Louisiana Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

How to fill out Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

Finding the right legal document design could be a have a problem. Obviously, there are tons of web templates available on the Internet, but how do you get the legal type you require? Make use of the US Legal Forms website. The service gives a large number of web templates, for example the Louisiana Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co, that you can use for enterprise and private demands. All the varieties are checked out by pros and meet federal and state requirements.

If you are currently listed, log in for your profile and click the Down load button to have the Louisiana Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co. Make use of your profile to search from the legal varieties you might have ordered formerly. Go to the My Forms tab of your own profile and have yet another backup of your document you require.

If you are a whole new customer of US Legal Forms, listed here are easy instructions so that you can comply with:

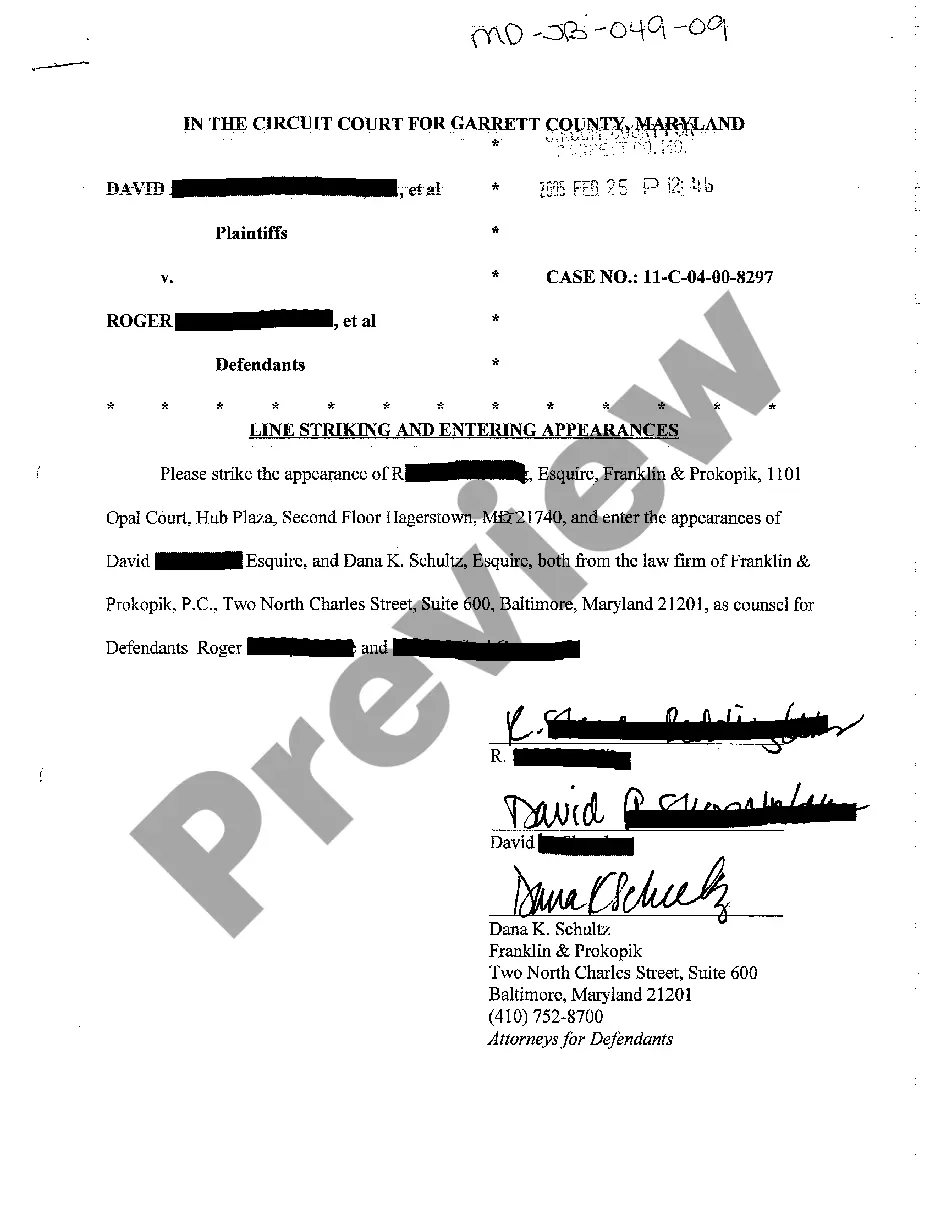

- Initial, be sure you have selected the appropriate type for your personal city/region. You may check out the form making use of the Preview button and look at the form outline to make certain this is basically the right one for you.

- In the event the type will not meet your requirements, use the Seach industry to discover the proper type.

- When you are positive that the form is acceptable, select the Purchase now button to have the type.

- Opt for the rates prepare you need and enter the required details. Create your profile and purchase the transaction using your PayPal profile or Visa or Mastercard.

- Opt for the submit file format and obtain the legal document design for your product.

- Total, modify and print and indication the acquired Louisiana Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co.

US Legal Forms is definitely the greatest catalogue of legal varieties that you can see various document web templates. Make use of the company to obtain skillfully-produced papers that comply with status requirements.