Louisiana Opinion of Lehman Brothers: The state of Louisiana had varied opinions about Lehman Brothers, a prominent investment banking company that filed for bankruptcy in 2008. The following description delves into the different types of opinions held by residents, policymakers, and financial experts in Louisiana. 1. Impact on Louisiana Economy: Louisiana's opinion of Lehman Brothers is largely shaped by the economic repercussions experienced after the bank's collapse. Many in the state experienced direct or indirect effects on their financial well-being due to the intricate web of Lehman Brothers' investments. The opinion ranges from disappointment and frustration for the loss of jobs and economic stability to anger and resentment towards the bank's risky practices. 2. Perception of Lehman Brothers' Role: Louisiana's opinions also highlight the perception of Lehman Brothers as a symbol of Wall Street greed and speculation. Some Louisianans view the bank's collapse as a consequence of reckless behavior and unsustainable financial practices, contributing to the subprime mortgage crisis, hence labeling it as one of the primary catalysts for the Great Recession. 3. Losses and Litigation: Another aspect of Louisiana's opinion of Lehman Brothers is linked to losses suffered by individuals, businesses, and pension funds as a result of the bankruptcy. Some Louisianans were left grappling with severe financial losses and legal battles to recover their investments. Their opinion often centers around a sense of betrayal and distrust towards Lehman Brothers and the financial industry at large. 4. Government Response: Opinions on Louisiana's government response to the Lehman Brothers' collapse can also differ. Some residents may acknowledge the efforts made by state authorities to mitigate the impact on local communities and businesses, while others might hold a more critical opinion, arguing that more substantial action could have been taken to protect Louisiana's interests. 5. Confidence in the Banking System: Lehman Brothers' bankruptcy shook the trust of many Louisianans in the overall banking system. This loss of confidence in the financial industry is a common sentiment post the Lehman Brothers' collapse and is likely echoed by some residents of Louisiana. Such opinions may emphasize the need for stricter regulations and corporate oversight to prevent similar financial crises in the future. In conclusion, the Louisiana opinion of Lehman Brothers encompasses a range of sentiments, including disappointment and resentment towards the bank's practices, frustration over economic consequences, and a call for accountability and regulation within the financial sector. The impact of Lehman Brothers' collapse on Louisiana continues to shape the state's perception of the banking industry and has left a lasting imprint on its residents.

Louisiana Opinion of Lehman Brothers

Description

How to fill out Opinion Of Lehman Brothers?

Are you presently in the position in which you need papers for possibly company or specific functions nearly every day time? There are plenty of authorized papers themes available on the net, but locating ones you can rely on is not simple. US Legal Forms provides 1000s of form themes, just like the Louisiana Opinion of Lehman Brothers, that are written to fulfill state and federal needs.

Should you be already acquainted with US Legal Forms internet site and have an account, basically log in. Following that, it is possible to obtain the Louisiana Opinion of Lehman Brothers web template.

Unless you come with an bank account and want to begin using US Legal Forms, adopt these measures:

- Find the form you want and ensure it is for that right area/county.

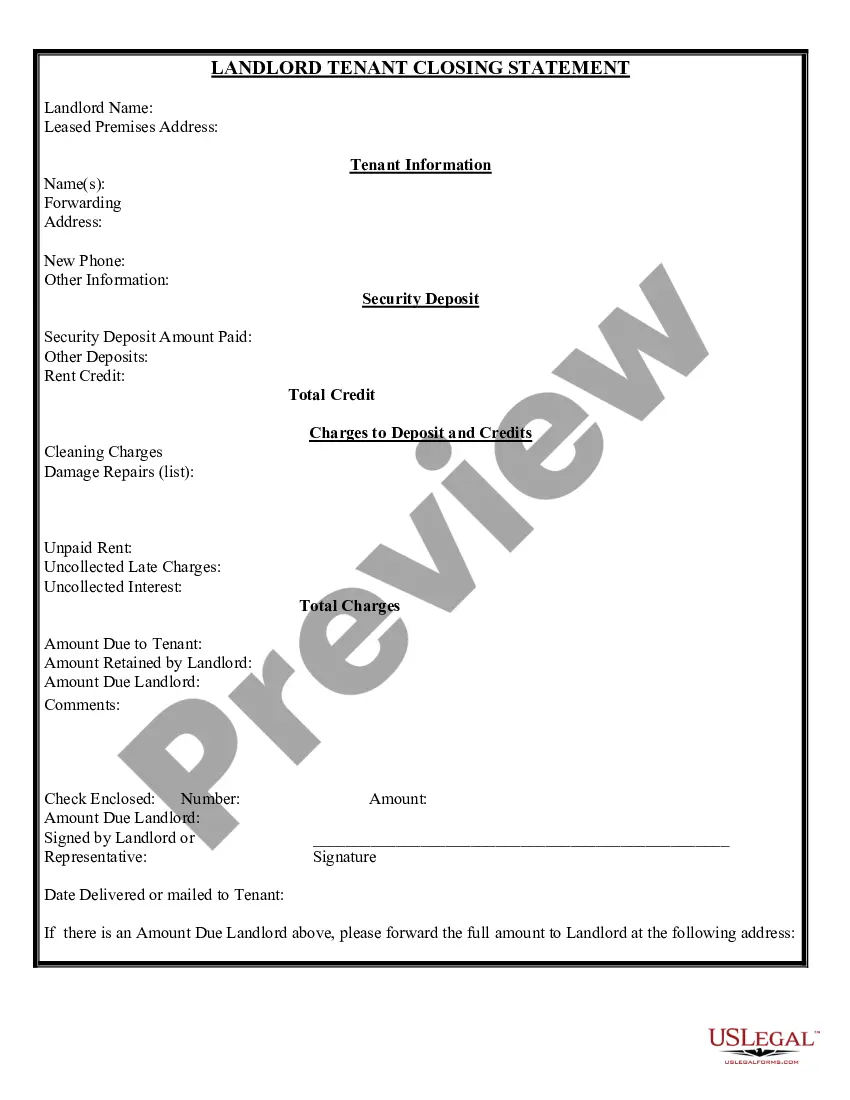

- Utilize the Review button to check the shape.

- Look at the outline to ensure that you have chosen the right form.

- In the event the form is not what you`re seeking, make use of the Research area to get the form that fits your needs and needs.

- Once you find the right form, just click Get now.

- Select the pricing program you need, fill out the desired information to produce your bank account, and pay money for an order making use of your PayPal or bank card.

- Decide on a hassle-free paper file format and obtain your duplicate.

Get all of the papers themes you possess purchased in the My Forms food list. You can aquire a more duplicate of Louisiana Opinion of Lehman Brothers anytime, if needed. Just click on the needed form to obtain or print the papers web template.

Use US Legal Forms, the most comprehensive selection of authorized forms, to save efforts and steer clear of blunders. The support provides skillfully made authorized papers themes that you can use for a selection of functions. Create an account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

Barclays acquired the investment banking business of Lehman Brothers in September 2008.

The dramatic fall of Lehman was due in large part to millions of risky mortgages propping up an unstable financial system. Homebuyers with mortgage payments they couldn't afford defaulted on their loans, sending shockwaves through Wall Street and leaving those borrowers vulnerable to foreclosure.

The Lehman Brothers bankruptcy was the largest in U.S. history. It invested heavily in risky mortgages just as housing prices started falling. The government could not bail out Lehman without a buyer. Lehman's bankruptcy kicked off the 2008 financial crisis.

Ethical malpractices were core in the fall of the Lehman Brothers' investment company. The firm invested without a proper analysis as required by ethics. Failure to conduct useful marketing research led to excess leveraging of mortgage firms.

While these costs are difficult to pin down, the analysis suggests that the most notable losses were borne by mutual funds that relied on Lehman's specialized brokerage advice and firms that employed Lehman for its equity underwriting services.

Essentially, Repo 105 is an aggressive and deceitful accounting off-balance sheet device which was used to temporarily remove securities and troubled liabilities from Lehman's balance sheet while reporting its quarterly financial results to the public. These transactions were recorded as sales rather than as loans.

Lehman misused an accounting trick called Repo 105 to temporarily remove the $50 billion from its ledgers to make it look as though it was reducing its dependency on borrowed money and was drawing down its debt. Lehman never told investors or regulators about it.

It explains how Repo 105 transactions allowed Lehman to exchange illiquid assets for short-term cash loans in order to disguise the crumbling financial state of the firm in its last days. How bad were the lies? Well, the report shows the transactions were not shown as loans. Instead, they were listed as sales?