Louisiana Stock Redemption Agreements: A Detailed Description with Exhibits of Fair Lanes, Inc. Introduction: Louisiana Stock Redemption Agreements play a crucial role in corporate law, allowing companies to repurchase their own shares from shareholders. In this article, we will explore the intricacies of Louisiana Stock Redemption Agreements, specifically focusing on its application in the case of Fair Lanes, Inc. We will provide a comprehensive overview of the agreement, its purpose, key terms, and potential variants found within Fair Lanes, Inc. Key Elements of Louisiana Stock Redemption Agreements: 1. Purpose: Louisiana Stock Redemption Agreements serve various purposes, including providing liquidity to shareholders, maintaining control within the company, and facilitating changes in ownership structure. Fair Lanes, Inc., a leading bowling alley chain, implemented this agreement to address specific business needs and strategic objectives. 2. Agreement Terms: Louisiana Stock Redemption Agreements typically outline the following key terms: a. Redemption Price: The price at which the corporation repurchases the stock. b. Redemption Period: The timeframe within which the stock redemption can occur. c. Method of Redemption: Describes how the redemption will be executed, whether through cash payment or other agreed-upon considerations. d. Shareholder Representations and Warranties: Statements made by the shareholder regarding the stock's legality, ownership, and transferability. e. Conditions Precedent: Specified conditions that must be met before the redemption takes place. f. Governing Law: Specifies that Louisiana state law governs the agreement. Different Types of Louisiana Stock Redemption Agreements within Fair Lanes, Inc.: 1. Promissory Note Redemption Agreement: Fair Lanes, Inc. may employ this type of agreement when repurchasing shares from a shareholder wherein the redemption price is paid over time via installments with interest. This option allows the company to manage its cash flow while still fulfilling its redemption obligations. 2. Cross-Purchase Agreement: In cases where there are multiple shareholders in Fair Lanes, Inc., a cross-purchase agreement may be utilized. This agreement stipulates that each shareholder has the right, or an obligation, to buy shares from the selling shareholder in proportion to their respective ownership interests. This arrangement ensures a smooth transition while maintaining the balance of control within the company. 3. Installment Agreement: Fair Lanes, Inc. may choose to structure its stock redemption using an installment agreement. This agreement allows the corporation to repurchase shares in multiple installments over an extended period. Such an arrangement might be employed when there is a need for gradual ownership transfer or when the corporation's financial capacity requires a staged redemption approach. Conclusion: Louisiana Stock Redemption Agreements provide invaluable flexibility and control for corporations like Fair Lanes, Inc. By exploring different types of stock redemption agreements, including promissory note redemption, cross-purchase, and installment agreements, Fair Lanes, Inc. can tailor its approach to meet specific business goals and shareholder requirements. As with any legal agreement, it is crucial for corporations to seek professional legal guidance when drafting and executing stock redemption agreements.

Louisiana Stock Redemption Agreements with exhibits of Fair Lanes, Inc.

Description

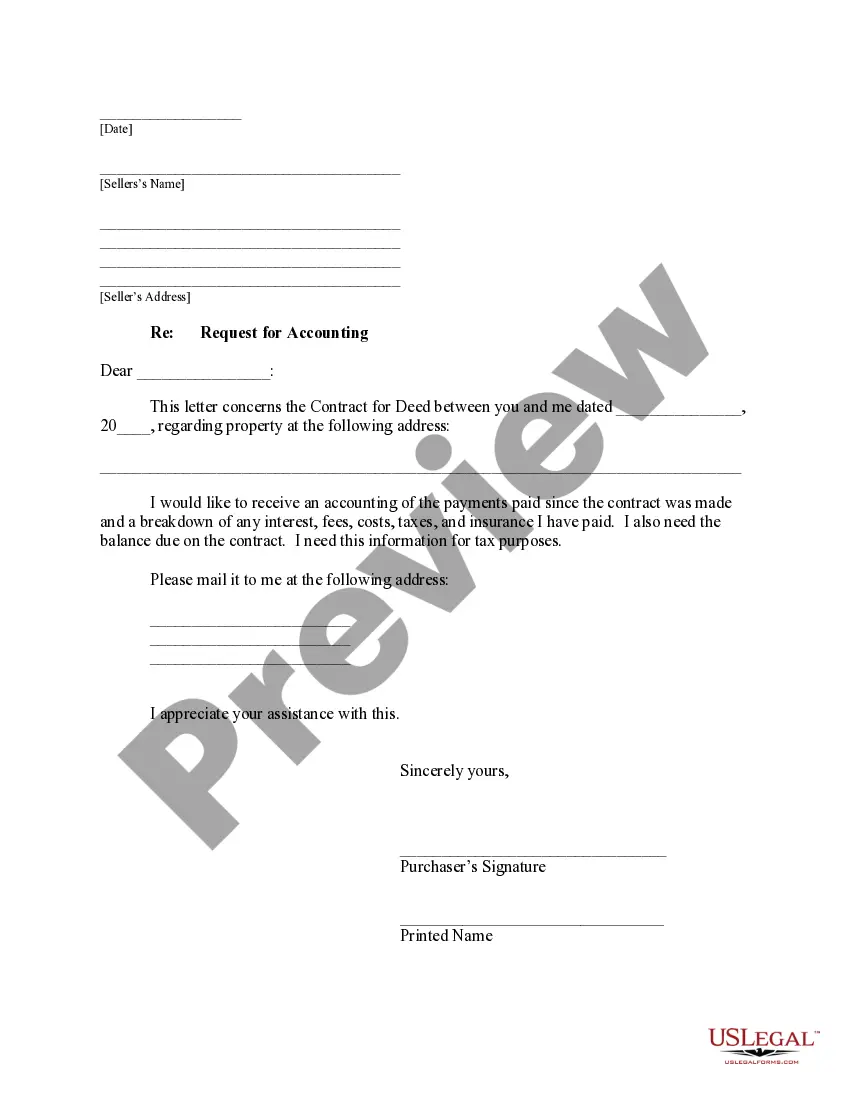

How to fill out Louisiana Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

You can invest time online attempting to find the legitimate file template that suits the state and federal demands you will need. US Legal Forms offers a huge number of legitimate kinds that happen to be examined by professionals. It is possible to acquire or printing the Louisiana Stock Redemption Agreements with exhibits of Fair Lanes, Inc. from the services.

If you already have a US Legal Forms account, you are able to log in and then click the Download key. After that, you are able to total, edit, printing, or signal the Louisiana Stock Redemption Agreements with exhibits of Fair Lanes, Inc.. Each legitimate file template you buy is the one you have eternally. To obtain another version associated with a bought type, visit the My Forms tab and then click the related key.

Should you use the US Legal Forms internet site for the first time, adhere to the basic directions beneath:

- Initially, make certain you have selected the correct file template to the county/metropolis of your choice. Look at the type explanation to make sure you have picked the proper type. If offered, utilize the Preview key to search throughout the file template also.

- If you would like locate another variation of your type, utilize the Research area to find the template that suits you and demands.

- When you have identified the template you want, simply click Purchase now to proceed.

- Find the costs strategy you want, key in your credentials, and register for a merchant account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal account to pay for the legitimate type.

- Find the structure of your file and acquire it for your system.

- Make adjustments for your file if necessary. You can total, edit and signal and printing Louisiana Stock Redemption Agreements with exhibits of Fair Lanes, Inc..

Download and printing a huge number of file web templates making use of the US Legal Forms web site, which offers the biggest variety of legitimate kinds. Use professional and status-particular web templates to deal with your small business or personal requires.

Form popularity

FAQ

A membership interest redemption agreement, or MERA, is a legal document that allows a business to purchase the ownership interest of another company. Membership Interest Redemption Agreement: Definition & Sample contractscounsel.com ? membership-interest... contractscounsel.com ? membership-interest...

If the distribution is treated as a dividend, the amount of the distribution is considered ordinary income. A redemption is treated as a sale or exchange in the following situations: The distribution is not essentially equivalent to a dividend. It is substantially disproportionate with respect to the shareholder. Stock Redemptions - Federal - Topics | Wolters Kluwer cch.com ? topic ? stock-redemptions cch.com ? topic ? stock-redemptions

A redemption agreement sometimes called a stock redemption agreement, is a legally binding agreement between shareholders of a company. It allows parties to specify the terms in which they may buy, sell, or transfer shares of a company. These agreements may include partners, shareholders, or LLC members. Redemption Agreement: Definition & Sample Contracts Counsel ? redemption-agree... Contracts Counsel ? redemption-agree...

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company. Selling Your Interest in a Business: Redemption Agreements hnwlaw.com ? passing-on-a-business ? sellin... hnwlaw.com ? passing-on-a-business ? sellin...