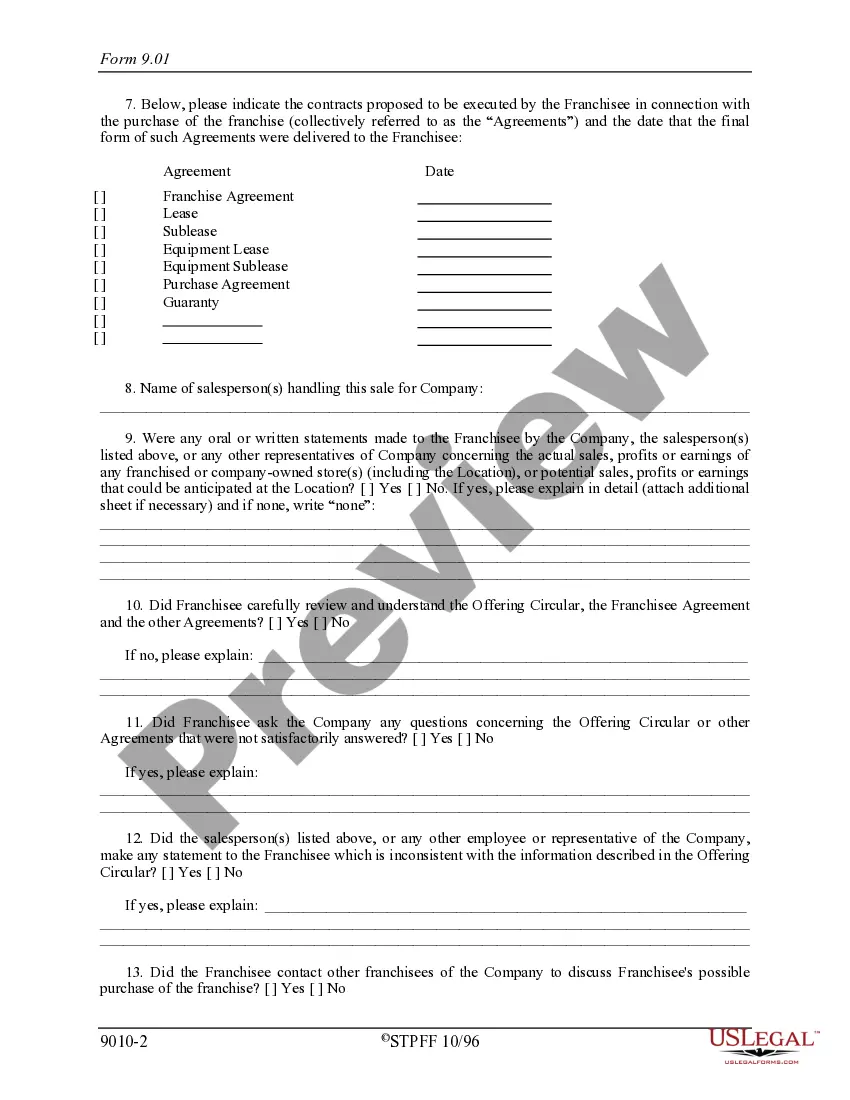

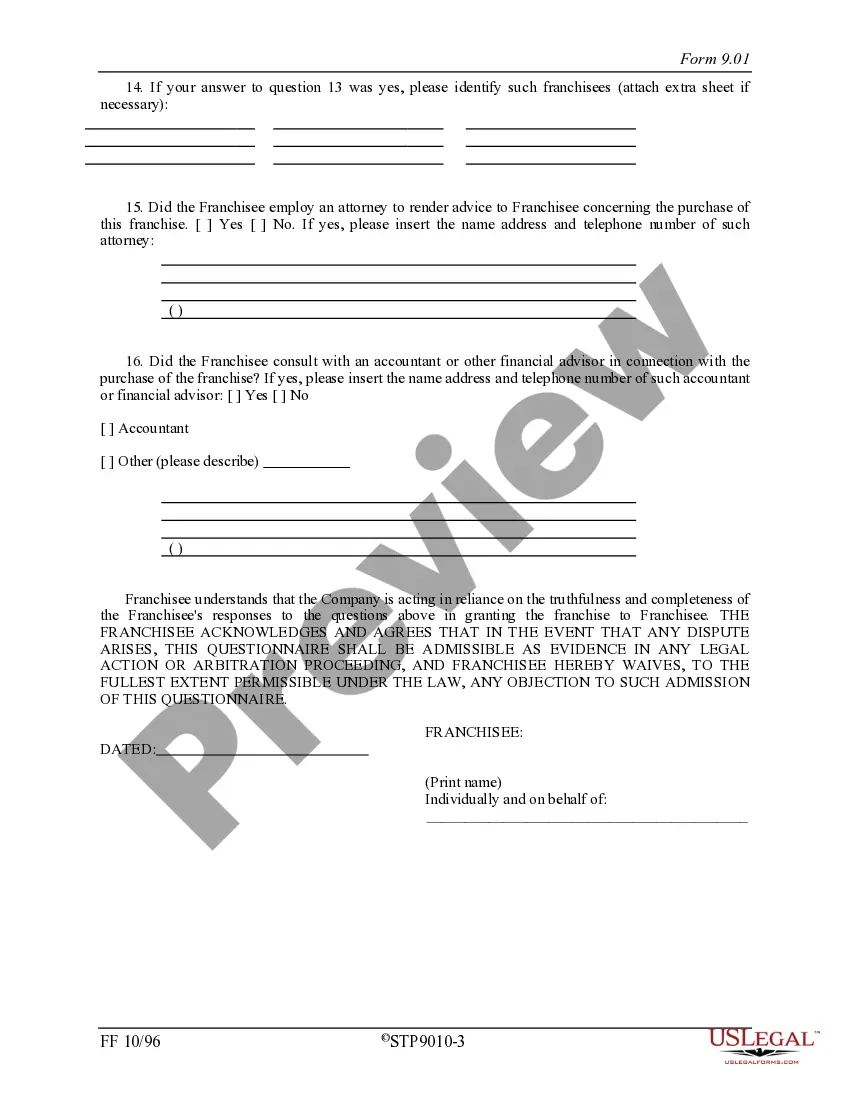

Louisiana Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

US Legal Forms - one of the most significant libraries of legal varieties in America - delivers a wide array of legal file themes you may acquire or print. Making use of the internet site, you will get thousands of varieties for business and specific uses, sorted by classes, states, or key phrases.You can get the most up-to-date models of varieties like the Louisiana Franchisee Closing Questionnaire within minutes.

If you currently have a registration, log in and acquire Louisiana Franchisee Closing Questionnaire in the US Legal Forms collection. The Obtain button can look on every develop you view. You have access to all in the past acquired varieties in the My Forms tab of your respective accounts.

If you would like use US Legal Forms for the first time, listed here are basic guidelines to help you get started out:

- Make sure you have selected the proper develop to your city/state. Select the Review button to examine the form`s content material. Look at the develop outline to ensure that you have selected the appropriate develop.

- When the develop does not satisfy your demands, make use of the Research field near the top of the screen to get the one who does.

- In case you are content with the shape, verify your option by visiting the Acquire now button. Then, choose the costs program you favor and offer your qualifications to sign up for an accounts.

- Approach the deal. Make use of charge card or PayPal accounts to finish the deal.

- Select the structure and acquire the shape in your device.

- Make adjustments. Fill out, modify and print and signal the acquired Louisiana Franchisee Closing Questionnaire.

Each and every design you added to your bank account does not have an expiration time and it is yours eternally. So, if you want to acquire or print yet another backup, just proceed to the My Forms segment and click in the develop you need.

Obtain access to the Louisiana Franchisee Closing Questionnaire with US Legal Forms, by far the most comprehensive collection of legal file themes. Use thousands of professional and state-specific themes that meet your organization or specific needs and demands.

Form popularity

FAQ

To dissolve/terminate your domestic LLC in Louisiana you have two options, online or paper form. Louisiana will send you a Certificate of Dissolution after you submit the notarized Affidavit to Dissolve Limited Liability Company with the appropriate filing fee by mail or fax.

Rate of Tax For periods beginning on or after January 1, 2023, $2.75 for each $1,000 or major fraction thereof in excess of $300,000 of capital employed in Louisiana. The initial corporation franchise tax is $110.

Louisiana State General Business Corporation tax extension Form CIFT-620EXT is due within 4 months and 15 days following the end of the corporation reporting period. Form CIFT-620EXT grants an automatic 7-month extension of time to file Form CIFT-620.

All corporations and entities taxed as corporations for federal income tax purposes deriving income from Louisiana sources, whether or not they have any net income, must file an income tax return. Corporation Income & Franchise Taxes Louisiana Department of Revenue (.gov) ? CorporationIncomeAn... Louisiana Department of Revenue (.gov) ? CorporationIncomeAn...

A person who moves into Louisiana after the start of the succeeding year, and who files his federal income tax return for the prior taxable year using a Louisiana address, will receive the letter of inquiry from the department concerning Louisiana income tax liability, even though the person was not a resident of ... Frequently Asked Questions - Louisiana Department of Revenue louisiana.gov ? QuestionsAndAnswers louisiana.gov ? QuestionsAndAnswers

DOMESTIC CORPORATIONS ? Corporations organized under the laws of Louisiana must file Form CIFT-620, Louisiana Income Tax and Louisiana Corporation Franchise Tax return each year unless exempt from both taxes. INSTRUCTIONS FOR COMPLETING FORM CIFT-620 louisiana.gov ? CIFT620i(1_14) - old louisiana.gov ? CIFT620i(1_14) - old

If your business has been closed or sold, you must file a Request to Close Business Tax Accounts, Form R-3406, to notify LDR to close your tax accounts.

Revised Statute 3 allows a six-month automatic extension of time to file the individual income tax return to be granted on request. If you know you cannot file your return by the due date, you do not need to file for an extension. Frequently Asked Questions - Louisiana Department of Revenue louisiana.gov ? Faq ? Details louisiana.gov ? Faq ? Details