The Louisiana Investment Management Agreement is a comprehensive legal contract that outlines the terms and conditions governing the investment management services provided by Fund, Asia Management, and CICAM in the state of Louisiana. This agreement ensures clarity, transparency, and legal protection for all parties involved in managing and investing funds. The agreement typically includes various clauses and provisions related to the investment objectives, responsibilities, and obligations of each party. It outlines the scope of the partnership and defines the roles and responsibilities of Fund, Asia Management, and CICAM in managing the investments in accordance with applicable laws and regulations. Some key components often found in the Louisiana Investment Management Agreement are: 1. Definitions: This section provides precise definitions for terms used throughout the agreement, ensuring clarity and avoiding any ambiguity. 2. Investment Objectives: The agreement clearly states the investment goals and objectives, including strategies for capital preservation, income generation, growth, or a combination thereof. 3. Investment Mandate: The agreement defines the specific investment mandate provided to Fund, Asia Management, and CICAM. It outlines the types of assets that can be invested in, such as equities, fixed income securities, real estate, or alternative investments. 4. Investment Guidelines: This section outlines the boundaries and restrictions for the investment activities. It includes considerations such as risk tolerance, diversification, concentration limits, ethical and responsible investment policies, and any specific requirements or limitations imposed by the regulatory authorities. 5. Reporting and Communication: The agreement stipulates the frequency, format, and content of reports that Fund, Asia Management, and CICAM are required to provide to the client (the fund). It also covers communication protocols and obligations to keep the client informed about investment performance, compliance matters, and any material changes to the portfolio. 6. Compensation and Fees: This section describes the fee structure and compensation arrangements between the parties. It includes details on management fees, performance-based fees, and any other agreed-upon charges such as custody fees or transaction costs. It is important to note that there may be different types or variations of the Louisiana Investment Management Agreement depending on the specific needs and preferences of the parties involved. These variations might include the duration of the agreement (short-term or long-term), the size of the fund (small-scale or large-scale), or any additional services required (such as consulting or advisory services). In summary, the Louisiana Investment Management Agreement is a crucial document that establishes the legal framework for the management and investment of funds by Fund, Asia Management, and CICAM in the state of Louisiana. It safeguards the interests of all parties involved and sets clear expectations, guidelines, and provisions to ensure a successful and compliant investment management partnership.

Louisiana Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Louisiana Investment Management Agreement Between Fund, Asia Management And NICAM?

Are you currently inside a position where you will need papers for sometimes organization or personal functions just about every day? There are plenty of lawful file web templates accessible on the Internet, but finding ones you can rely on isn`t effortless. US Legal Forms delivers a large number of form web templates, like the Louisiana Investment Management Agreement between Fund, Asia Management and NICAM, that are published in order to meet federal and state demands.

Should you be already knowledgeable about US Legal Forms web site and have your account, simply log in. Afterward, you may down load the Louisiana Investment Management Agreement between Fund, Asia Management and NICAM design.

If you do not provide an accounts and wish to begin using US Legal Forms, abide by these steps:

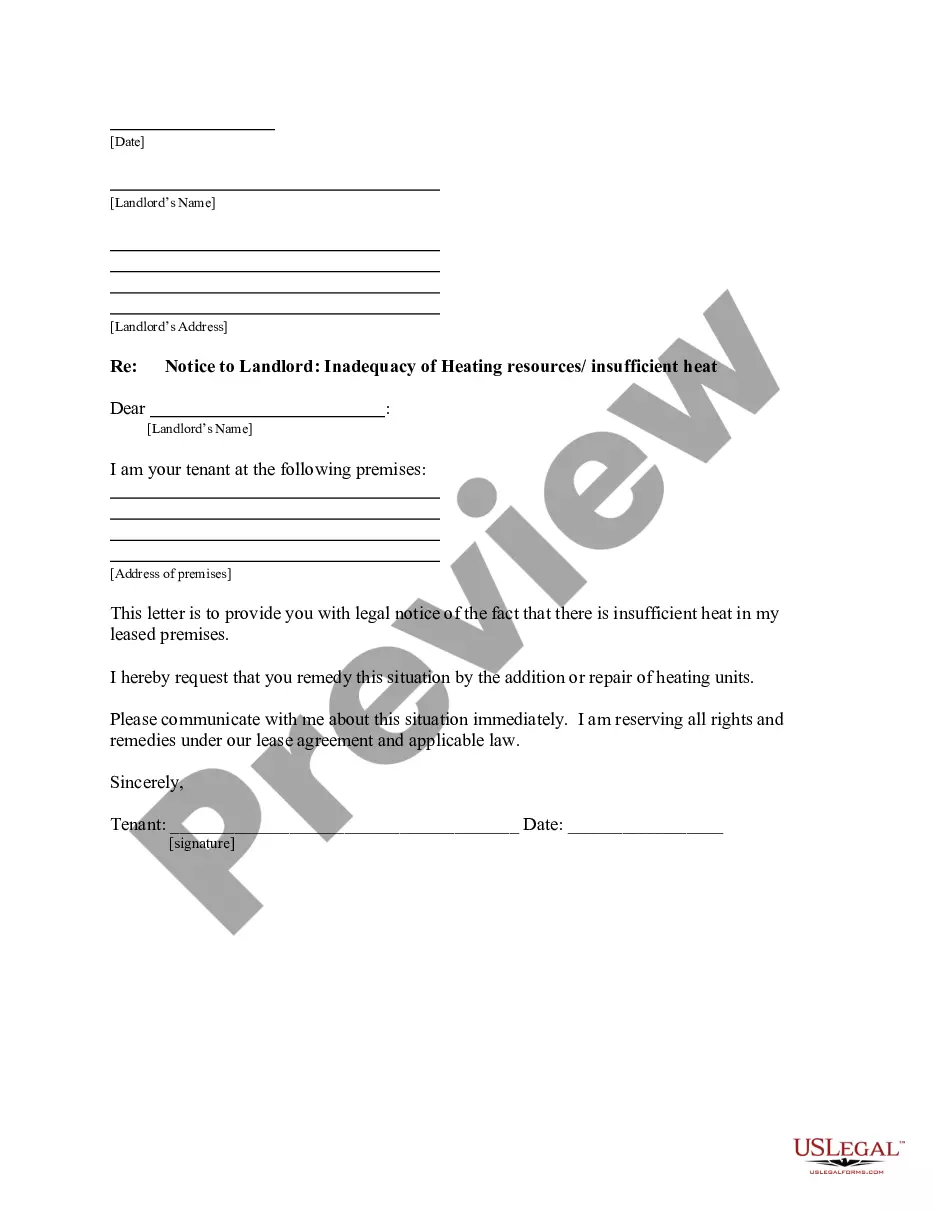

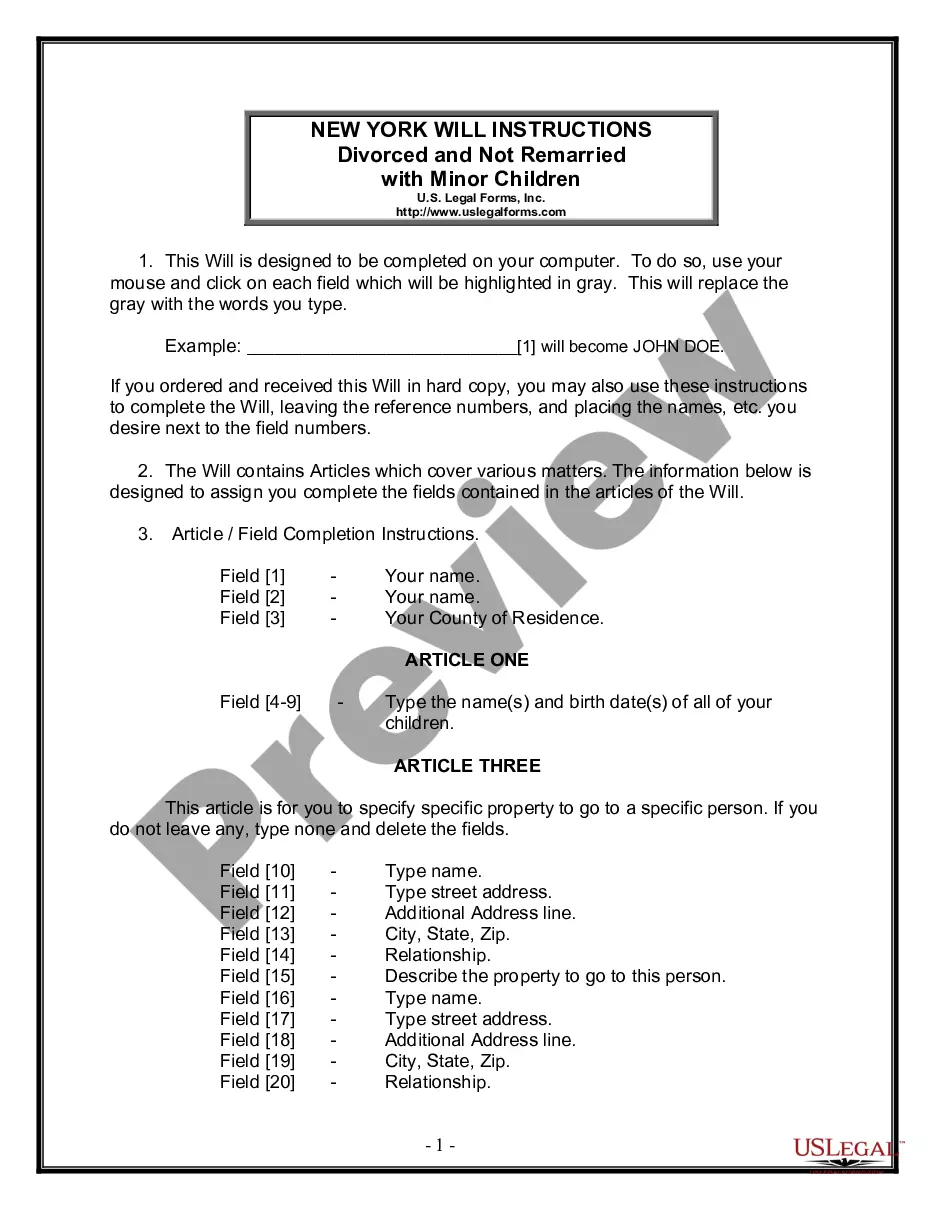

- Discover the form you need and make sure it is for your correct town/state.

- Make use of the Review switch to check the form.

- Browse the description to actually have chosen the proper form.

- When the form isn`t what you`re looking for, take advantage of the Lookup field to discover the form that meets your requirements and demands.

- When you find the correct form, click Buy now.

- Choose the prices strategy you want, complete the desired information and facts to generate your money, and pay for the order making use of your PayPal or Visa or Mastercard.

- Choose a handy paper format and down load your copy.

Get all of the file web templates you may have purchased in the My Forms food list. You can aquire a additional copy of Louisiana Investment Management Agreement between Fund, Asia Management and NICAM at any time, if possible. Just click the required form to down load or printing the file design.

Use US Legal Forms, probably the most substantial variety of lawful types, to conserve efforts and stay away from blunders. The service delivers skillfully created lawful file web templates that you can use for a variety of functions. Generate your account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

What Is Funds Management? Funds management is the overseeing and handling of a financial institution's cash flow. The fund manager ensures that the maturity schedules of the deposits coincide with the demand for loans.

The management agreement is a binding legal agreement, generally between the fund's general partner on behalf of the fund and the fund's investment manager. This form management agreement provides an example of how to document the management fee and other elements of the fund and manager relationship.

A funding agreement is an agreement between an issuer and an investor. While the investor provides a lump sum of money, the issuer guarantees a fixed rate of return over a time period. Funding agreements are popular with high-net-worth and institutional investors due to their low-risk, fixed-income nature.

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

The key components of an IMA include identification of parties, scope of services, investment objectives and guidelines, investment restrictions, fees and expenses, performance measurement and reporting, risk management, confidentiality and data protection, termination and dispute resolution, and compliance with ...

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

In the financial world, the term "fund management" ultimately describes people and institutions that manage investments on behalf of investors. An example would be investment managers who fix the assets of pension funds for pension investors.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.