Louisiana Time Adjustment Report

Description

How to fill out Time Adjustment Report?

US Legal Forms - one of the largest compilations of legal documents in the USA - offers a variety of legal record templates that you can download or print.

By using the site, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the newest forms like the Louisiana Time Adjustment Report within minutes.

If you already have a subscription, Log In and download the Louisiana Time Adjustment Report from your US Legal Forms library. The Download option will be visible on every template you view. You can access all previously downloaded forms from the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Louisiana Time Adjustment Report.

Each form you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Louisiana Time Adjustment Report with US Legal Forms, the most extensive assortment of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are some simple steps to help you get started.

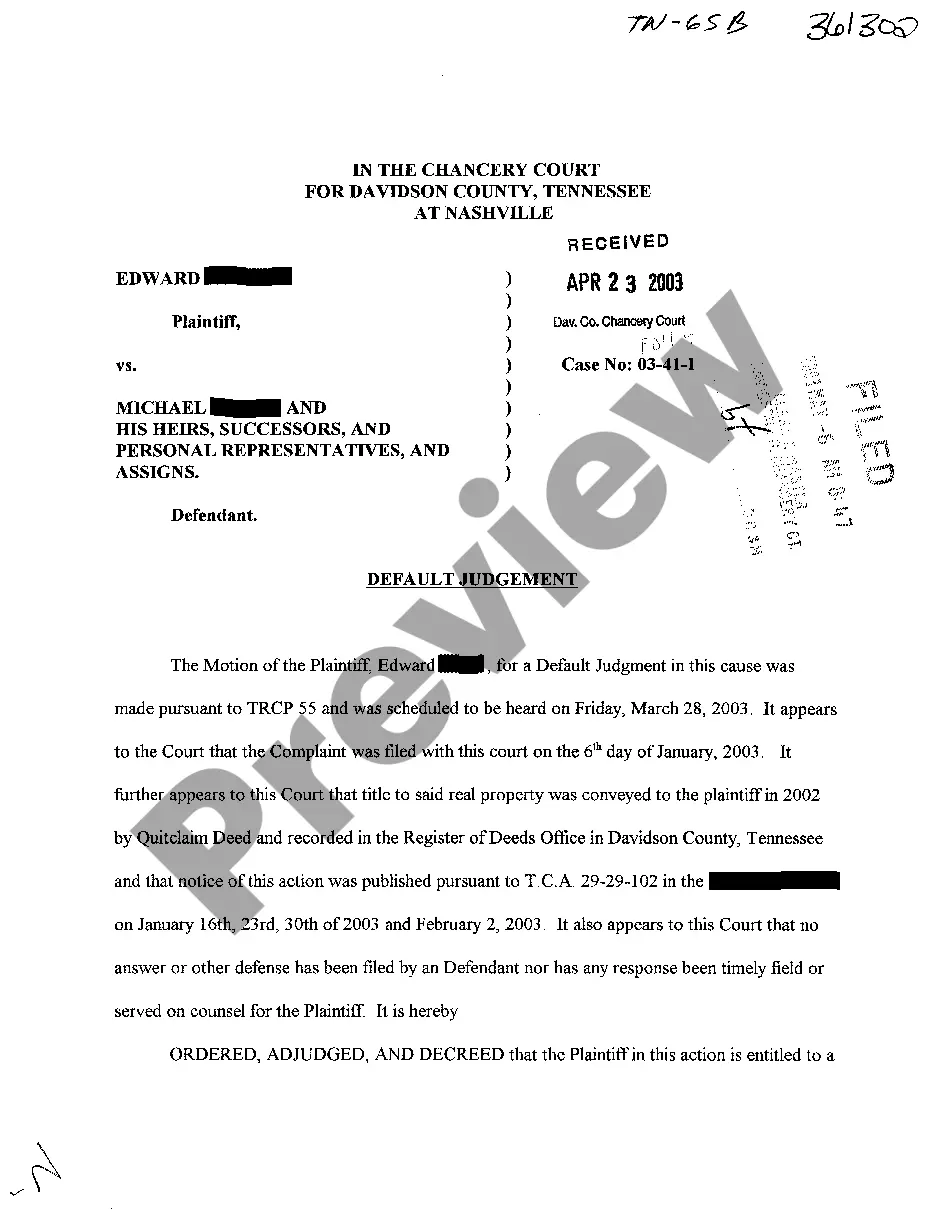

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content. Read the form description to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred payment plan and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

An IRS revenue agent's job is to conduct tax audits of individuals and businesses as well as trusts and non-profit organizations. Revenue agents generally conduct tax audits of the most complicated tax returns ranging from small "Schedule C" businesses to the largest multi-national corporations.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

When a state department of revenue sends you a letter, it usually is to start a dialogue about proposed changes to your state return. You won't owe any tax to the state until you agree with the proposed changes.

The Louisiana Department of Revenue (LDR) introduced the program to create an efficient and expedited resolution for transfer pricing issues involving corporate tax audits, and to provide certainty and uniformity to taxpayers.

Revised Statute 3 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

If it crosses the federal finish line, Louisiana will automatically apply permanent daylight saving time because of a law passed by Haughton Republican state Rep. Dodie Horton in 2020. "We'll be ready to roll right into it," Horton told USA Today Network.

You might get an IRS letter or notice for several reasons other than an audit, including: You owe money. Your refund is going to be larger or smaller than you thought it would be. The agency has a question about the tax return you filed.

Important notice: Louisiana recognizes and accepts the federal extension (Federal Form 4868).

The department has responded to increasing occurrences of tax fraud by implementing enhanced security measures to protect Louisiana taxpayers. This means it will take additional time to process refunds. The expected refund processing time for returns filed electronically is up to 45 days.

The Louisiana Department of Revenue has now issued Revenue Information Bulletin (RIB) 21-024 automatically granting additional extensions to taxpayers in certain Louisiana areas impacted by Hurricane Ida for certain taxes that were due on or after August 26, 2021.