Louisiana Schedule 14B Information is a specific form used by individuals or businesses in the state of Louisiana to report their nonresident income and claim any available credits or deductions. This form serves as an attachment to the Louisiana Individual Income Tax Return (Form IT-540) or Partnership Return of Income (Form IT-565). The purpose of Louisiana Schedule 14B Information is to accurately disclose and calculate the amount of income earned from sources outside of Louisiana. It is essential for taxpayers who reside in Louisiana but have income from out-of-state sources to accurately report this information to ensure compliance with state tax laws. Keywords: Louisiana Schedule 14B Information, nonresident income, credits, deductions, Louisiana Individual Income Tax Return, Form IT-540, Partnership Return of Income, Form IT-565, out-of-state sources, compliance, state tax laws. Different types of Louisiana Schedule 14B Information may include: 1. Nonresident Income: This section requires taxpayers to report all income earned from sources outside of Louisiana. This can include wages, self-employment income, rental income, interest, dividends, and any other types of income generated from out-of-state activities. 2. Nonresident Tax Credits: Louisiana provides certain tax credits for individuals or businesses earning income outside the state but still subject to taxation in Louisiana. These credits may include credits for taxes paid to another state, foreign tax credits, or credits for income earned in a designated enterprise zone. 3. Deductions: Taxpayers may be eligible for specific deductions related to their nonresident income. These deductions can vary and may include items such as business expenses incurred in another state, state income taxes paid to another state, or deductions related to investment income from out-of-state sources. 4. Multiple State Filings: In cases where an individual or business has income from multiple states, separate Schedule 14B forms may be required for each state. This allows for accurate reporting and calculation of income from each jurisdiction. 5. Record-keeping: Taxpayers utilizing Louisiana Schedule 14B Information should maintain adequate records, such as pay stubs, bank statements, and receipts, to support the accurate reporting of their nonresident income. These records are essential in case of an audit or verification by the Louisiana Department of Revenue. In conclusion, Louisiana Schedule 14B Information is a crucial form that enables taxpayers in Louisiana to report their nonresident income accurately. By providing detailed information on income, credits, and deductions from out-of-state sources, taxpayers can ensure compliance with state tax laws and potentially reduce their overall tax liability.

Louisiana Schedule 14B Information

Description

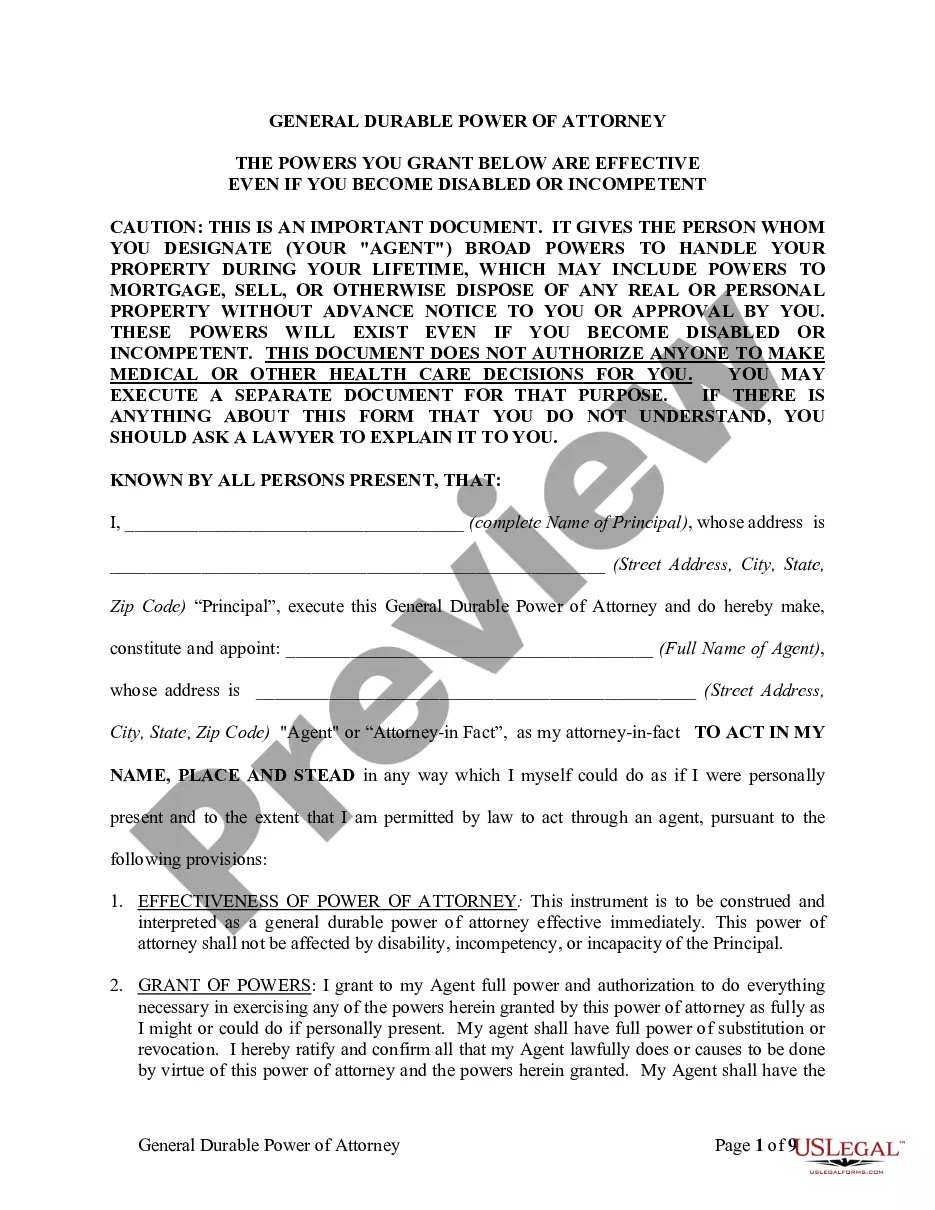

How to fill out Louisiana Schedule 14B Information?

If you need to comprehensive, acquire, or print out authorized file web templates, use US Legal Forms, the biggest collection of authorized types, that can be found on the web. Make use of the site`s simple and easy hassle-free research to get the paperwork you require. A variety of web templates for business and person uses are categorized by categories and says, or keywords and phrases. Use US Legal Forms to get the Louisiana Schedule 14B Information within a few clicks.

Should you be presently a US Legal Forms consumer, log in for your account and then click the Acquire option to have the Louisiana Schedule 14B Information. You can also access types you earlier acquired from the My Forms tab of your account.

If you work with US Legal Forms the very first time, follow the instructions under:

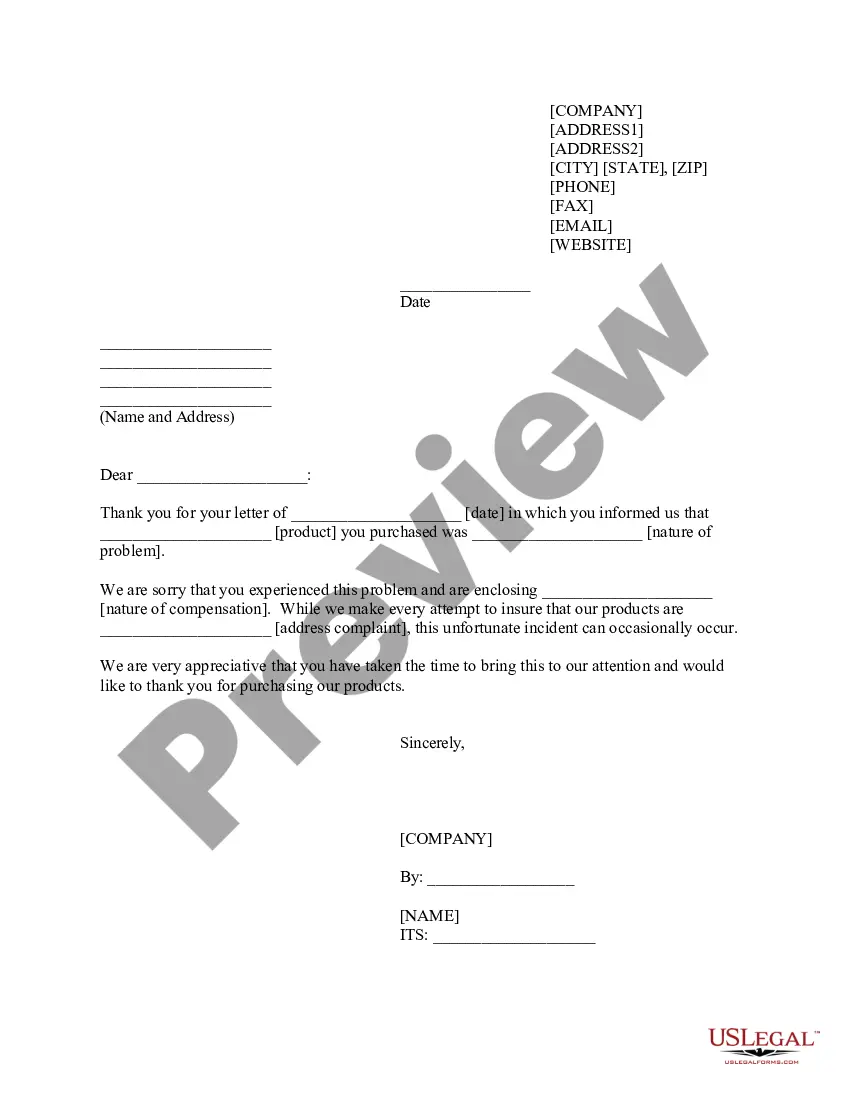

- Step 1. Be sure you have selected the shape to the right metropolis/region.

- Step 2. Take advantage of the Review option to look through the form`s content material. Don`t overlook to read through the explanation.

- Step 3. Should you be not satisfied with all the form, use the Look for industry towards the top of the monitor to locate other models in the authorized form format.

- Step 4. When you have found the shape you require, click the Buy now option. Select the costs program you like and include your references to register on an account.

- Step 5. Process the deal. You can utilize your credit card or PayPal account to complete the deal.

- Step 6. Select the structure in the authorized form and acquire it on the device.

- Step 7. Comprehensive, edit and print out or sign the Louisiana Schedule 14B Information.

Each authorized file format you purchase is the one you have permanently. You might have acces to every single form you acquired inside your acccount. Select the My Forms portion and choose a form to print out or acquire once more.

Remain competitive and acquire, and print out the Louisiana Schedule 14B Information with US Legal Forms. There are thousands of professional and express-specific types you may use for the business or person demands.

Form popularity

FAQ

Supplemental. Income and Loss. Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources.

Annual Retirement Income Exclusion (R.S. .1(A))?Persons 65 years or older may exclude up to $6,000 of annual retirement income from their taxable income. Taxpayers that are married filing jointly and are both age 65 or older can each exclude up to $6,000 of annual retirement income.

For oil and gas royalty owners, percentage depletion is calculated using a rate of 15% of the gross income based on your average daily production of crude oil or natural gas, up to your depletable oil or natural gas quantity.

Percentage depletion allowance is calculated by multiplying the gross income received in a tax year. The IRS determines the percentage for each resource. In the case of oil and gas royalty owners, the percentage depletion is often estimated by using the 15% rate for gross income.

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

To calculate depletion expense, a business typically uses one of two methods: cost depletion or units-of-production depletion. Cost Depletion method divides the total cost of the natural resource (including acquisition, exploration, and development expenses) by the estimated total quantity of recoverable units.

What Is Percentage Depletion? Percentage depletion is a tax deduction for depreciation allowable for businesses involved in extracting fossil fuels, minerals, and other nonrenewable resources from the earth.

The depletion deduction cannot exceed 50% of the net income of the taxpayer computed without allowance for depletion from the property. In determining net income from the property, federal income tax is considered an expense. Enter the amount of the S Bank shareholder exclusion that the estate or trust can claim.