The Louisiana Reclassification of Class B common stock into Class A common stock refers to the process of converting Class B shares into Class A shares in accordance with Louisiana corporate laws. This reclassification can occur for various reasons, including organizational restructuring, changes in voting rights, or to comply with regulatory requirements. In this reclassification, Class B common stockholders voluntarily exchange their existing shares for Class A common stock shares, which may possess different rights and privileges. Class A shares often hold superior voting rights, offering greater control and decision-making power within the corporation. This reclassification empowers the corporation to align its share structure with its evolving strategic goals. Keywords: Louisiana, reclassification, Class B common stock, Class A common stock, corporate laws, organizational restructuring, voting rights, regulatory requirements, exchange, rights and privileges, control, decision-making power, share structure, strategic goals. Different Types of Louisiana Reclassification of Class B common stock into Class A common stock: 1. Statutory Reclassification: This type of reclassification involves complying with specific Louisiana state statutes and regulations governing the conversion of Class B shares to Class A shares. Corporations carrying out this process must adhere to the legal requirements and obtain the necessary approvals from shareholders and regulatory authorities. 2. Voting Rights Reclassification: In some cases, reclassification occurs to modify the voting rights associated with the shares. Class A common stock may hold greater voting power compared to Class B common stock. This type of reclassification allows corporations to balance voting influence and streamline decision-making processes amongst stakeholders. 3. Structural Reclassification: Structural reclassification involves reshaping the share and ownership structure of a corporation. By converting Class B common stock into Class A common stock, the corporation can reposition itself strategically or secure additional capital by attracting new investors who prefer shares with superior rights and privileges. 4. Compliance Reclassification: Corporations may choose to reclassify Class B common stock into Class A common stock to adhere to regulatory requirements imposed by Louisiana authorities or other governing bodies. This reclassification ensures that the corporation remains in compliance with the applicable standards and avoids potential legal or financial penalties. 5. Merger or Acquisition Reclassification: During mergers or acquisitions, reclassification can be necessary to align different classes of stock held by the merging entities. This type of reclassification aims to harmonize the share structure and voting rights to streamline decision-making within the newly formed or combined corporation. 6. Strategic Realignment Reclassification: Corporations might reclassify Class B common stock into Class A common stock as part of their strategic realignment efforts. This type of reclassification could occur when a company shifts its focus, business model, or target market, aiming to attract a different set of investors or secure capital for new ventures. Keywords: statutory, voting rights, structural, compliance, merger, acquisition, strategic realignment, legal requirements, approvals, shareholders, regulatory authorities, balance, decision-making, ownership structure, capital, merger, acquisition, strategic realignment.

Louisiana Reclassification of Class B common stock into Class A common stock

Description

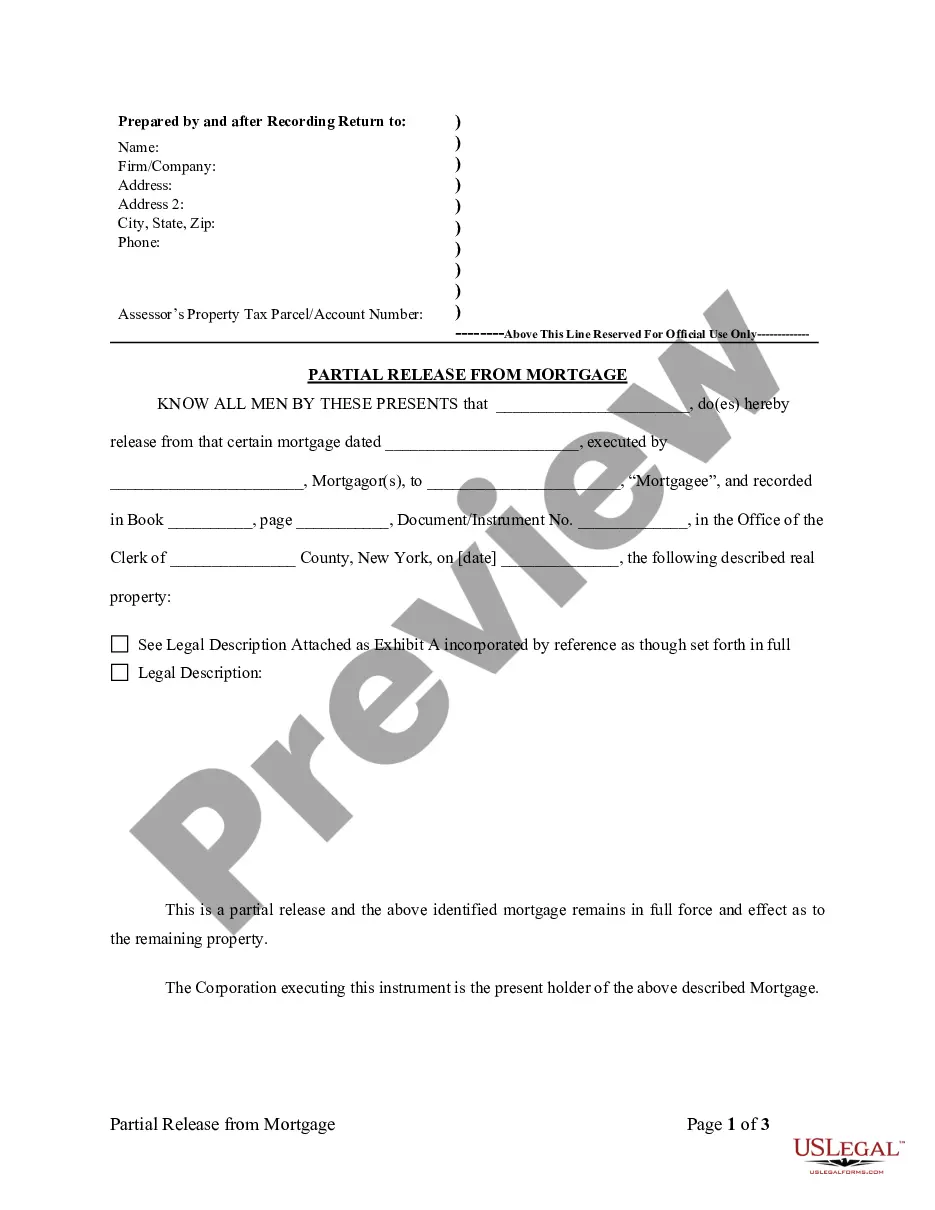

How to fill out Louisiana Reclassification Of Class B Common Stock Into Class A Common Stock?

US Legal Forms - one of the largest libraries of lawful varieties in the States - provides a wide range of lawful file layouts it is possible to obtain or printing. Utilizing the site, you will get a large number of varieties for company and person purposes, sorted by groups, suggests, or keywords and phrases.You will discover the most up-to-date types of varieties just like the Louisiana Reclassification of Class B common stock into Class A common stock in seconds.

If you have a monthly subscription, log in and obtain Louisiana Reclassification of Class B common stock into Class A common stock in the US Legal Forms library. The Obtain option can look on each type you look at. You gain access to all earlier delivered electronically varieties from the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, allow me to share simple directions to get you started out:

- Ensure you have selected the right type for your metropolis/area. Go through the Review option to analyze the form`s content material. Read the type outline to actually have selected the right type.

- If the type doesn`t suit your demands, use the Lookup field near the top of the monitor to discover the one that does.

- In case you are happy with the shape, affirm your option by simply clicking the Buy now option. Then, opt for the prices strategy you favor and provide your qualifications to register to have an bank account.

- Method the purchase. Make use of your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Find the file format and obtain the shape on your own gadget.

- Make changes. Fill out, modify and printing and sign the delivered electronically Louisiana Reclassification of Class B common stock into Class A common stock.

Every single design you included in your money does not have an expiry time and is the one you have eternally. So, if you want to obtain or printing one more version, just proceed to the My Forms segment and click on in the type you need.

Gain access to the Louisiana Reclassification of Class B common stock into Class A common stock with US Legal Forms, probably the most comprehensive library of lawful file layouts. Use a large number of skilled and condition-distinct layouts that satisfy your business or person requirements and demands.