Louisiana Stock Option Plan of Hayes Wheels International, Inc. Hayes Wheels International, Inc., a company based in Louisiana, provides its employees with a comprehensive stock option plan known as the Louisiana Stock Option Plan. This plan offers two types of stock options to eligible employees: Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS). 1. Incentive Stock Options (SOS): The Louisiana Stock Option Plan of Hayes Wheels International, Inc. provides for the grant of SOS to eligible employees. SOS are stock options that can only be offered to specific employees designated by the company. These options come with certain tax advantages, as they are taxed at a potentially lower rate compared to SOS. To qualify for SOS, employees must meet specific eligibility criteria outlined in the plan. SOS provide employees with the right to purchase company stock at a predetermined exercise price. 2. Nonqualified Stock Options (SOS): The Louisiana Stock Option Plan also includes the provision for the grant of SOS to eligible employees. SOS are stock options that can be offered to a broader group of employees, including executives, employees, and consultants. Unlike SOS, SOS do not offer any special tax advantages and are subject to ordinary income tax rates when exercised. SOS also provide employees with the right to purchase company stock at a predetermined exercise price. Hayes Wheels International, Inc. has designed its Louisiana Stock Option Plan to incentivize and reward employees for their contributions to the company's success. By granting both SOS and SOS, the plan caters to different levels of employees and provides them with an opportunity to participate in the company's growth and financial success. It is important to note that the specific terms and conditions of the Louisiana Stock Option Plan may vary and are subject to the company's discretion. Employees should refer to the official plan documents and consult with their Human Resources department or legal advisors for accurate and up-to-date details regarding their eligibility, vesting schedules, exercise prices, and any other relevant provisions outlined in the plan.

Louisiana Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options

Description

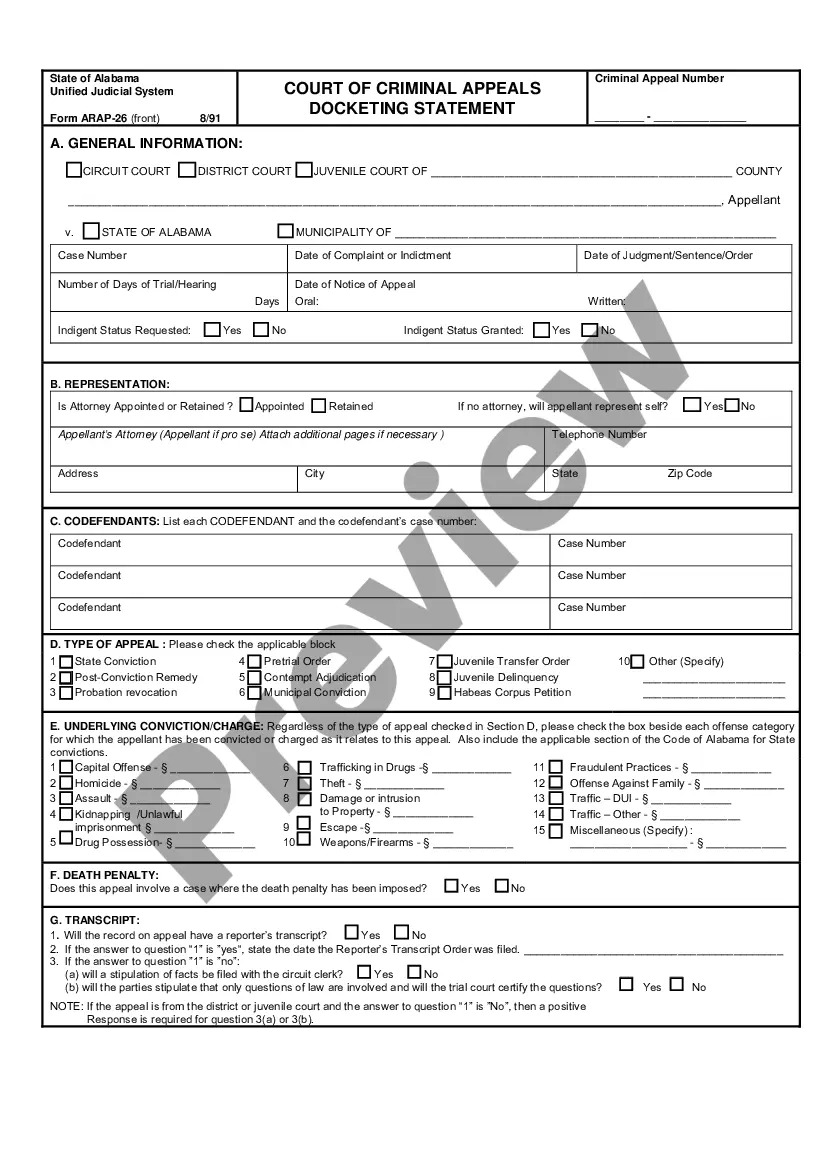

How to fill out Louisiana Stock Option Plan Of Hayes Wheels International, Inc., Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options?

Are you in the position the place you need documents for either organization or individual uses nearly every time? There are a lot of legal file templates available on the net, but finding types you can rely on isn`t easy. US Legal Forms offers a huge number of develop templates, like the Louisiana Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options, which are composed in order to meet federal and state specifications.

When you are presently informed about US Legal Forms website and get an account, merely log in. Next, you can download the Louisiana Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options design.

If you do not offer an account and wish to begin using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for the proper town/region.

- Utilize the Review key to review the shape.

- Browse the description to actually have selected the proper develop.

- If the develop isn`t what you are looking for, utilize the Research field to find the develop that suits you and specifications.

- If you find the proper develop, click on Buy now.

- Opt for the costs prepare you need, submit the necessary information and facts to produce your money, and pay for an order utilizing your PayPal or bank card.

- Pick a handy data file formatting and download your version.

Discover every one of the file templates you may have purchased in the My Forms food selection. You can get a additional version of Louisiana Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options anytime, if needed. Just click on the necessary develop to download or print the file design.

Use US Legal Forms, probably the most considerable selection of legal kinds, to save time as well as prevent mistakes. The service offers expertly manufactured legal file templates which can be used for a selection of uses. Create an account on US Legal Forms and commence producing your daily life easier.