Louisiana Approval of Ambase Corporation's Stock Incentive Plan

Description

How to fill out Approval Of Ambase Corporation's Stock Incentive Plan?

Are you currently in the placement the place you need to have files for possibly business or individual uses virtually every day time? There are a variety of lawful papers layouts accessible on the Internet, but discovering kinds you can trust is not easy. US Legal Forms provides a huge number of type layouts, much like the Louisiana Approval of Ambase Corporation's Stock Incentive Plan, that are composed to meet federal and state needs.

If you are previously familiar with US Legal Forms web site and possess your account, merely log in. After that, it is possible to download the Louisiana Approval of Ambase Corporation's Stock Incentive Plan web template.

If you do not offer an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for the correct town/county.

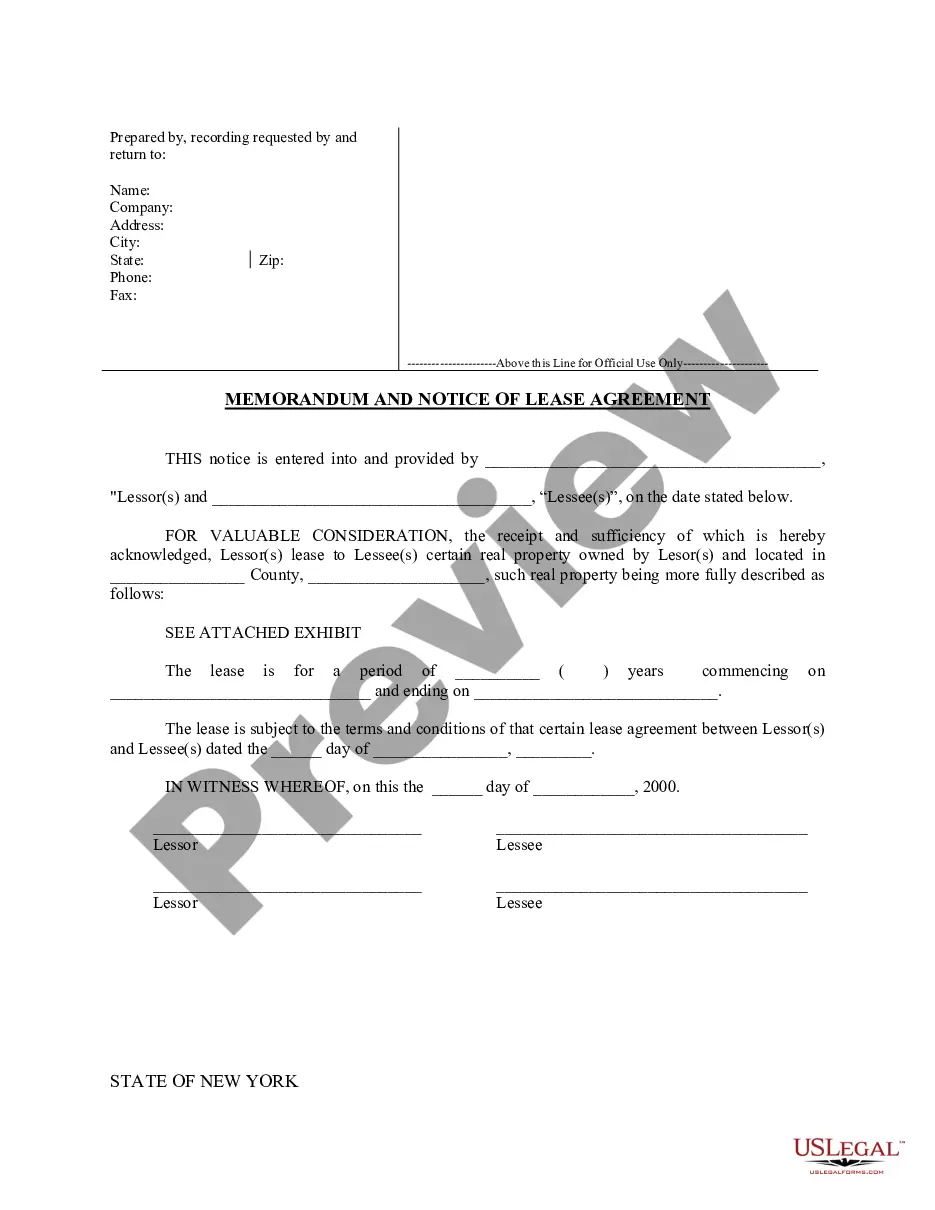

- Utilize the Review button to analyze the shape.

- Read the explanation to actually have chosen the right type.

- If the type is not what you`re searching for, use the Search discipline to get the type that suits you and needs.

- Whenever you obtain the correct type, simply click Get now.

- Select the rates strategy you want, submit the necessary info to produce your account, and pay money for the transaction using your PayPal or charge card.

- Pick a practical document formatting and download your backup.

Get every one of the papers layouts you have bought in the My Forms food list. You can get a extra backup of Louisiana Approval of Ambase Corporation's Stock Incentive Plan at any time, if required. Just go through the necessary type to download or printing the papers web template.

Use US Legal Forms, probably the most considerable variety of lawful types, in order to save some time and avoid blunders. The assistance provides expertly created lawful papers layouts that you can use for a range of uses. Produce your account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

The benefit of incentive stock options Over time, you can make a significant amount of money on your shares. You not only owe a portion of the business, but you also benefit from the company's growth. Companies offering ISOs can also increase employee motivation .

Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.