Louisiana Adjustments refer to specific legal provisions that are applied when a company undergoes reorganization or changes in its capital structure, within the state of Louisiana in the United States. These adjustments ensure that the reorganization or capital structure changes comply with state laws and regulations. This detailed description will explore the types and significance of Louisiana Adjustments in such situations while incorporating relevant keywords. When a company decides to reorganize or make changes to its capital structure in Louisiana, certain legal requirements must be met to ensure the process conforms to state guidelines. These requirements are commonly known as Louisiana Adjustments and help safeguard the interests of various stakeholders involved, such as shareholders, creditors, and employees. One type of Louisiana Adjustment that may occur during reorganization or changes in the capital structure is the approval and filing of necessary documentation with the Louisiana Secretary of State's office. This step is essential to ensure compliance with the state's corporate laws. The documentation may include amended articles of incorporation, bylaws, stock certificates, or other relevant legal documents. Another type of Louisiana Adjustment is the consideration of existing contracts and agreements during the reorganization or capital structure changes. It is crucial that any existing contractual obligations are reviewed and, if necessary, modified to accommodate the new structure. This ensures that all parties involved are protected and that the changes do not result in a breach of contract or legal dispute. In addition, employee-related adjustments may be required during reorganization or changes in the capital structure. This could involve evaluating the impact of the structural changes on employees, both in terms of their positions within the organization and their benefits or compensation packages. Compliance with applicable labor laws, such as the Louisiana Employment Security Law, is crucial to ensure fair treatment of employees during these transitions. Furthermore, Louisiana Adjustments may also include considerations related to taxation. Companies must assess the potential impact of reorganization or capital structure changes on their tax liabilities, both at the state and federal levels. This may involve consulting with tax professionals or accountants to develop a tax-efficient strategy that complies with Louisiana tax laws. The reasons for undertaking these Louisiana Adjustments during reorganization or changes in the capital structure are manifold. Compliance with state laws and regulations ensures that the entire process is executed legally and ethically. By adhering to the proper procedures, the company can avoid potential legal issues, penalties, and disruptions to business operations. Moreover, these adjustments provide transparency, protect the rights of shareholders, creditors, and employees, and contribute to maintaining a stable business environment. In summary, Louisiana Adjustments play a vital role when a company undergoes reorganization or changes in its capital structure within the state. These adjustments encompass obtaining necessary approvals, modifying existing contracts, addressing employee-related considerations, and assessing taxation implications. By diligently following these adjustments, companies can navigate the reorganization or capital structure changes smoothly while complying with Louisiana laws and ensuring the best interests of all stakeholders involved.

Louisiana Adjustments in the event of reorganization or changes in the capital structure

Description

How to fill out Louisiana Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

Discovering the right authorized papers web template could be a have a problem. Naturally, there are plenty of themes accessible on the Internet, but how can you obtain the authorized type you need? Make use of the US Legal Forms website. The services offers 1000s of themes, like the Louisiana Adjustments in the event of reorganization or changes in the capital structure, that you can use for enterprise and personal requires. All of the types are inspected by experts and satisfy state and federal needs.

In case you are previously signed up, log in in your profile and click the Download key to obtain the Louisiana Adjustments in the event of reorganization or changes in the capital structure. Utilize your profile to appear with the authorized types you have ordered in the past. Check out the My Forms tab of your profile and obtain yet another copy in the papers you need.

In case you are a whole new customer of US Legal Forms, here are straightforward recommendations so that you can comply with:

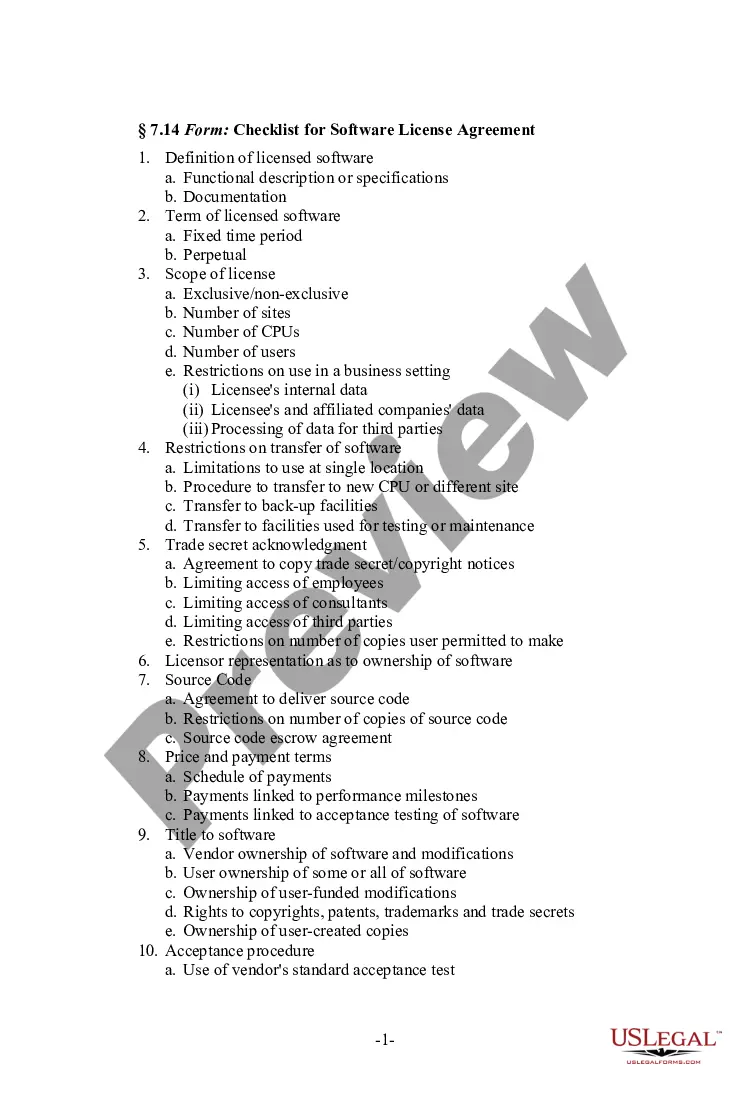

- Very first, make sure you have chosen the appropriate type for your personal city/area. You are able to look through the form while using Preview key and read the form description to make sure this is the right one for you.

- In the event the type does not satisfy your preferences, take advantage of the Seach industry to get the appropriate type.

- Once you are positive that the form is acceptable, click the Get now key to obtain the type.

- Choose the costs plan you need and type in the required information. Make your profile and buy an order utilizing your PayPal profile or credit card.

- Pick the data file formatting and obtain the authorized papers web template in your system.

- Comprehensive, edit and printing and indicator the attained Louisiana Adjustments in the event of reorganization or changes in the capital structure.

US Legal Forms may be the biggest collection of authorized types that you can discover numerous papers themes. Make use of the service to obtain appropriately-manufactured papers that comply with express needs.

Form popularity

FAQ

Without prejudice to any other mode of citation, the Louisiana Administrative Code may be cited by Title, Part and Section number. The preferred short form of citation of the Louisiana Administrative Code is "LAC." Thus, "LAC 35:XI. 315" refers to Section 315 of Part XI of Title 35 of the LouisianaAdministrative Code.

The purpose of this regulation is to inform all taxpayers that nonresident individuals are allowed to carry back and carry over their Louisiana net operating losses. This regulation also provides guidance to taxpayers about the procedures for carrying these losses.

To determine net apportionable income or loss, most Louisiana taxpayers must use a single- sales factor apportionment formula for tax years beginning on or after January 1, 2016.

The Louisiana Administrative Procedure Act is the law governing procedures for state administrative agencies to propose and issue regulations and provides for judicial review of agency adjudications and other final decisions in Louisiana. It can be found in Title 49, Chapter 13 of the Louisiana Revised Statutes.

Louisiana Administrative Code Title 61 of the LAC contains the rules for taxes administered by the La Department of Revenue. Complete set of rules promulgated by the Louisiana Department of Revenue can be obtained through the Office of State Register.

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana.

The LAC is the official compilation of administrative rules published by agencies and boards in the state of Louisiana. Revised Statutes (laws passed by the legislature), and the internal guidelines of agencies are not included in administrative rules.

To report Louisiana-sourced unrelated business income, exempt organizations are required to file Form CIFT-620. In instances when a multi-state exempt organization earns unrelated business income within Louisiana and outside of Louisiana, Form CIFT-620A, Schedules P and Q are also required.