A Louisiana Promissory Note is a legally binding document that outlines a written promise to repay a specific amount of money borrowed by one party, known as the borrower, to another party, known as the lender. This financial agreement establishes the terms and conditions of the loan, including the repayment schedule, interest rate, and any collateral held against the loan. In Louisiana, there are various types of Promissory Notes designed to accommodate different borrowing situations: 1. Secured Promissory Note: This type of Promissory Note includes collateral that the borrower pledges to the lender to secure repayment of the loan. If the borrower fails to repay the loan, the lender can seize and sell the collateral to recover the outstanding amount. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured Promissory Note does not involve any collateral. It relies solely on the borrower's promise to repay the debt and often requires a higher credit rating or a stronger relationship between the lender and borrower to be granted. 3. Demand Promissory Note: This type of Promissory Note does not establish a specific repayment schedule. Instead, it enables the lender to demand full repayment of the loan at their discretion. This type of note is commonly used in situations where the borrower and lender have a close relationship. 4. Installment Promissory Note: An installment note establishes a pre-determined repayment schedule, typically divided into equal payments over a specified period, including interest. This type of note provides clarity on the dates and amounts due, ensuring both parties are aware of their obligations. 5. Balloon Promissory Note: A balloon note allows borrowers to make smaller, regular payments for a set period, followed by a larger lump-sum payment, known as the balloon payment, at the end of the term. This type of note is suitable for those who expect a sizable sum of money or improved financial circumstances by the end of the loan's term. When drafting a Louisiana Promissory Note, several essential elements must be included to ensure its enforceability and protect the rights and obligations of both parties. These elements include the names and contact information of both parties, the loan amount, interest rate, repayment terms, any late payment penalties or fees, and a provision for dispute resolution. It is crucial for both parties to understand the terms and sign the Promissory Note willingly and with full knowledge of its contents. Seeking legal advice or utilizing online templates specific to Louisiana can provide further guidance on drafting a comprehensive and legally binding Promissory Note in accordance with the state's laws.

Louisiana Promissory Note

Description

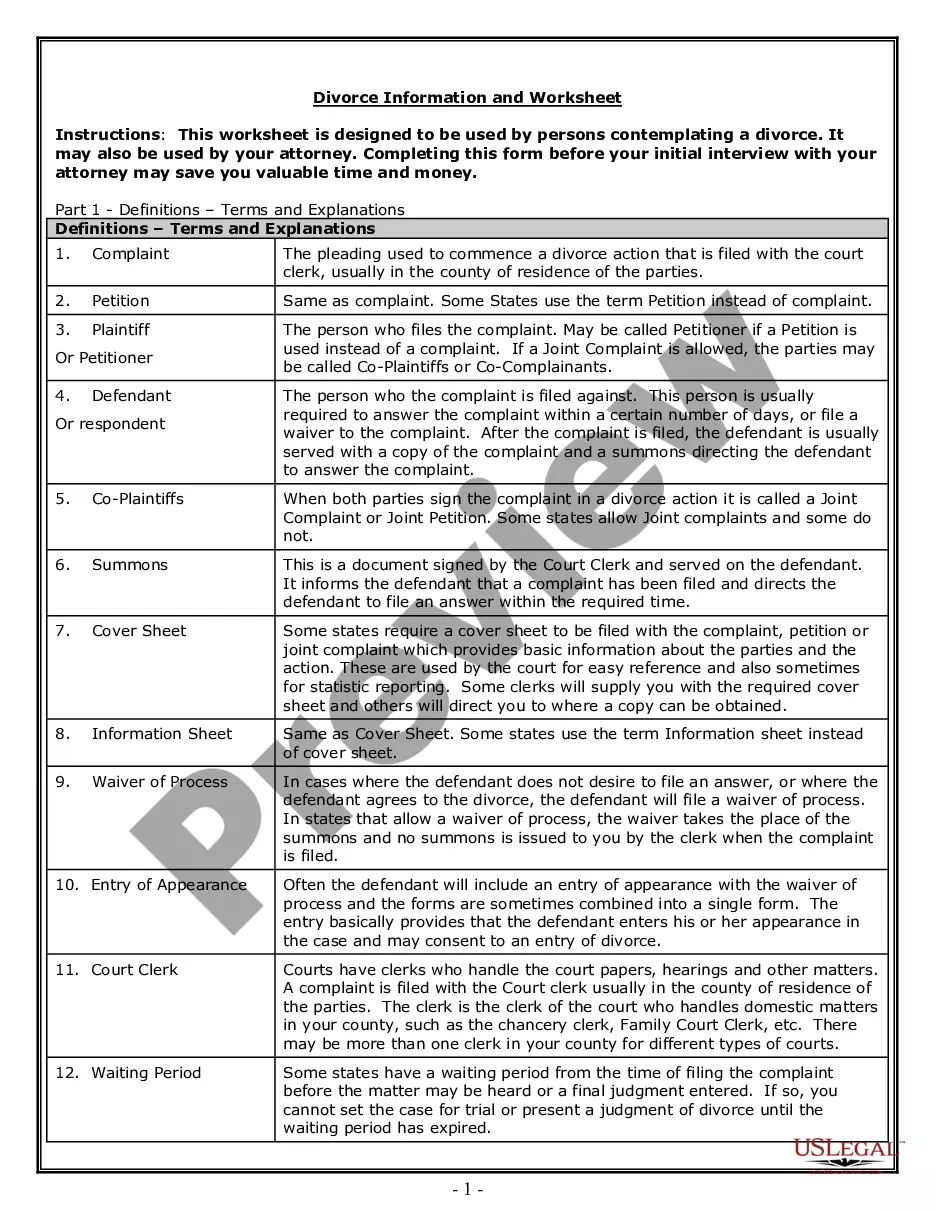

How to fill out Louisiana Promissory Note?

Are you currently in the placement that you need to have papers for sometimes company or individual uses virtually every day time? There are a variety of legal document web templates available online, but getting ones you can depend on is not simple. US Legal Forms provides a huge number of develop web templates, such as the Louisiana Promissory Note, which can be composed to meet state and federal specifications.

Should you be already informed about US Legal Forms site and have a free account, basically log in. Next, you can down load the Louisiana Promissory Note template.

Unless you offer an accounts and need to begin to use US Legal Forms, adopt these measures:

- Discover the develop you want and make sure it is for the proper town/region.

- Utilize the Preview switch to check the shape.

- Look at the information to actually have chosen the correct develop.

- When the develop is not what you are looking for, take advantage of the Research area to obtain the develop that meets your needs and specifications.

- Whenever you find the proper develop, click Get now.

- Choose the pricing plan you want, fill out the required information and facts to generate your money, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a practical file formatting and down load your copy.

Get every one of the document web templates you may have bought in the My Forms food selection. You can get a more copy of Louisiana Promissory Note any time, if needed. Just click the required develop to down load or print out the document template.

Use US Legal Forms, one of the most comprehensive collection of legal forms, to save some time and avoid mistakes. The support provides professionally produced legal document web templates that can be used for a variety of uses. Generate a free account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

When the amount due on the note, including interest and penalties is paid, the note must be cancelled and surrendered to the person who signed it. A promissory note need only be signed and does not require an acknowledgement before a notary public to be valid.

A promissory note need only be signed and does not require an acknowledgement before a notary public to be valid.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

If no demand for payment is made to the maker, an action to enforce the note is barred if neither principal nor interest on the note has been paid for a continuous period of five years.

An exception of prescription is a peremptory exception, which a defendant may raise at any time, including on appeal or after the close of evidence, but prior to the submission of the case after trial pursuant to La.

Actions on instruments, whether negotiable or not, and on promissory notes, whether negotiable or not, are subject to a liberative prescription of five years.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Contracts (Breach of Contract) ? 10 years to file suit. Debt Collection ? Three years to file suit. Annulment of Testament (Disputing a Will)- Five years to file suit. Child Support ? 10 years to file suit.