The Louisiana Proposal to amend stock purchase plan is a legislative initiative aimed at implementing changes in the existing stock purchase plan framework in the state of Louisiana. This proposal seeks to address various aspects of the stock purchase plan to ensure its efficacy and better alignment with the needs and aspirations of the state's businesses and employees. The potential amendments include provisions related to the eligibility criteria for participating in the stock purchase plan, the maximum stock purchase limit, the allocation of stocks, and the taxation policies governing the plan. Additionally, the proposal aims to introduce new features that can enhance the attractiveness and viability of the stock purchase plan, such as employee matching contributions and increased flexibility in stock options. One type of proposed amendment under the Louisiana Proposal is to expand the eligibility criteria for participating in the stock purchase plan. The amendment seeks to provide access to this program to a broader range of employees, including part-time workers and contractors. This aims to promote inclusivity and empower a larger segment of the workforce to become shareholders and benefit from the growth of the companies they work for. Another type of proposed amendment is to increase the maximum stock purchase limit. This amendment acknowledges the need to align the plan with the ever-evolving market dynamics and inflation rates, allowing employees to purchase more stocks and have a greater stake in the company's success. By raising this limit, the proposal aims to encourage greater participation and long-term commitment from employees. Additionally, the proposal includes amendments aiming to modify the allocation of stocks within the plan. This may involve changes in the allocation formula based on factors such as employee tenure, job position, and performance evaluation. By implementing a fair and transparent allocation system, the proposal seeks to ensure that the benefits of the stock purchase plan are distributed equitably among employees, motivating them to contribute to the company's growth and success. One crucial aspect of the Louisiana Proposal to amend the stock purchase plan includes revisiting the taxation policies related to this program. The proposed amendments seek to streamline and simplify the tax treatments for both employers and employees participating in the plan. This may involve changes in tax rates, reporting requirements, and exemptions, ultimately making the stock purchase plan more attractive and financially viable for all stakeholders involved. In summary, the Louisiana Proposal to amend the stock purchase plan aims to make significant improvements to the existing framework. By expanding eligibility criteria, increasing stock purchase limits, modifying stock allocations, and simplifying taxation policies, these amendments seek to enhance the benefits and attractiveness of the stock purchase plan for both businesses and employees.

Louisiana Proposal to amend stock purchase plan

Description

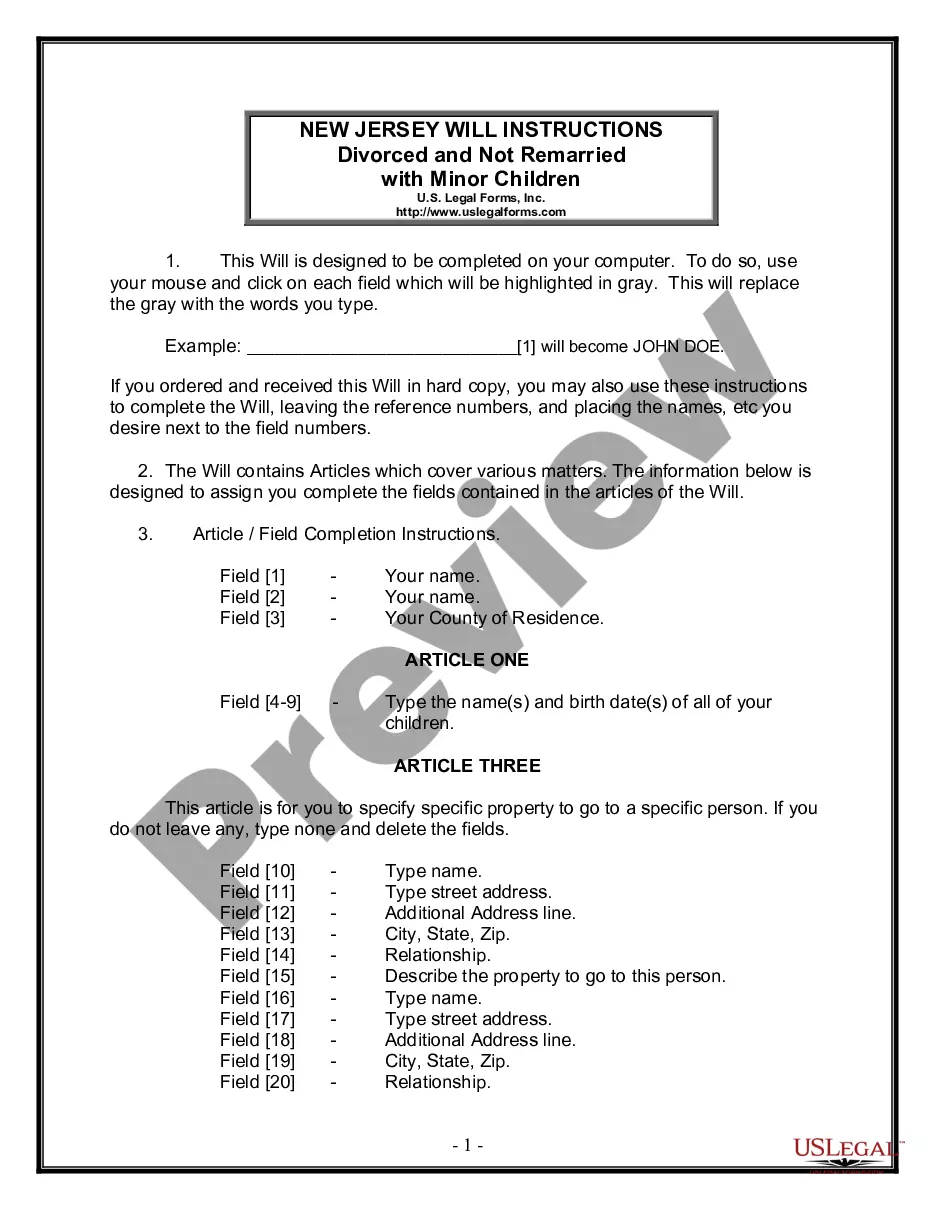

How to fill out Louisiana Proposal To Amend Stock Purchase Plan?

If you wish to comprehensive, obtain, or produce legitimate papers layouts, use US Legal Forms, the biggest variety of legitimate forms, which can be found on the web. Utilize the site`s simple and practical research to get the papers you need. A variety of layouts for organization and individual uses are sorted by categories and states, or search phrases. Use US Legal Forms to get the Louisiana Proposal to amend stock purchase plan within a couple of mouse clicks.

Should you be presently a US Legal Forms client, log in for your bank account and click the Download key to obtain the Louisiana Proposal to amend stock purchase plan. You can also gain access to forms you earlier downloaded from the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for your appropriate metropolis/region.

- Step 2. Utilize the Preview solution to look through the form`s content material. Never forget about to read through the information.

- Step 3. Should you be not satisfied with all the develop, use the Look for field near the top of the monitor to get other models of the legitimate develop design.

- Step 4. Upon having found the shape you need, click the Purchase now key. Pick the costs prepare you choose and include your references to sign up for the bank account.

- Step 5. Procedure the deal. You should use your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Choose the structure of the legitimate develop and obtain it on your own device.

- Step 7. Full, revise and produce or sign the Louisiana Proposal to amend stock purchase plan.

Every legitimate papers design you buy is your own property eternally. You possess acces to every develop you downloaded with your acccount. Click the My Forms section and choose a develop to produce or obtain yet again.

Contend and obtain, and produce the Louisiana Proposal to amend stock purchase plan with US Legal Forms. There are thousands of skilled and status-distinct forms you can utilize for your organization or individual demands.

Form popularity

FAQ

Amendment of a Louisiana LLC's Articles of Organization requires you to file with the Secretary of State by mail, fax, or in person along with the filing fee. You can use legally drafted amendments. The state also allows online filing through the official website of the Secretary of State.

Less than a year later, when Congress proposed the 15th Amendment, its text banned discrimination in voting, but only based on ?race, color, or previous condition of servitude.? Despite some valiant efforts by activists, ?sex? was left out, reaffirming the fact that women lacked a constitutional right to vote.

2023 Regular Session, ACT 107 (HB 47) Existing constitution limits the ability of the legislature to spend state nonrecurring revenue to six particular items.

FIFTEENTH AMENDMENT SECTION 1. The right of citizens of the United States to vote shall not be denied or abridged by the United States or by any State on account of race, color, or previous condition of ser- vitude.