Louisiana Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Proxy Statement And Prospectus Of USX Corporation?

US Legal Forms - one of many biggest libraries of legal forms in the United States - delivers a wide array of legal file themes it is possible to down load or print. Making use of the internet site, you can find a huge number of forms for enterprise and individual functions, categorized by types, states, or key phrases.You can get the most up-to-date types of forms much like the Louisiana Proxy Statement and Prospectus of USX Corporation in seconds.

If you already possess a membership, log in and down load Louisiana Proxy Statement and Prospectus of USX Corporation in the US Legal Forms library. The Obtain button will appear on every form you look at. You have accessibility to all in the past acquired forms inside the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, listed here are simple instructions to obtain started:

- Be sure you have chosen the proper form for your city/area. Click the Review button to analyze the form`s information. Browse the form description to ensure that you have selected the right form.

- When the form doesn`t match your needs, utilize the Search area at the top of the display screen to get the one that does.

- If you are content with the form, validate your option by clicking the Get now button. Then, select the pricing plan you favor and offer your qualifications to register for the profile.

- Process the financial transaction. Use your charge card or PayPal profile to complete the financial transaction.

- Pick the structure and down load the form on your own system.

- Make changes. Fill up, revise and print and indication the acquired Louisiana Proxy Statement and Prospectus of USX Corporation.

Every single template you included with your bank account does not have an expiry particular date and is also your own forever. So, if you want to down load or print one more copy, just go to the My Forms portion and click on on the form you want.

Obtain access to the Louisiana Proxy Statement and Prospectus of USX Corporation with US Legal Forms, the most considerable library of legal file themes. Use a huge number of specialist and condition-particular themes that meet up with your company or individual demands and needs.

Form popularity

FAQ

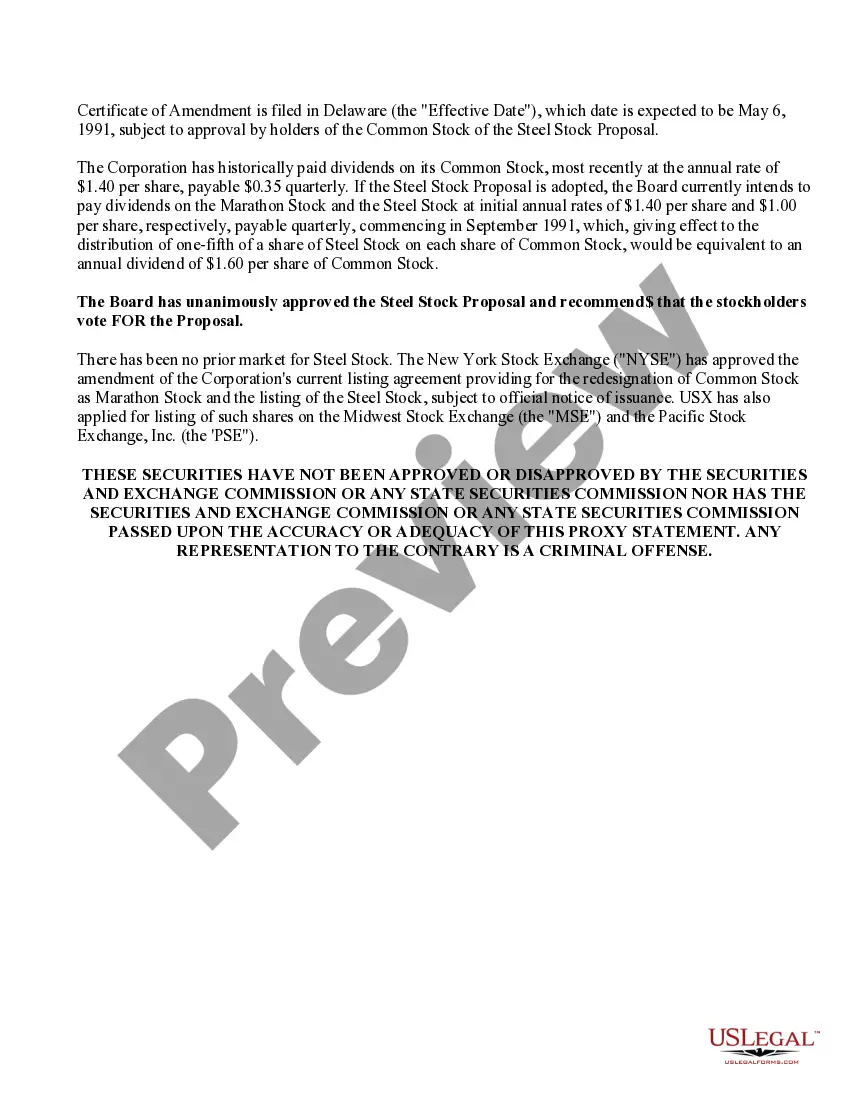

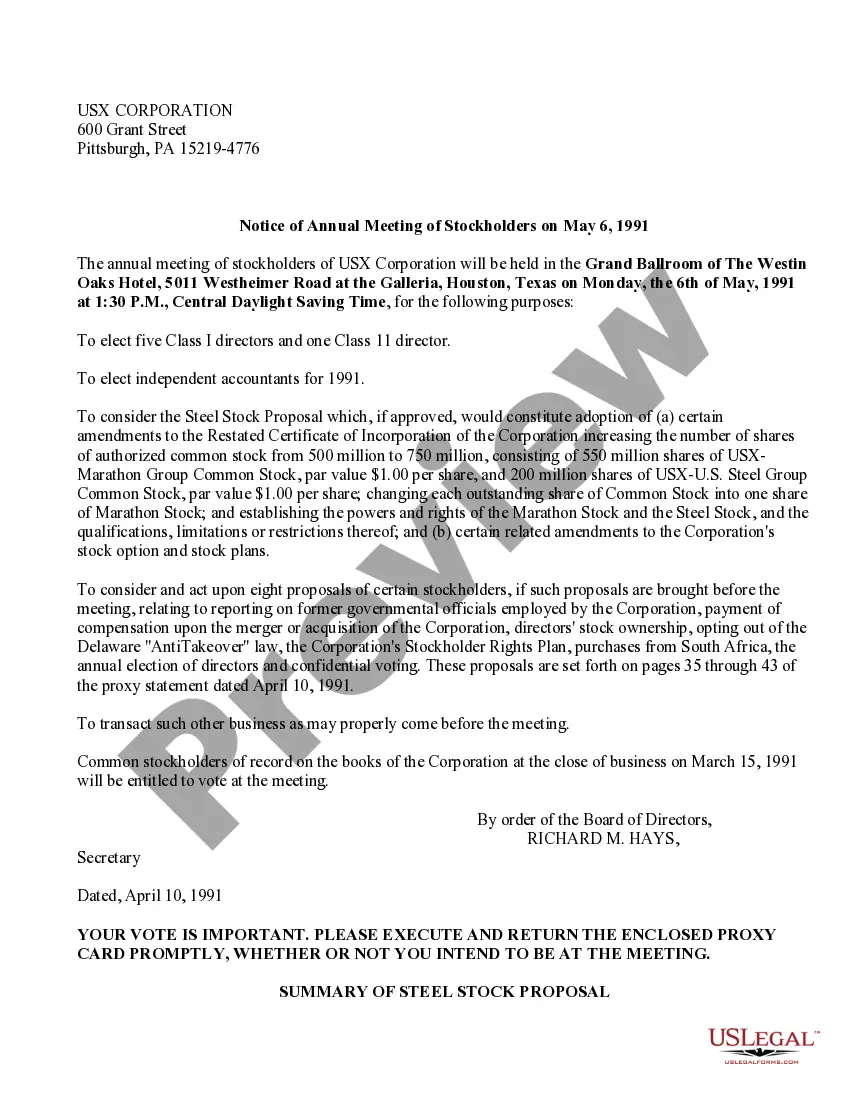

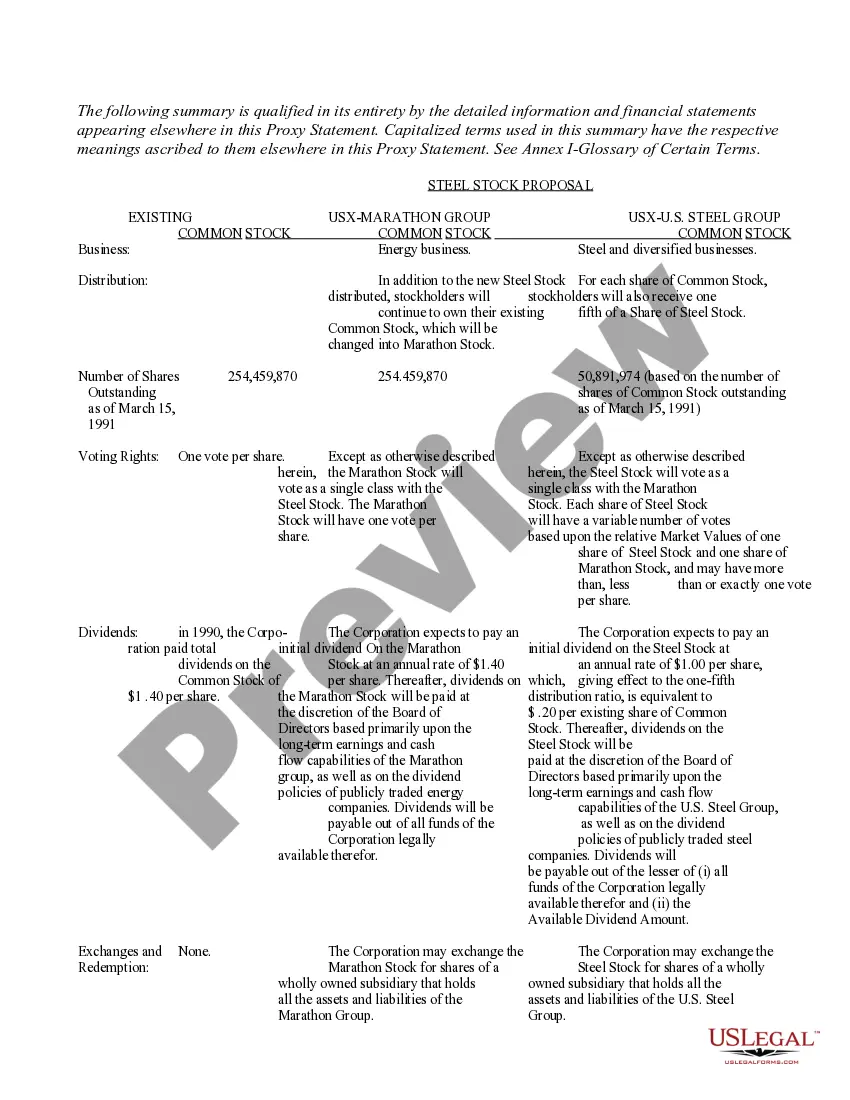

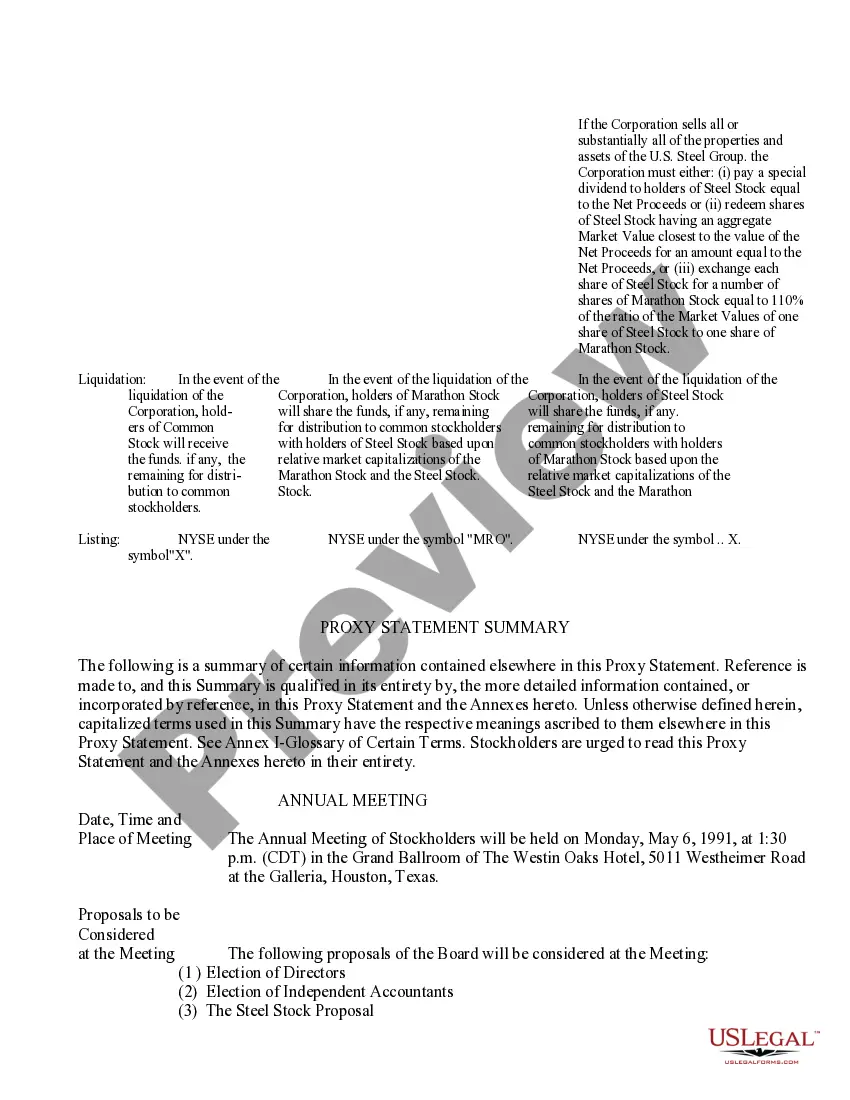

Joint Proxy Statement/Prospectus means a proxy statement to be filed with the SEC for the purpose of obtaining the Company Stockholder Approval at the Company Stockholders' Meeting and the Parent Stockholder Approval at the Parent Stockholders' Meeting, as amended or supplemented from time to time.

A proxy statement is a legal document that a company must provide to its shareholders (investors who hold the company shares) to make further informed investment decisions.

A proxy statement is a document that public companies must provide their shareholders prior to a shareholder meeting. The Securities and Exchange Commission (SEC) requires companies to file their proxy statement in compliance with Schedule 14A. Companies file proxy statements on a Form DEF 14A.