The Louisiana Employee Stock Ownership Plan (ESOP) of First American Health Concepts, Inc. is a unique program offered by the company to its employees in Louisiana. It is a retirement benefit plan that provides eligible employees an opportunity to own a portion of the company through company-provided stock options. First American Health Concepts, Inc., a leading healthcare company in Louisiana, believes in empowering its employees and creating a sense of ownership within the organization. The ESOP is designed to accomplish exactly that. By participating in this plan, employees become beneficiaries of the company's growth and success, aligning their interests with the long-term performance of the organization. Sops are significant in ensuring a cooperative and mutually beneficial relationship between employees and the company they work for. First American Health Concepts, Inc. recognizes the importance of providing a secure and financially rewarding retirement option for its employees through Sops. The Louisiana ESOP of First American Health Concepts, Inc. offers several advantages to participating employees. Firstly, it allows eligible employees to acquire company stock at favorable terms, often below market value, increasing their personal wealth as the company flourishes. As the value of the company increases, so does the value of the employee's shares, providing them with a tangible stake in the company's future. Furthermore, an ESOP can serve as a long-term incentive for employees, fostering a culture of loyalty and commitment. As employees become shareholders, they are more likely to actively contribute to the company's growth and success, knowing their efforts directly impact their own financial well-being. Another advantage of Sops is their tax advantages. Contributions made by the company to the ESOP are tax-deductible, and dividends paid on ESOP stock are also tax-deductible for the company. Additionally, participating employees can defer taxes on the value of their shares until they withdraw funds from the ESOP upon retirement, potentially offering significant tax savings. It is important to note that the specific details and structure of the Louisiana Employee Stock Ownership Plan of First American Health Concepts, Inc. may vary. Employees interested in participating should consult the plan documents and seek advice from the plan administrators to have a comprehensive understanding of the plan's terms, vesting schedules, and distribution options. By offering the Louisiana ESOP, First American Health Concepts, Inc. aims to enhance employee engagement, foster a culture of teamwork and ownership, and provide employees with a fulfilling and financially secure retirement option.

Louisiana Employee Stock Ownership Plan of First American Health Concepts, Inc.

Description

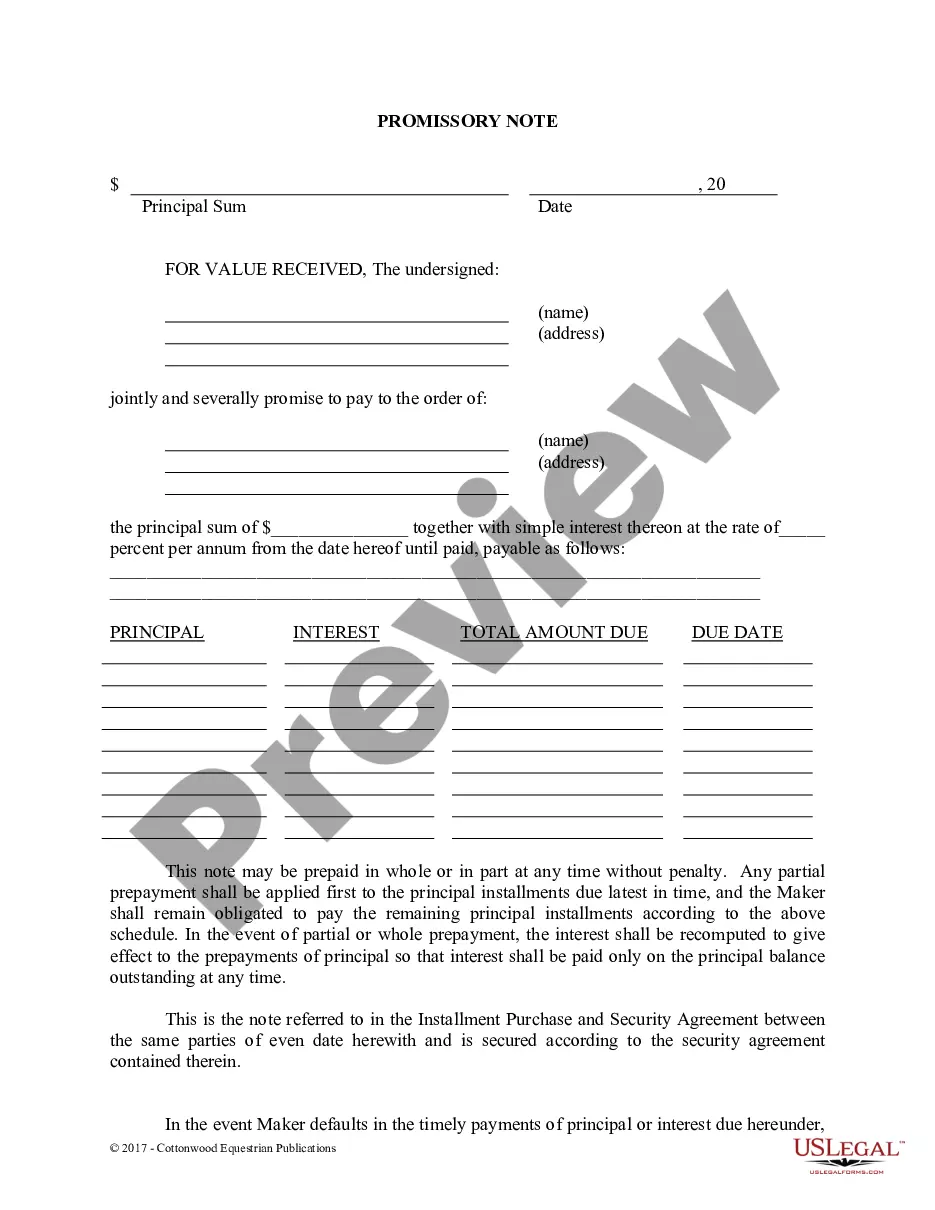

How to fill out Louisiana Employee Stock Ownership Plan Of First American Health Concepts, Inc.?

US Legal Forms - one of several most significant libraries of legal varieties in the USA - provides a wide array of legal file templates it is possible to download or produce. Making use of the internet site, you can find thousands of varieties for business and person functions, sorted by types, says, or keywords and phrases.You can find the most up-to-date versions of varieties such as the Louisiana Employee Stock Ownership Plan of First American Health Concepts, Inc. in seconds.

If you already have a membership, log in and download Louisiana Employee Stock Ownership Plan of First American Health Concepts, Inc. from the US Legal Forms catalogue. The Download key can look on each and every kind you see. You get access to all formerly saved varieties inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the very first time, here are straightforward directions to help you started out:

- Ensure you have picked out the correct kind for your personal metropolis/region. Go through the Review key to analyze the form`s articles. See the kind description to ensure that you have chosen the correct kind.

- In case the kind doesn`t suit your needs, utilize the Lookup discipline at the top of the monitor to get the the one that does.

- When you are happy with the shape, verify your choice by visiting the Acquire now key. Then, select the pricing plan you want and provide your accreditations to sign up for the bank account.

- Method the deal. Use your Visa or Mastercard or PayPal bank account to perform the deal.

- Choose the formatting and download the shape on your own system.

- Make modifications. Complete, modify and produce and sign the saved Louisiana Employee Stock Ownership Plan of First American Health Concepts, Inc..

Each format you included with your bank account lacks an expiration particular date and it is the one you have eternally. So, if you wish to download or produce an additional backup, just go to the My Forms segment and click on around the kind you require.

Get access to the Louisiana Employee Stock Ownership Plan of First American Health Concepts, Inc. with US Legal Forms, by far the most comprehensive catalogue of legal file templates. Use thousands of specialist and express-distinct templates that satisfy your company or person requires and needs.