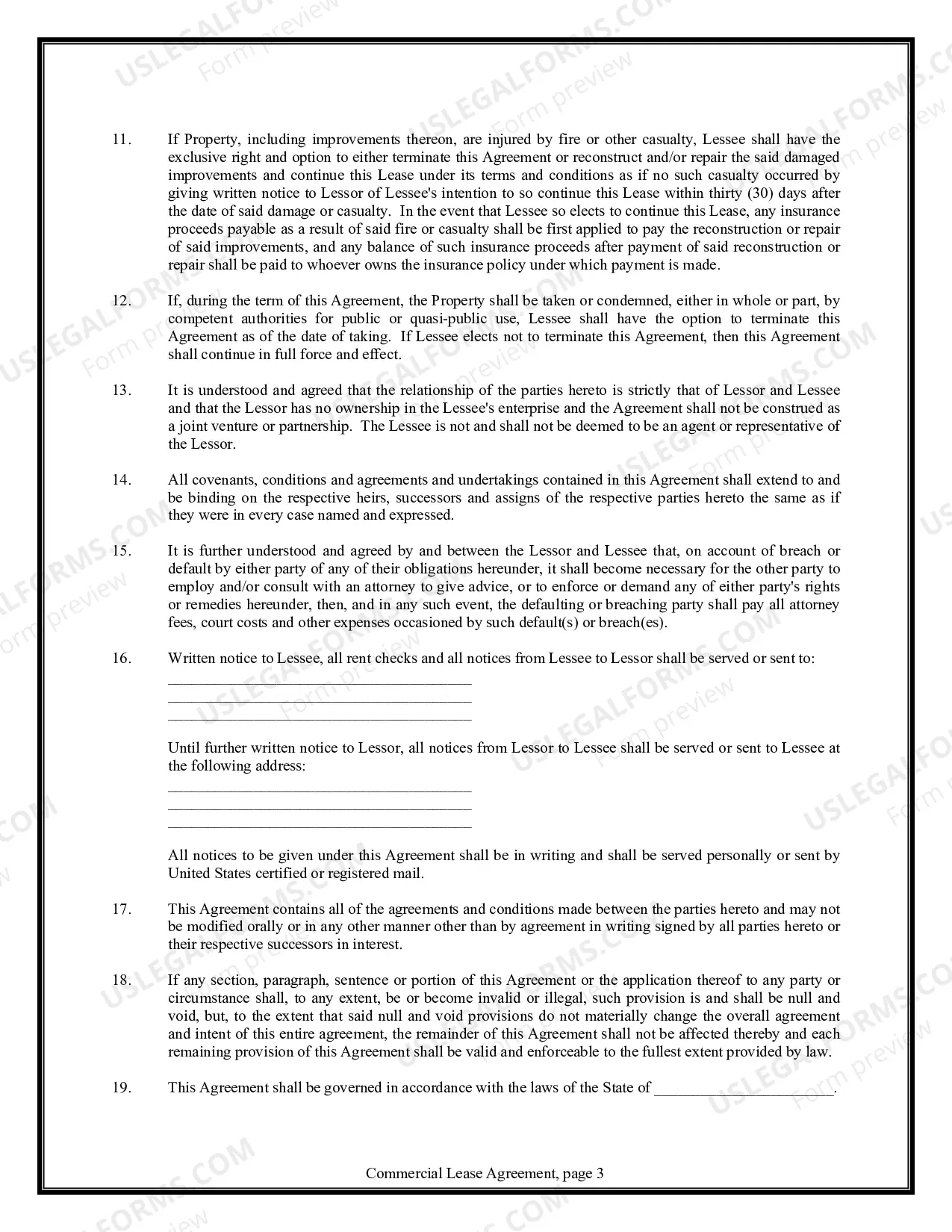

A Louisiana Commercial Lease Agreement for Restaurants is a legal contract between a landlord and a tenant, specifically designed for leasing a commercial property to be used for restaurant businesses in the state of Louisiana. This agreement outlines the terms and conditions that govern the rental arrangement, including the use of the premises, payment of rent, maintenance responsibilities, and other important provisions. Keywords: 1. Louisiana Commercial Lease Agreement: Refers to a legally binding document specifically tailored for commercial rental properties in Louisiana. 2. Restaurant: Pertains to an establishment where food and beverages are prepared, served, and/or sold for consumption. 3. Landlord: The owner or representative of the commercial property who grants the lease to the tenant. 4. Tenant: The individual or entity (such as a restaurant owner) who rents the commercial property from the landlord. 5. Legal Contract: A written agreement that binds both parties involved, ensuring compliance with all terms and conditions stated within the document. 6. Premises: The physical space, building, or property that is being leased to the tenant for their restaurant business. 7. Rental Arrangement: The agreement made between the landlord and tenant regarding the terms, conditions, and duration of the lease. 8. Rent: The payment made by the tenant to the landlord in exchange for the use and occupancy of the leased premises. 9. Maintenance Responsibilities: The obligations and duties related to repairs, upkeep, and cleanliness of the leased property, typically defined in the agreement. 10. Provisions: The specific clauses and rules included in the Commercial Lease Agreement that protect the rights and interests of both the landlord and tenant. Different types of Louisiana Commercial Lease Agreements for Restaurants might include: 1. Gross Lease Agreement: In this type of agreement, the tenant pays a fixed rent amount, and the landlord takes care of all operating expenses, including property taxes, insurance, and maintenance costs. 2. Triple Net Lease Agreement: With this type of agreement, the tenant is responsible for not only the base rent but also additional costs including property taxes, insurance, and maintenance expenses. 3. Percentage Lease Agreement: This lease includes a base rent plus a percentage of the tenant's gross sales. Thus, the tenant pays a portion of their revenue in addition to regular rent. 4. Modified Gross Lease Agreement: It is a combination of gross lease and triple net lease, where both the landlord and tenant share various operating expenses, usually negotiated between the parties. 5. Build-to-Suit Lease Agreement: This type of agreement involves the landlord constructing a customized restaurant space according to the tenant's specifications before entering into the lease agreement. Overall, a Louisiana Commercial Lease Agreement for Restaurants serves as a vital tool for ensuring a clear understanding and protection of the rights and responsibilities of both landlords and tenants involved in the leasing of commercial properties for restaurant businesses in Louisiana.

Louisiana Commercial Lease Agreement for Restaurant

Description

How to fill out Louisiana Commercial Lease Agreement For Restaurant?

US Legal Forms - among the most significant libraries of authorized varieties in the United States - provides an array of authorized record templates you may down load or print. Using the web site, you can get a huge number of varieties for enterprise and personal purposes, categorized by groups, says, or key phrases.You will discover the most recent models of varieties like the Louisiana Commercial Lease Agreement for Restaurant within minutes.

If you have a registration, log in and down load Louisiana Commercial Lease Agreement for Restaurant from the US Legal Forms local library. The Down load button will appear on every single develop you see. You have accessibility to all earlier downloaded varieties inside the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, allow me to share easy instructions to help you get started out:

- Ensure you have picked out the correct develop for your personal area/area. Select the Preview button to check the form`s content. Read the develop outline to actually have selected the appropriate develop.

- If the develop does not match your needs, take advantage of the Lookup discipline near the top of the display screen to find the one that does.

- In case you are content with the form, validate your selection by clicking on the Purchase now button. Then, choose the rates strategy you favor and supply your credentials to sign up to have an bank account.

- Process the transaction. Utilize your charge card or PayPal bank account to finish the transaction.

- Choose the structure and down load the form on the product.

- Make changes. Fill up, edit and print and signal the downloaded Louisiana Commercial Lease Agreement for Restaurant.

Every design you put into your account lacks an expiry day and is also your own property for a long time. So, if you would like down load or print an additional duplicate, just go to the My Forms section and click on in the develop you want.

Get access to the Louisiana Commercial Lease Agreement for Restaurant with US Legal Forms, probably the most comprehensive local library of authorized record templates. Use a huge number of professional and condition-distinct templates that satisfy your business or personal needs and needs.

Form popularity

FAQ

Once the notice is delivered, the earliest the lease can terminate is 30 days after the beginning of the next rent period.

Commercial leases are legally binding contracts between landlords and commercial tenants. They give tenants the right to use the premises in a particular way for a set period for an agreed rent. Your lease will establish your rights and responsibilities as a tenant, as well as those of your landlord.

As of today, Louisiana is considered a landlord-friendly state since there are little to no regulations regarding security deposits, rent prices, evictions, and other clauses.

A Commercial Rental Agreement is a contract you use to rent business property to or from another individual or company. This document outlines the terms and conditions of the tenancy, including the rights and obligations of the landlord and tenant.

The Commercial lease agreement is an agreement between landlord and tenant to rent property with the intention to operate a business.

A lease is automatically void when it is against the law, such as a lease for an illegal purpose. In other circumstances, like fraud or duress, a lease can be declared void at the request of one party but not the other.

Louisiana Lease and Rent Information There are two types of leases, written and oral with written being the most binding and common. Oral leases can take place but they are impossible to prove if a dispute arises. It is important to always get a written lease to help prevent any issues from arising.

In Louisiana, leases may be written or oral; however, we highly recommend you use a written lease regardless of the length of tenancy.

A lease is a legal, binding contract outlining the terms under which one party agrees to rent property owned by another party. It guarantees the tenant or lessee use of the property and guarantees the property owner or landlord regular payments for a specified period in exchange.

No, lease agreements do not need to be notarized in Louisiana. As long as all parties agree to the lease terms, it is considered binding. A landlord and tenant can agree to have a written lease notarized if they wish, but it is not required by Louisiana law.