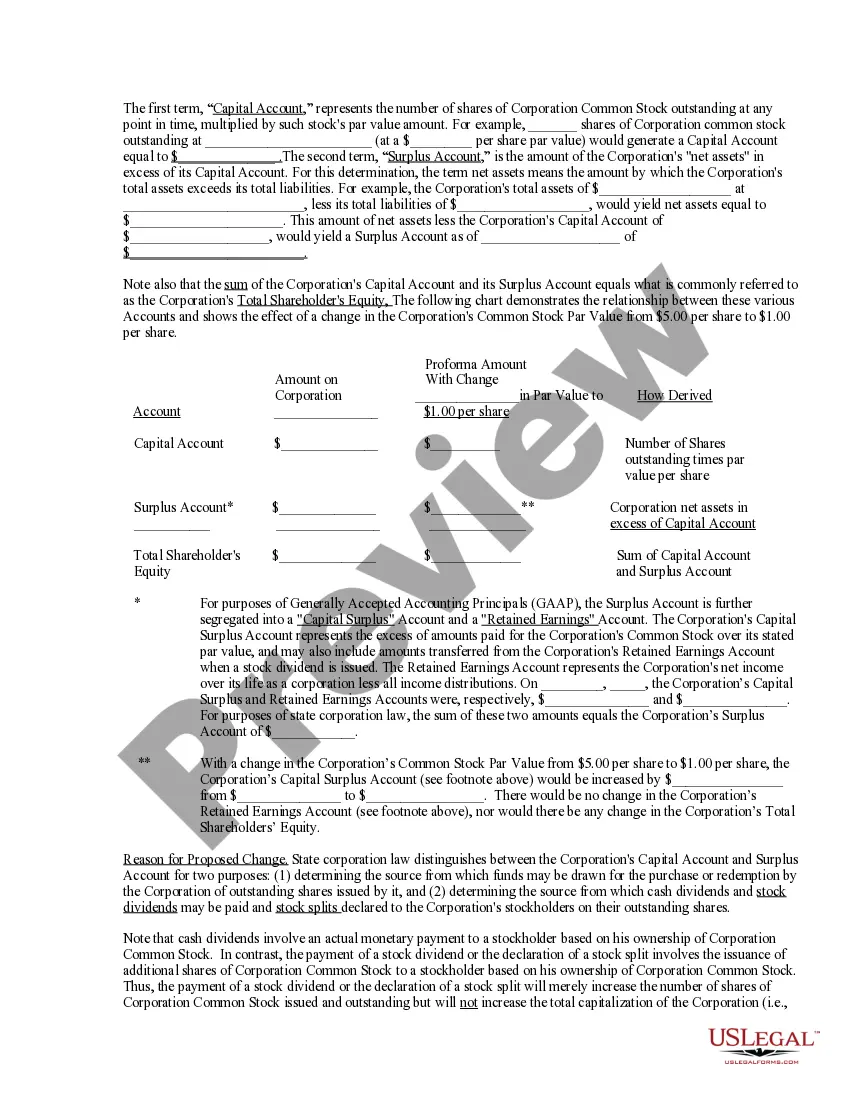

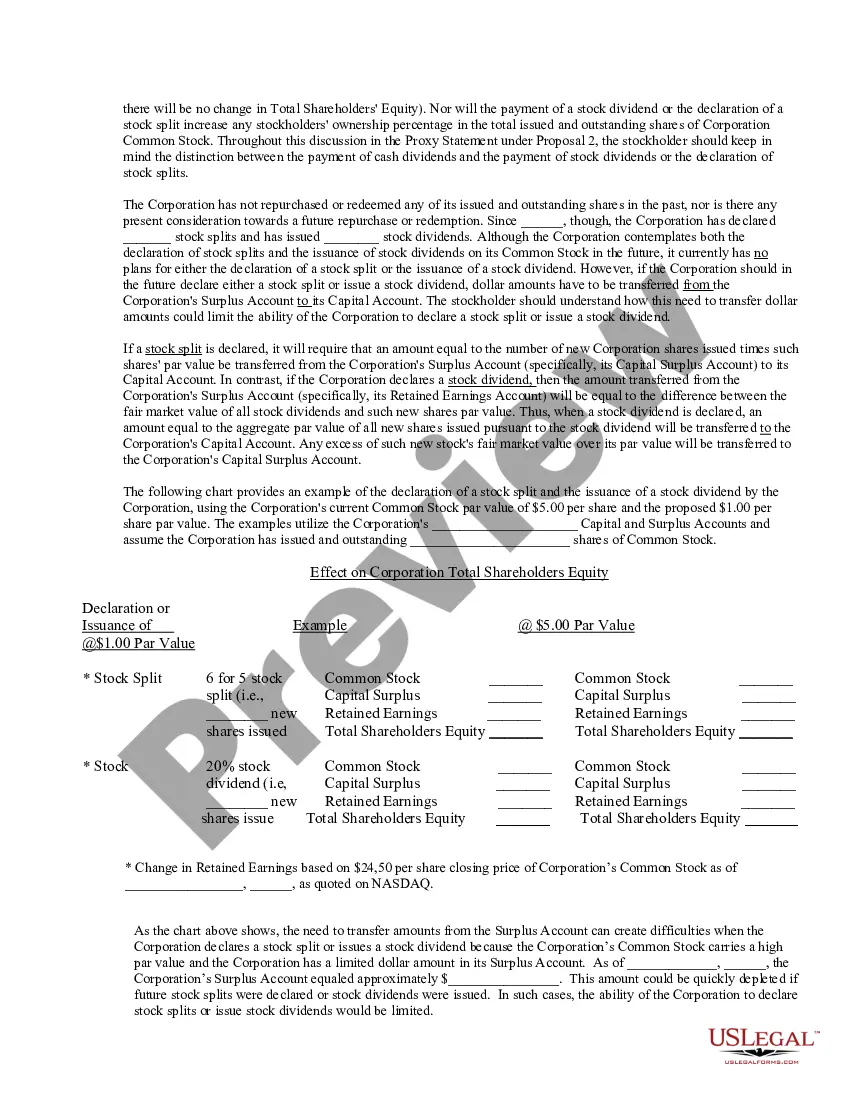

Louisiana Amendment of common stock par value

Description

How to fill out Amendment Of Common Stock Par Value?

Are you within a placement in which you need to have paperwork for either company or personal functions just about every day time? There are tons of authorized file web templates available on the Internet, but getting ones you can trust isn`t straightforward. US Legal Forms provides a large number of type web templates, like the Louisiana Amendment of common stock par value, which can be written to satisfy federal and state needs.

Should you be currently knowledgeable about US Legal Forms web site and have an account, just log in. Afterward, you are able to acquire the Louisiana Amendment of common stock par value format.

If you do not offer an account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the type you require and make sure it is for the correct area/region.

- Take advantage of the Review key to examine the form.

- Look at the description to ensure that you have selected the correct type.

- In case the type isn`t what you`re seeking, make use of the Search field to find the type that meets your needs and needs.

- If you find the correct type, just click Buy now.

- Choose the pricing strategy you want, fill in the required info to produce your bank account, and purchase your order making use of your PayPal or bank card.

- Decide on a handy data file file format and acquire your duplicate.

Find all of the file web templates you have bought in the My Forms menu. You can obtain a further duplicate of Louisiana Amendment of common stock par value anytime, if possible. Just go through the essential type to acquire or produce the file format.

Use US Legal Forms, the most extensive selection of authorized forms, in order to save time as well as avoid blunders. The service provides expertly produced authorized file web templates that can be used for a range of functions. Produce an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

The Louisiana Constitution of 1974, Article 1, Section 5, recognizes the right to be protected against unreasonable invasions of privacy by the state or state actors. The Louisiana Supreme Court has described the right to privacy as the right to be let alone and to be free from unnecessary public scrutiny.

No sale of property for taxes shall be set aside for any cause, except on proof of payment of the taxes prior to the date of the sale, unless the proceeding to annul is instituted within six months after service of notice of sale. A notice of sale shall not be served until the final day for redemption has ended.

No person shall be denied the equal protection of the laws. No law shall discriminate against a person because of race or religious ideas, beliefs, or affiliations.

A defendant shall plead in response to an amended petition within the time remaining for pleading to the original pleading or within ten days after service of the amended petition, whichever period is longer, unless the time is extended under Article 1001.

CONST 7 18. Section 18. (A) Assessments. Property subject to ad valorem taxation shall be listed on the assessment rolls at its assessed valuation, which, except as provided in Paragraphs (C) and (G), shall be a percentage of its fair market value.

Article I, Section 13 of the Constitution of Louisiana, in ance with the state's obligation under the Sixth and Fourteenth Amendments of the United States Constitution, provides that at "each stage of the proceedings, every person is entitled to assistance of counsel of his choice, or appointed by the court if he ...

No conveyance, lease, royalty agreement, or unitization agreement involving minerals or mineral rights owned by the state shall be confected without prior public notice or public bidding as shall be provided by law.

Section 21. In addition to the homestead exemption provided for in Section 20 of this Article, the following property and no other shall be exempt from ad valorem taxation: (A) Public lands and other public property used for public purposes.